Table of Contents

SAP Profit Center Accounting Overview

Within SAP ECC, there are several tools available to report and plan profitability. At the company code level, there are various financial statement reporting options like using an income statement to report on periodic profitability at a legal entity basis. Profit center accounting is a tool used for management reporting. It provides financial statement in dimension other than company code. It provides below functionalities:

- Provide profitability information based on the physical or management structure of the business

- Provide information and allow planning based on responsibility areas such as region, business function, or product

- Use a structure defined in terms of profit centers and arranged in a standard hierarchy

- Easily achieve a full profit and loss (P&L) statement by profit center

In general, profit centers or groupings of profit centers are often used in SAP to represent areas within the organization that are responsible for revenues and costs.

Profit Center Accounting Concepts

- In classic Profit Center accounting, posting are collected in a separate ledger 8A

- Profit Center postings are always statistical in nature. Profit center are not real cost objects

- Profit Centers can be assigned to Cost centers, Orders, Material Master

- Every Profit Center belongs to standard Hierarchy

- Profit Center accounting is always period accounting

- In New GL Profit Center accounting there is no Dummy Profit Center

Classic versus New GL Profit Center Accounting

Classic Profit Center Accounting

It is statistical accounting component in SAP Controlling. This means that the profit center itself cannot serve as an account assignment object in CO and that PCA will take transaction data posted to a real account assignment object and derive a profit center posting based on it. To achieve this, classic PCA utilizes a separate ledger (8A) and stores the actual and plan line items and totals records in their own database tables GLPCA, GLPCP, and GLPCT.

New GL Profit Center Accounting

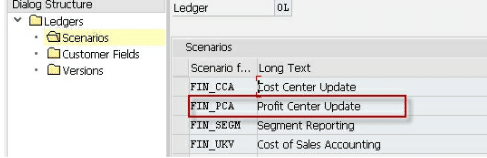

In New GL Profit Center Accounting, scenario FIN_PCA is assigned to ledger in FI configuration. A scenario defines which fields are updated in the general ledger view from the data in the entry view. The assignment of FIN_PCA means that the profit center and partner profit center fields will get updated in the new GL tables, thus there is no separate Profit center accounting document for any postings

SAP recommends using new GL Profit center accounting. SAP notes #826357, 1280060. Benefit of using New GL Profit Center Accounting:

- Not having to reconcile PCA with GL as part of a period-end process

- Not having to run period-end processes to transfer payables and receivables to PCA

- Having the ability to create a full balance sheet at the profit center level

For detailed, step-by-step instructions on SAP Profit Center Accounting, follow along with my video tutorial below

SAP Profit Center Accounting Training

Profit Center accounting Configuration in SAP

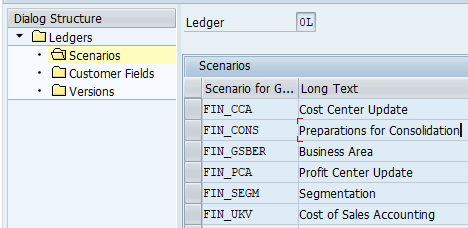

Activate PCA by adding PCA scenario

IMG Path: SPRO-FA (N)-FAGS-ledger-Ledger- Assign scenario in customer fields

Only SAP standard scenarios can be assigned. Assign below scenarios

- FIN_PCA

- FIN_SEGM

- FIN_UKV (Cost of sales accounting)

- FIN_CCA (Cost center update)

- FIN_CONS (Trading Partner field update in New GL)

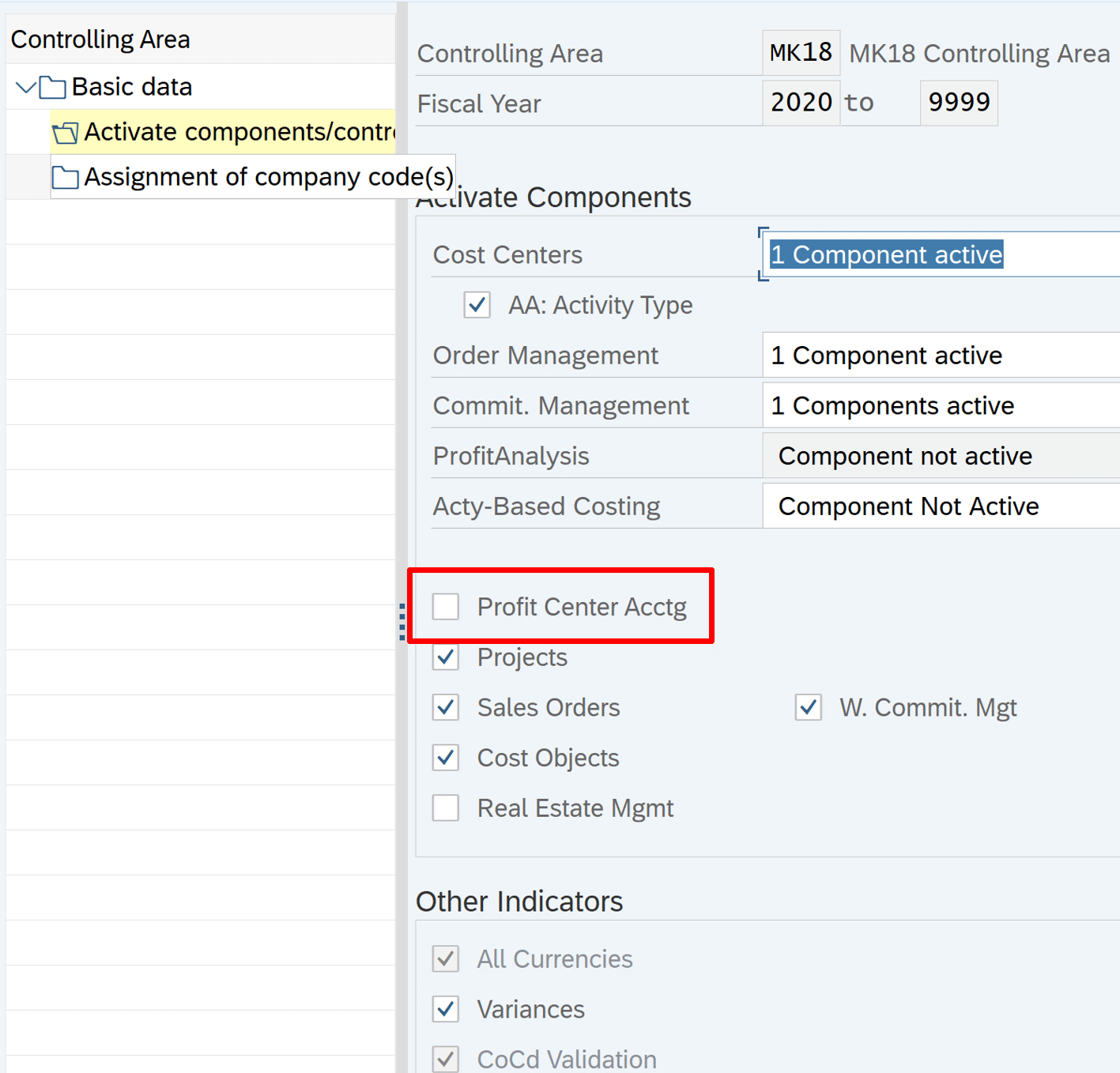

Deactivate Profit Center accounting in classic GL

Transaction code: OKKP

Deselect check box ‘Profit Center Accounting’.

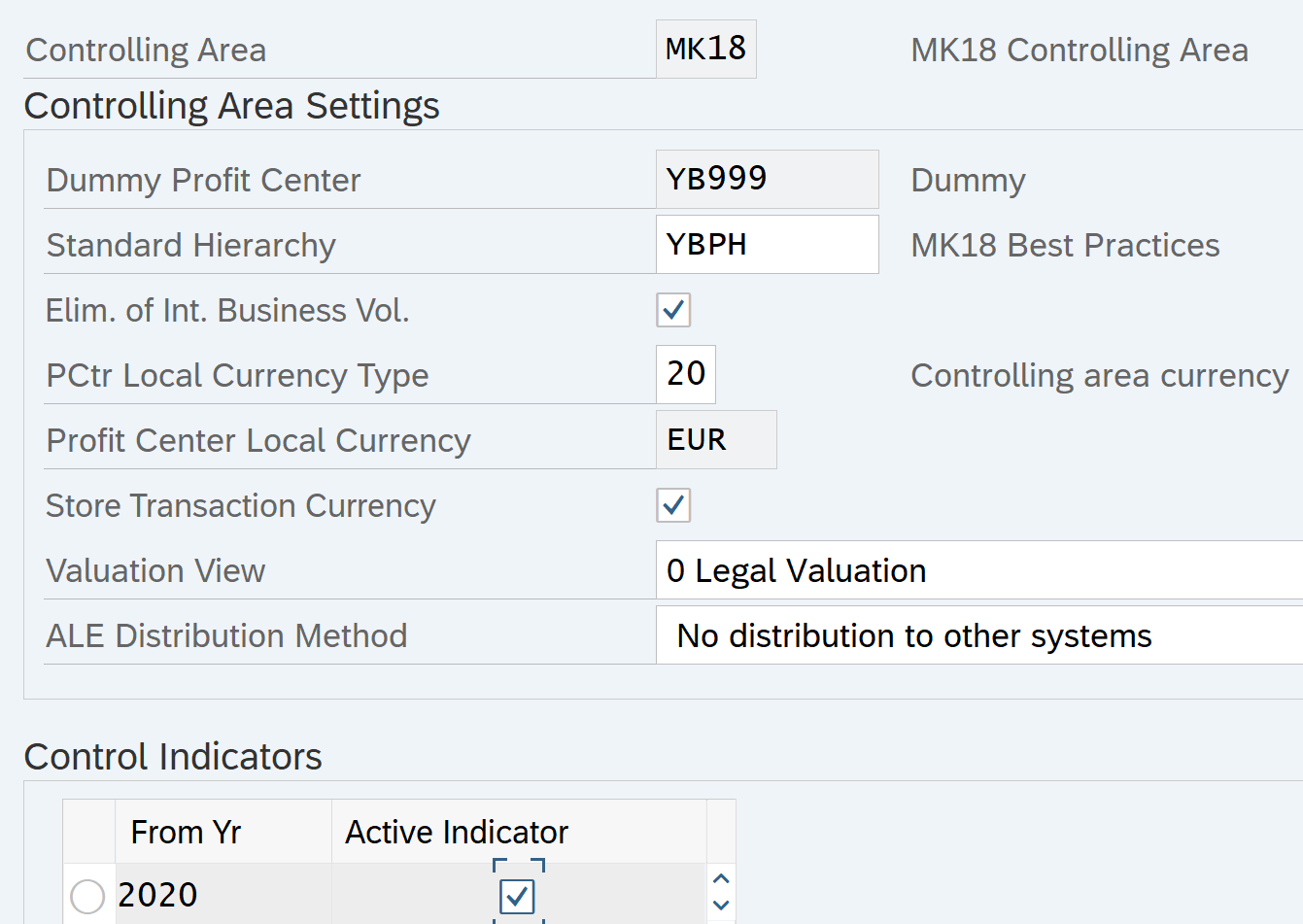

Maintain controlling area settings for Profit center

Transaction code: 0KE5

- Profit center accounting is made up of Profit centers

- Profit centers are responsibility areas.

- They receive revenue and expense posting

- All revenue and expense posting to Profit Center are statistical in nature

- Profit and Loss statements can be made for each profit centers.

- Profit centers can be created based on geography, products, functional divisions etc.

- Do not assign Dummy Profit Center when using Profit Center functionality in New GL

Tcode : 0KE5

Create Dummy Profit Center

Required only in case of classic Profit Center Accounting. As we are doing Profit Center accounting in New GL, we will not be setting up Dummy Profit center

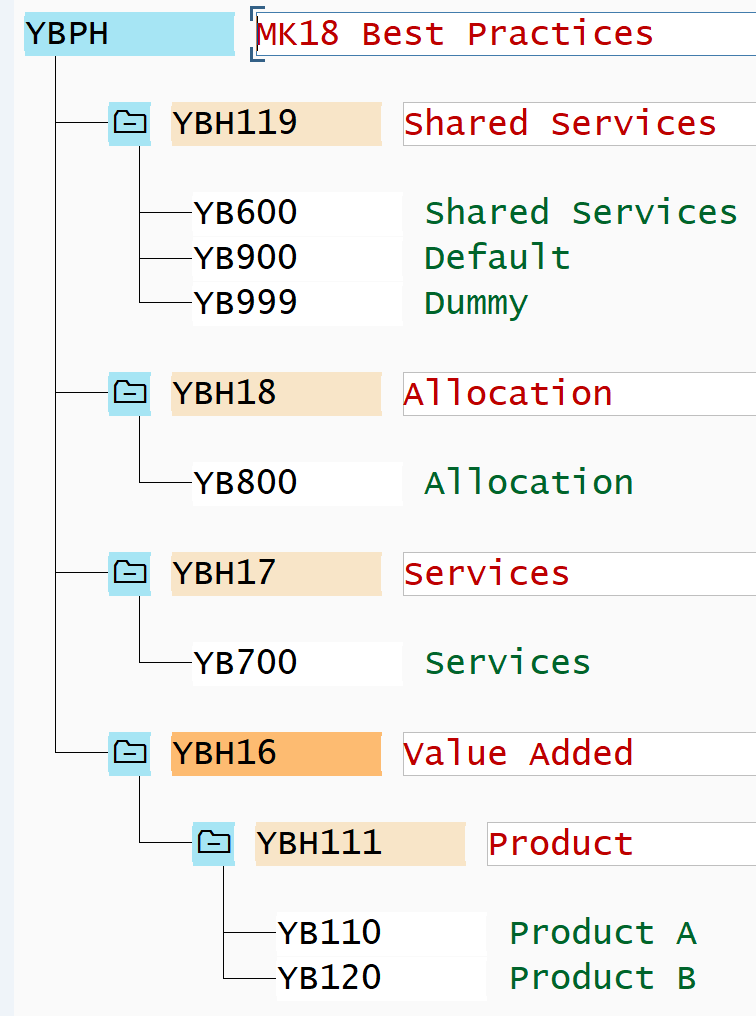

Create Profit Center Group in SAP

PC Group is a group of Profit Centers. Used for alternative reporting. Profit Center groups are also called alternative hierarchies.

- Create Profit Center Group: KCH1

- Change Profit Center Group: KCH2

- Display Profit Center Group: KCH3

- Where used for PC Group: KCH5N – Extras – Use of Group

- Remove / Insert Profit Center: Select PC Group – In the new toolbar Remove / Insert / Where used functionality

- Move SAP Profit Center Group to another SAP system: PC group can be exported as a text file on desktop and then imported into the intended system. Extras – Export / Import

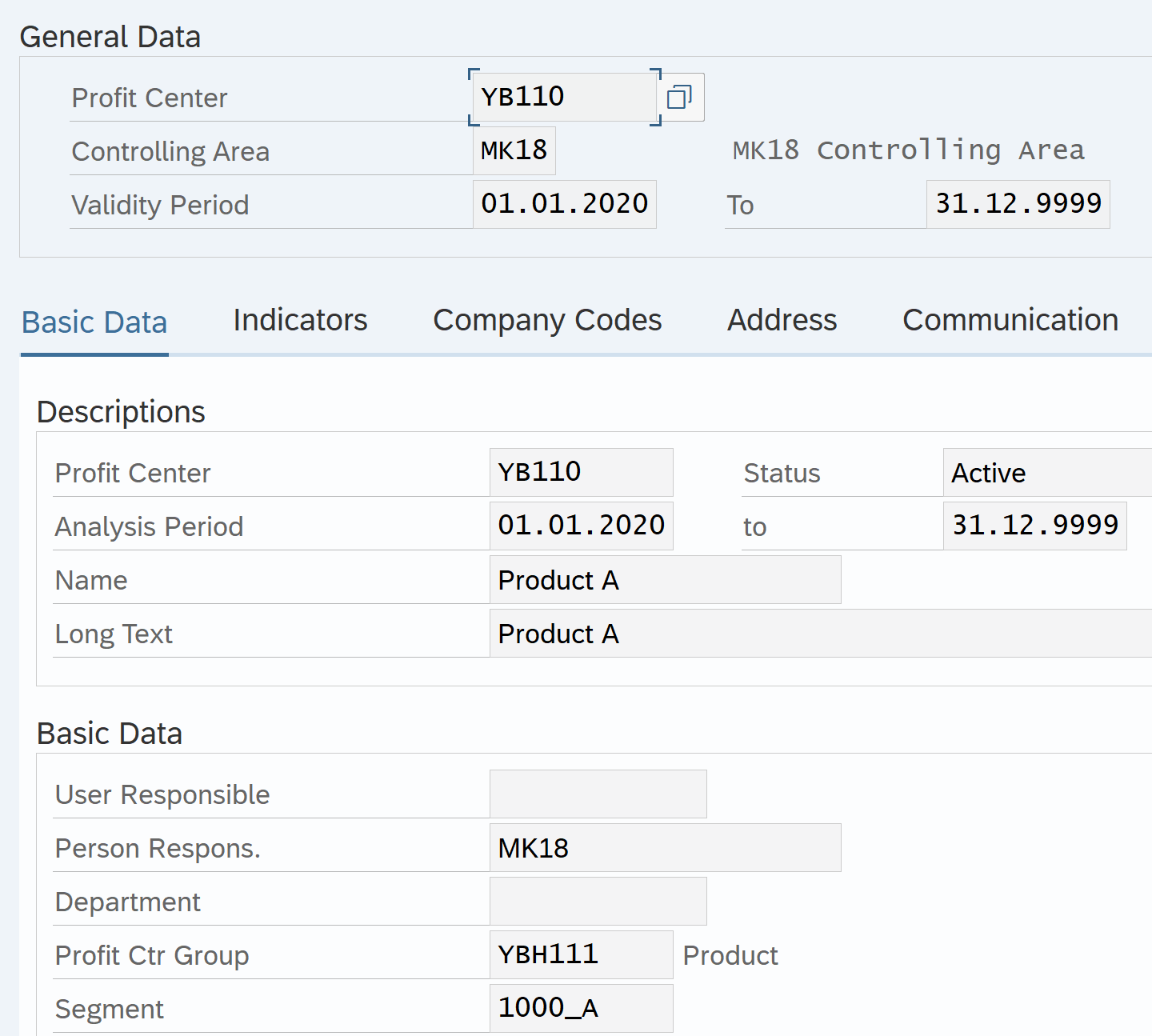

Create Profit Center in SAP

A Profit Center represents a responsibility center. A responsibility center could be created based on geographical area, Product lines or some other basis.

Profit centers are created in hierarchical structure. Top node of the hierarchy is assigned to the controlling area. Profit centers is a master data. It is created in transaction KE51

Set the controlling area in which Profit centers will be created: OKKS

Profit center is a time dependent cost object

Profit Center considered as a time-based object. => It has a validity period. Certain fields can be created as time sensitive, for e.g. person responsible. Thus if responsible person changes, a new view of PCA will be available. Thus, every change to a time dependent object causes SAP to create a new PCA master data records

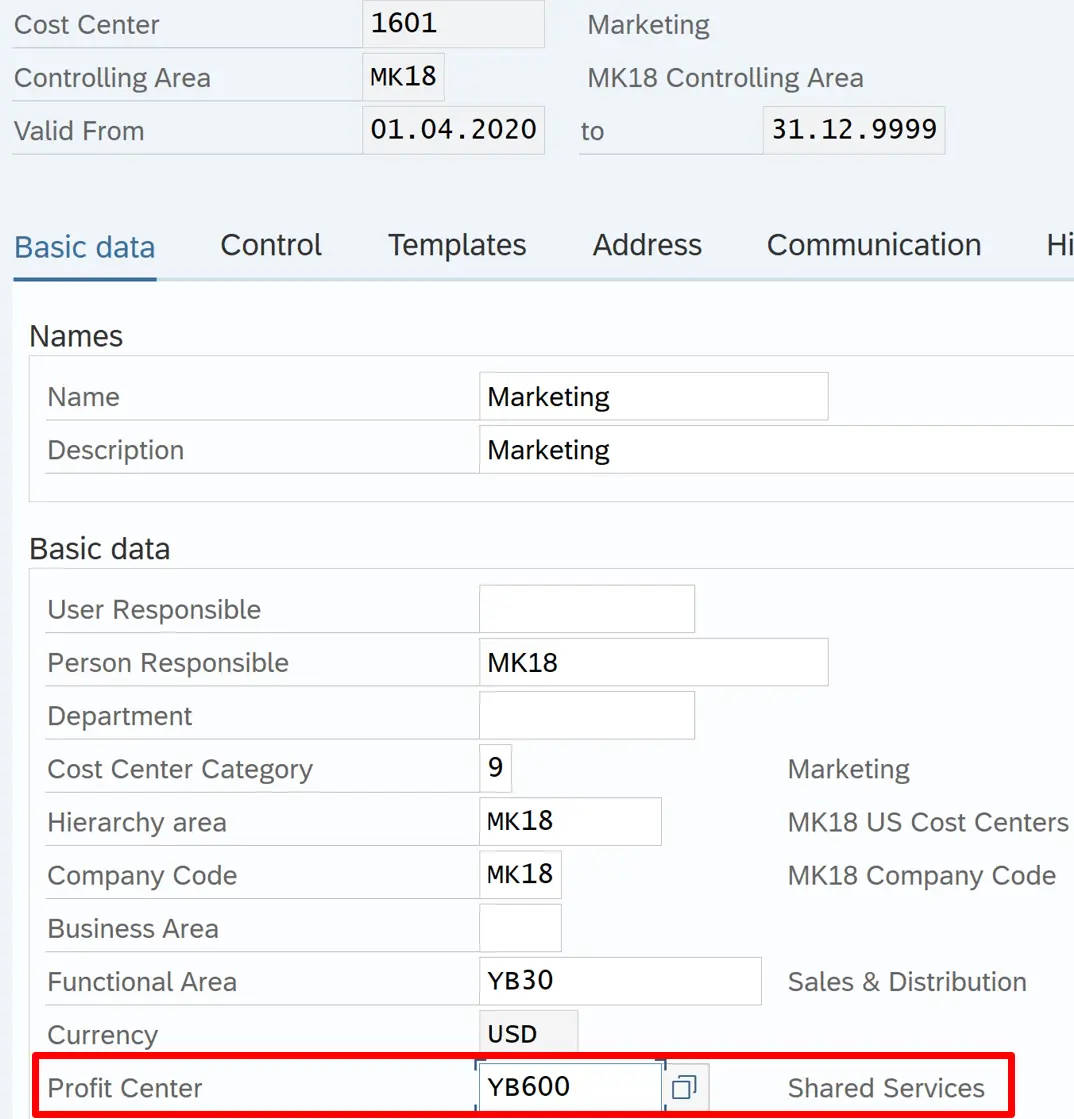

PCA Fields- Basic Tab

Responsible person: Person responsible for the PC

Department: Free text field

PC Group: Makes the connection between PC and it’s place in the standard hierarchy. PC Group selected here is a node in the PC hierarchy

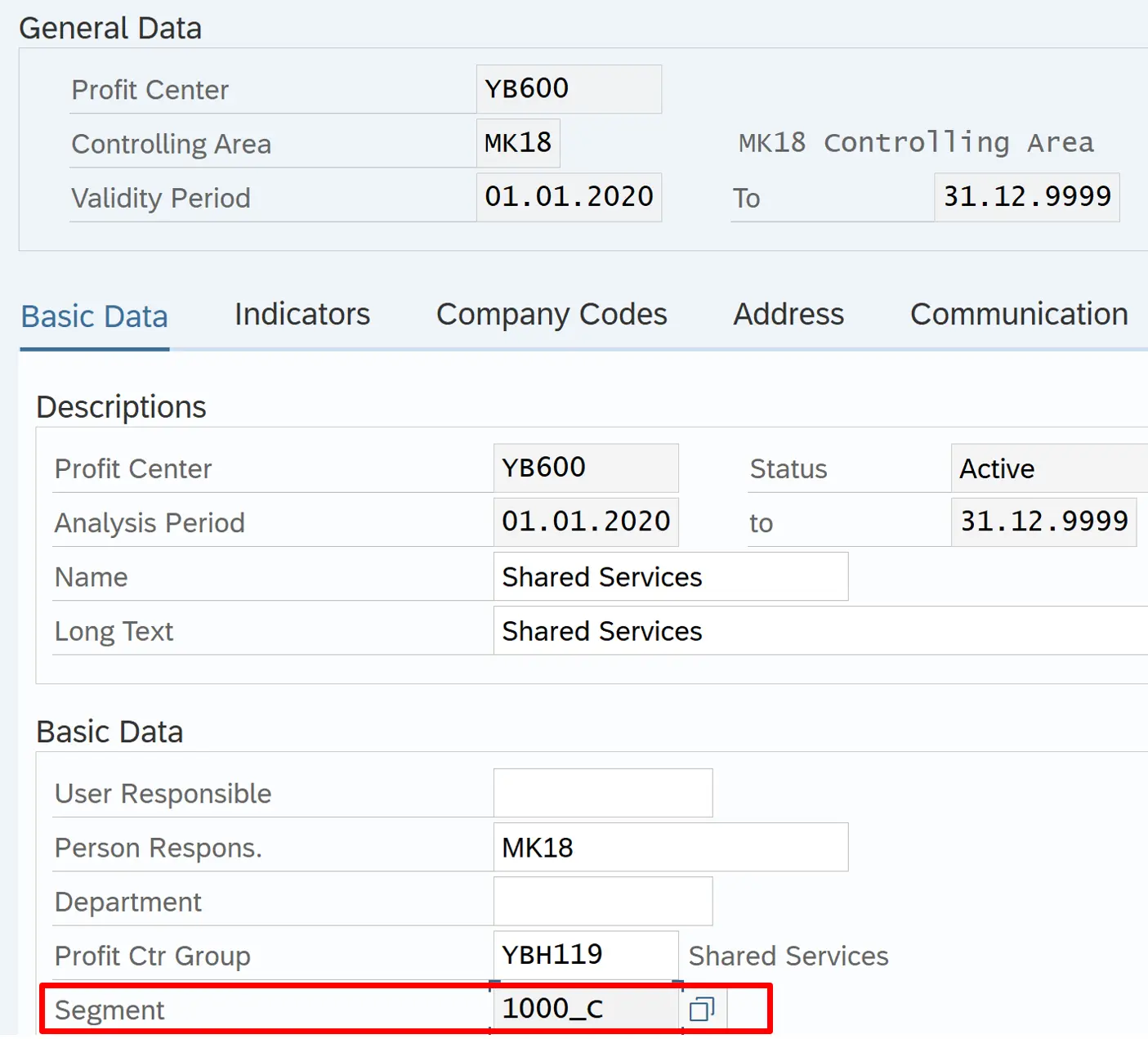

Segment: Relevant only when New GL and document splitting is activated. To activate Segment reporting, assign scenario FIN_SEGM to a ledger in FI. Segment reporting required for US GAAP & IFRS reporting. Segment can be seen as grouping of PC. A segment assigned to Profit Center can be changed after Profit Center is created in SE16-V_FAGL_SEGM_PRCT. This is possible only if no postings have been made to the Profit Center. Segment is derived from Profit Center, so assigned in Profit center master data

Profit Center Accounting Fields- Indicators Tab

Lock the profit center so no posting can be made to PC once locked

Profit Center Accounting Fields- Company codes

Here assign the company codes to Profit Center. By default, all company codes are assigned to Profit center. Can deselect the once which are not required

Profit Center Accounting Fields – Address and Communication Tab:

Fields available to enter Address, Tax jurisdiction, Language, Telephone etc. These are optional fields

Once a Profit Center is created it needs to be activated either singly or mass activation in transaction#KEOA2

Create Profit Center: KE51

Change Profit Center: KE52

Delete Profit Center: KE54

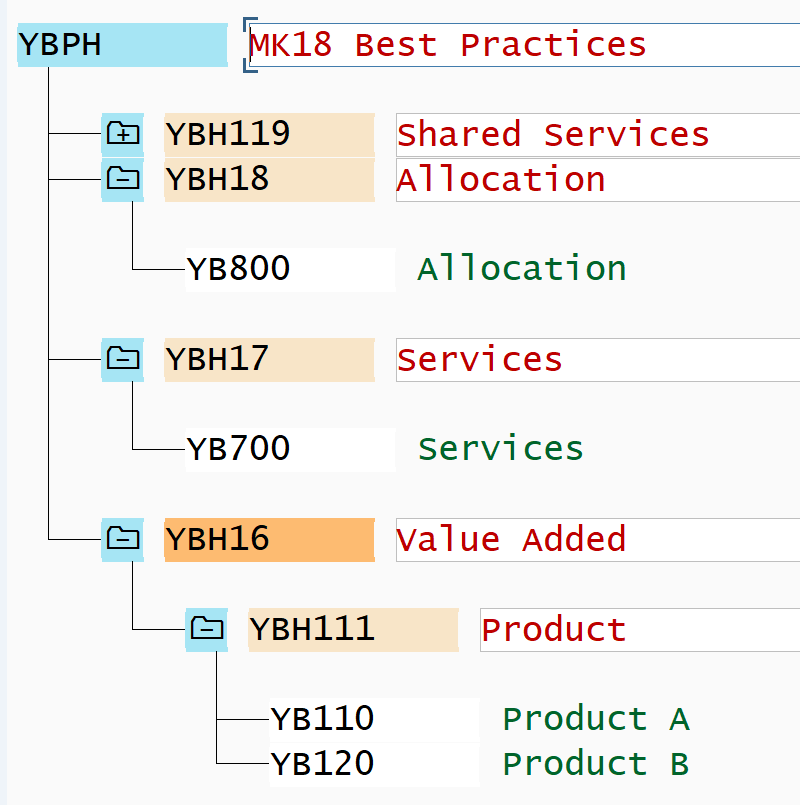

SAP Profit Center Hierarchy

It is tree like structure of Profit Centers. It is assigned to the controlling area. It is made up of Profit Center groups. All Profit Centers are assigned to the Standard hierarchy

- Create Top node of Hierarchy/ Profit Center Group: KCH1

- Assign subsequent node (Profit Center Groups): KCH5N

Profit Center Assignment in SAP

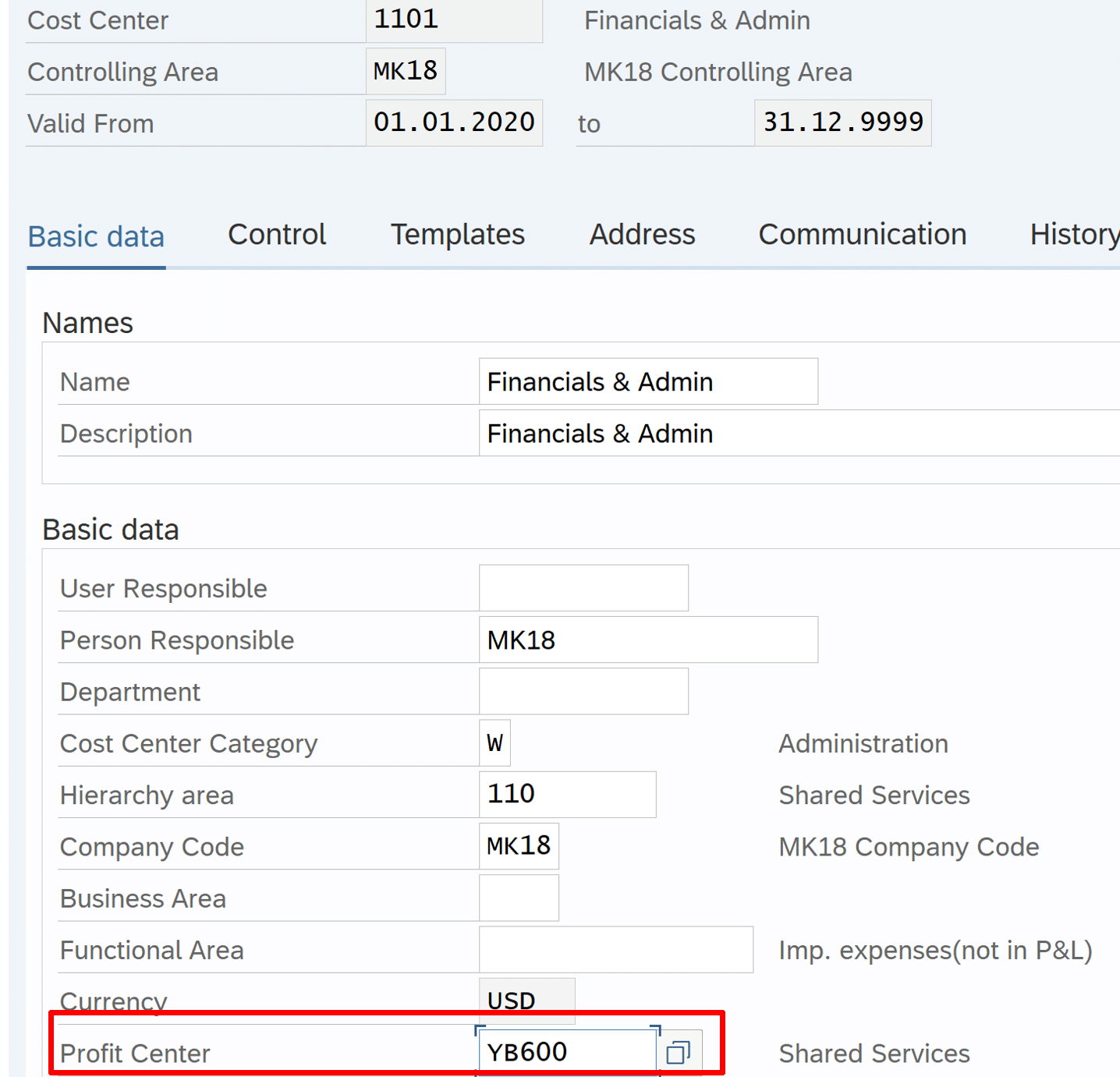

Profit Center is a statistical object. It is derived from a real cost object. Below is the list of real controlling objects:

- Cost Centers

- Internal Orders (true)

- Projects / WBS (true)

- Material Master

- Fixed Assets

- Make-to-order sales orders

- Profitability segments

Thus, Cost / Revenue can be posted statistically to Profit Centers. Profit Center is assigned to Cost center in the Basic data tab: KS02

Cost Center

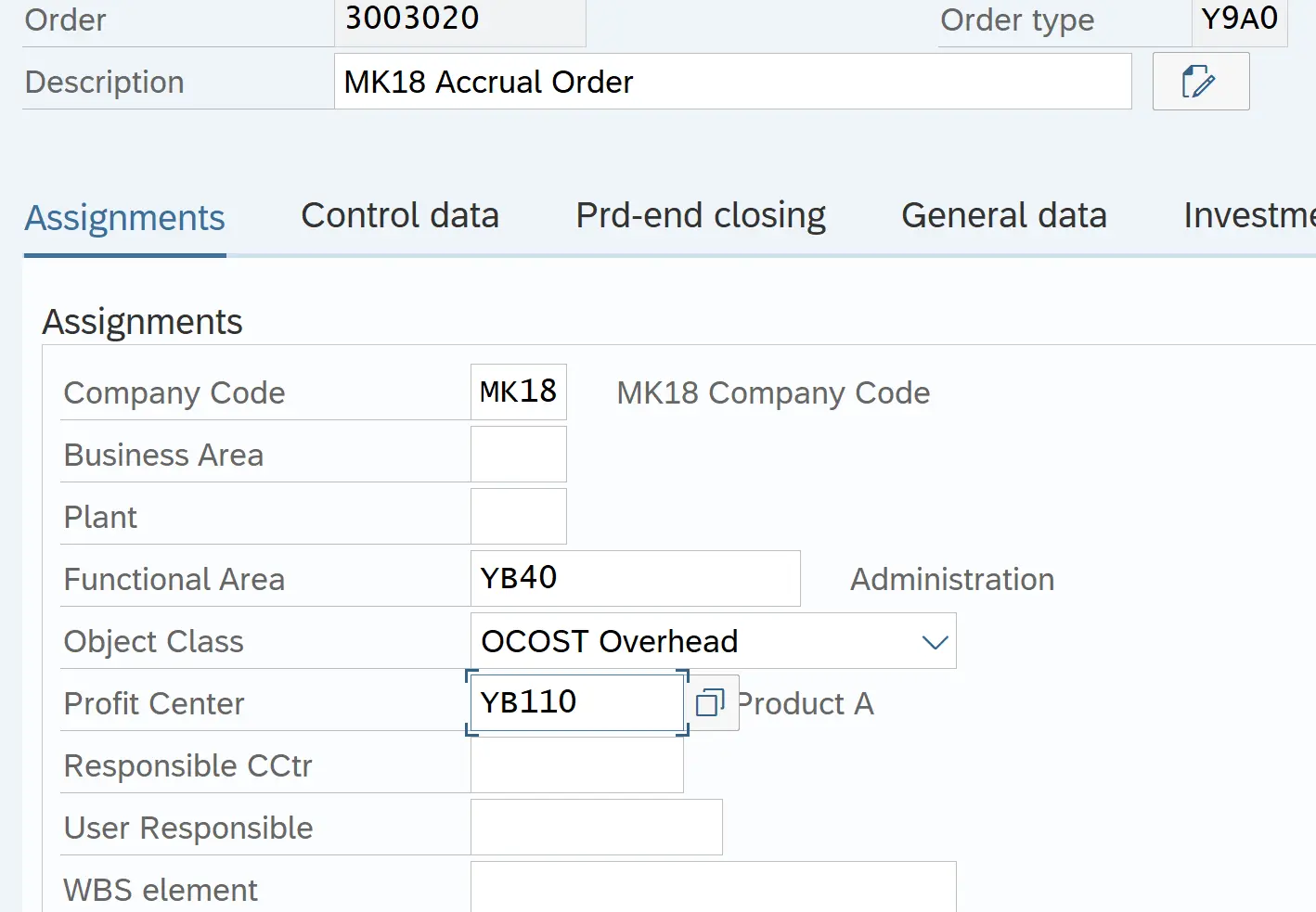

Internal Order

Profit Center are assigned to internal order in assignment tab: KO01 / KO02

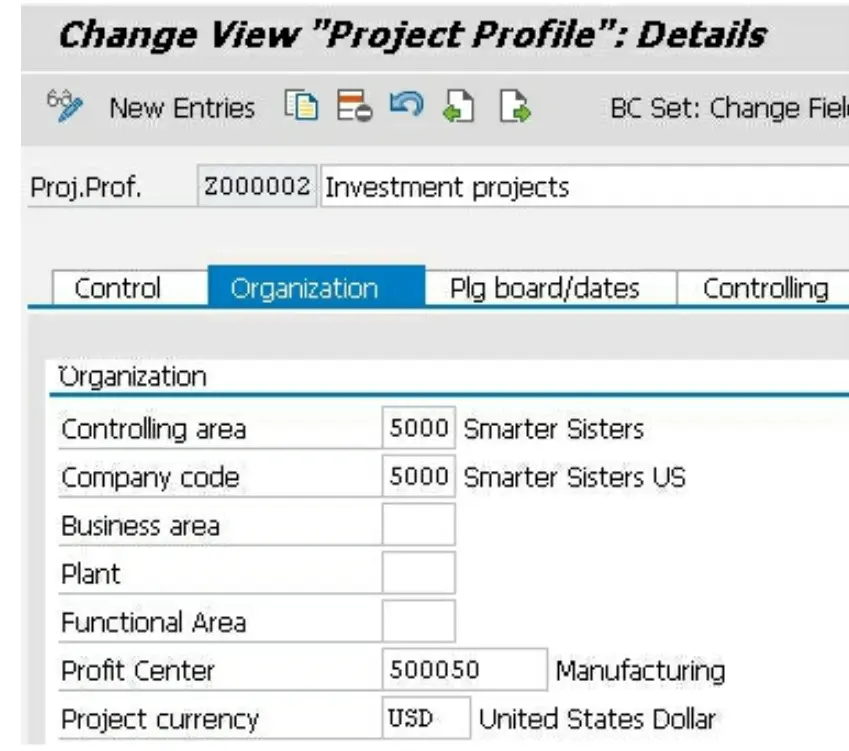

Project / WBS

Profit Center is assigned to Project in assignment tab: CJ20N / CJ02

Profit Center can also be assigned to WBS element. This will take precedence over the profit center assigned to Project

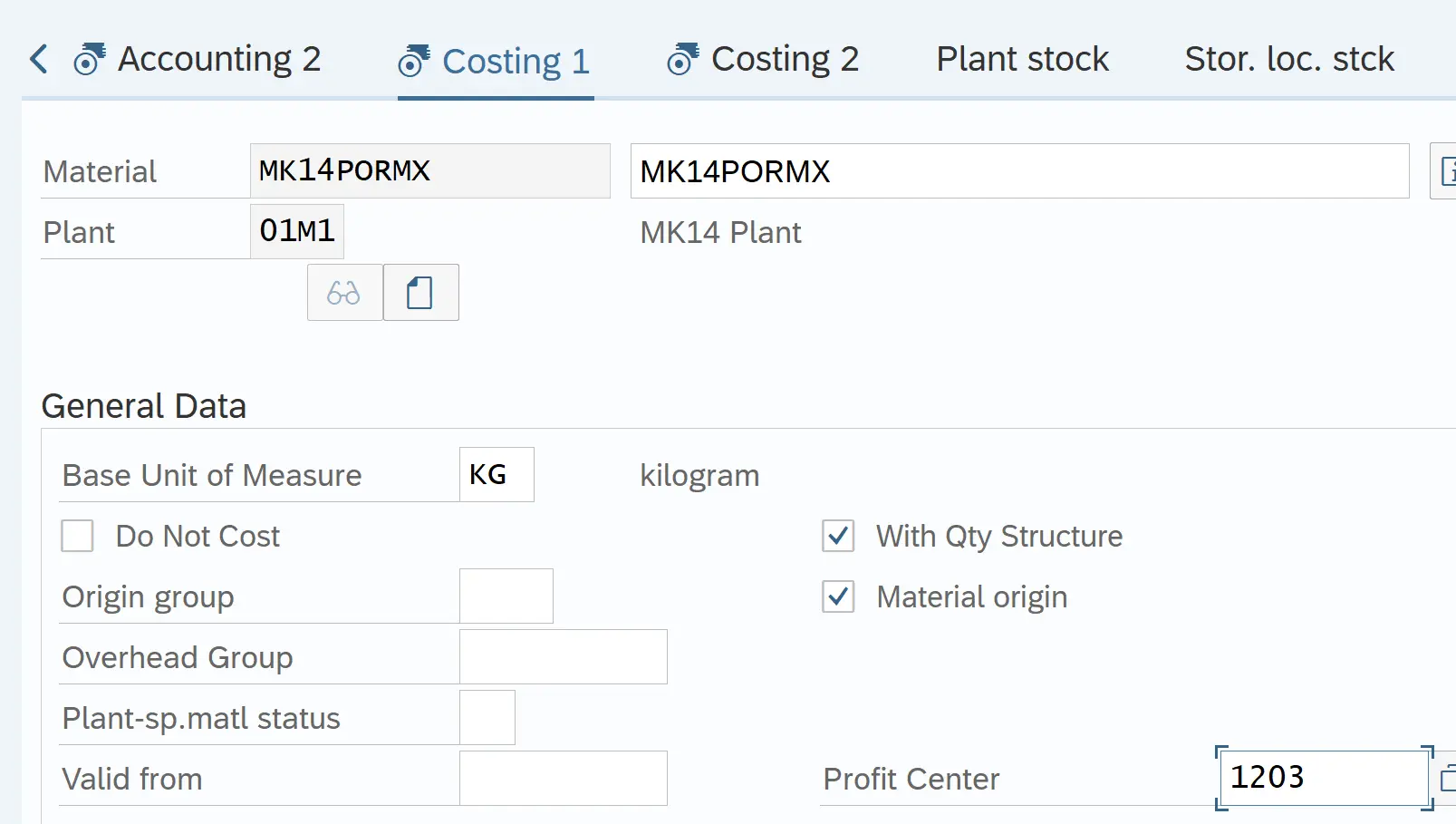

Raw Material

Assign Profit center to Finished Goods and Raw Material in transaction code : MM01 / MM02

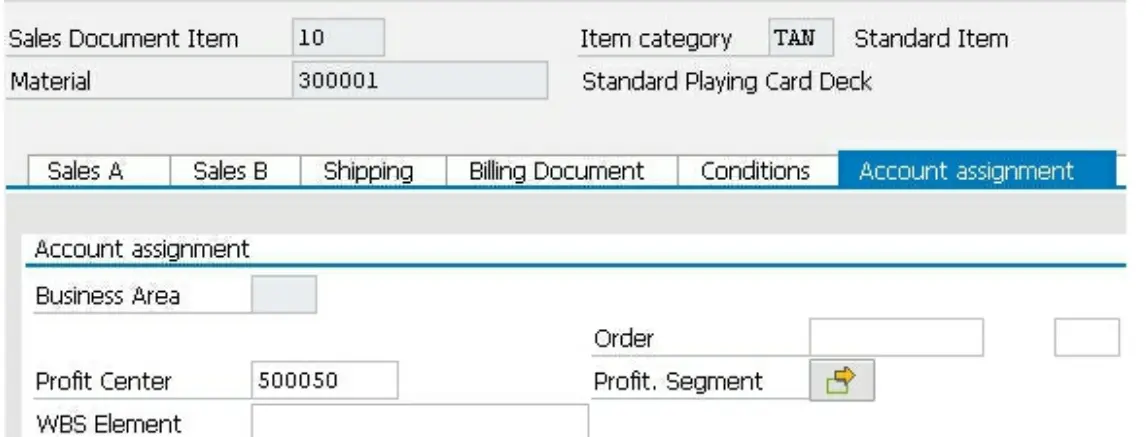

Assign Profit Center to Sales Order: VA01 / VA02

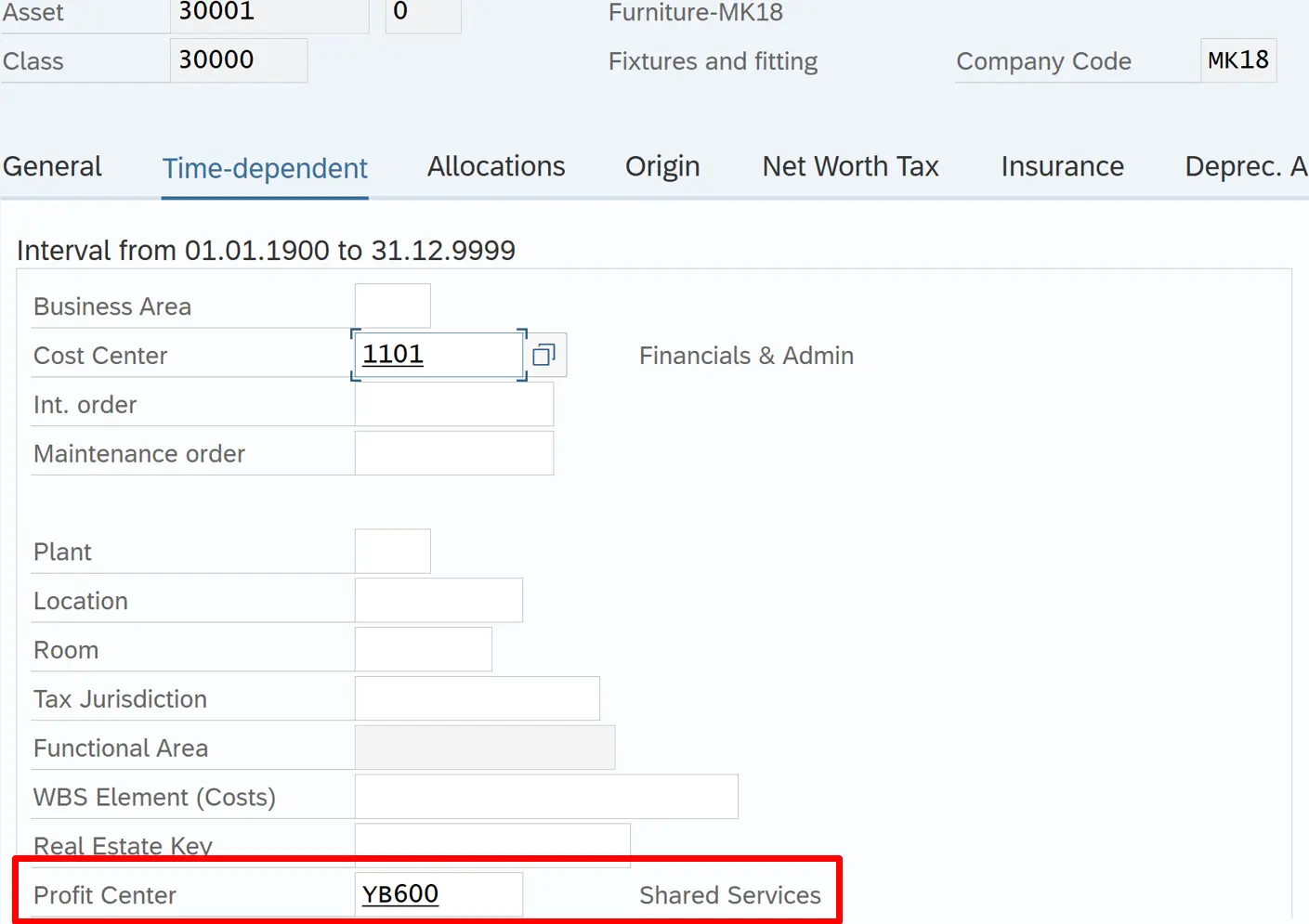

Profit Center assignment in Asset master: AS01 / AS02

In asset master time dependent tab, we assign Cost center. Therefore, when depreciation for the asset is posted to this cost center, Profit center is derived from the cost center

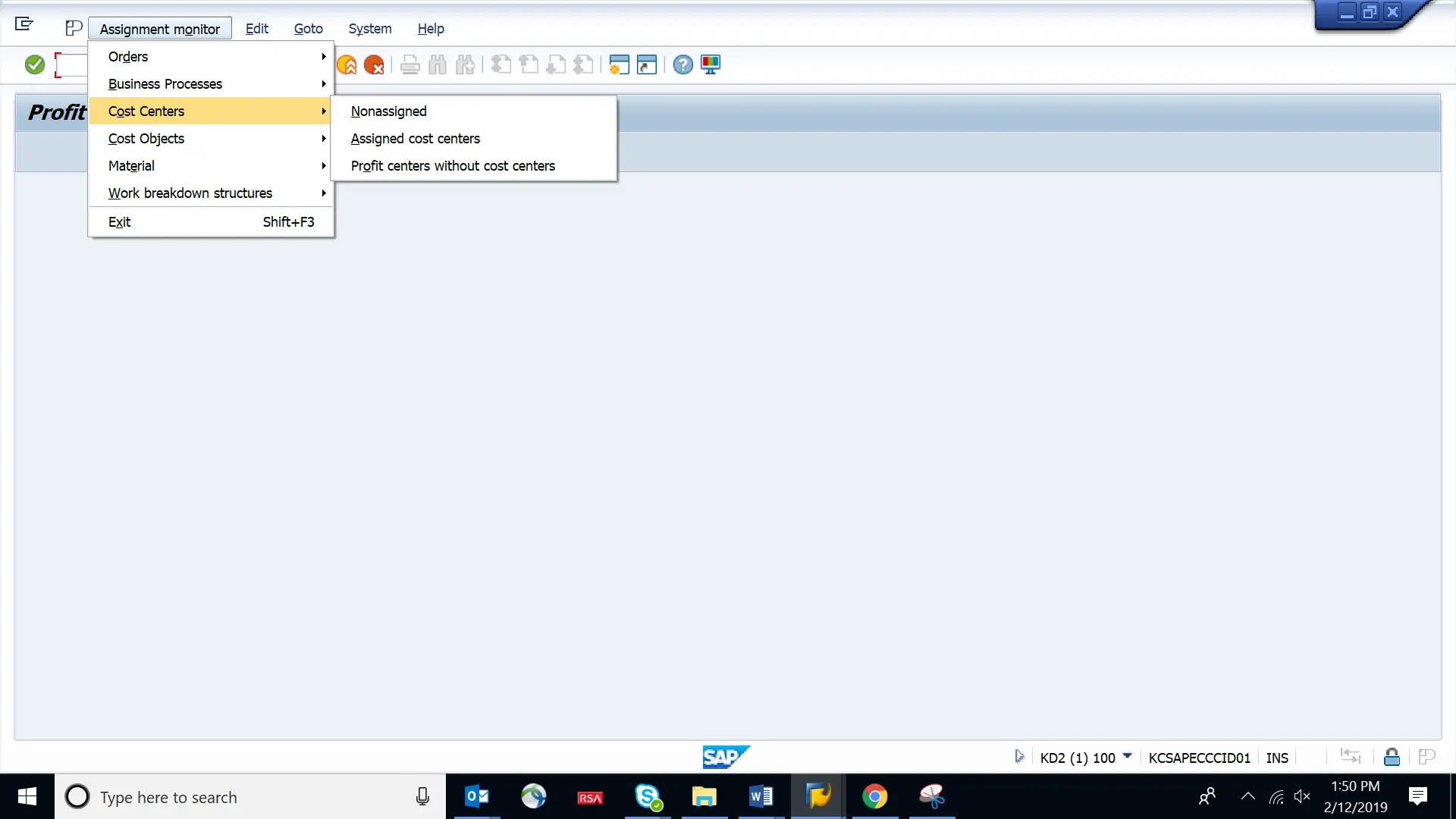

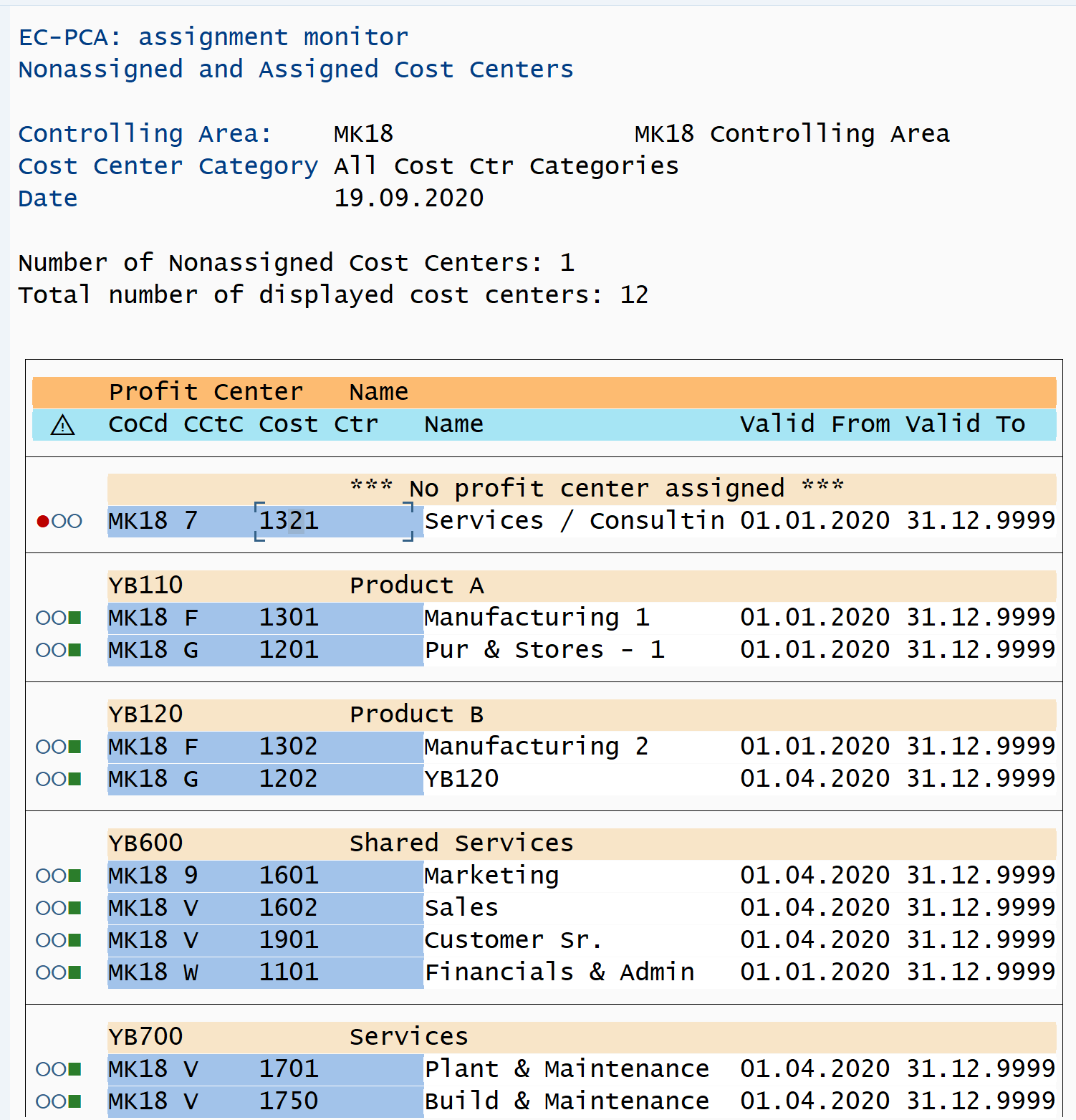

Assignment Monitor

Verify that Profit center is assigned to all relevant cost object assignment monitor is used

Transaction Code: 1KE4

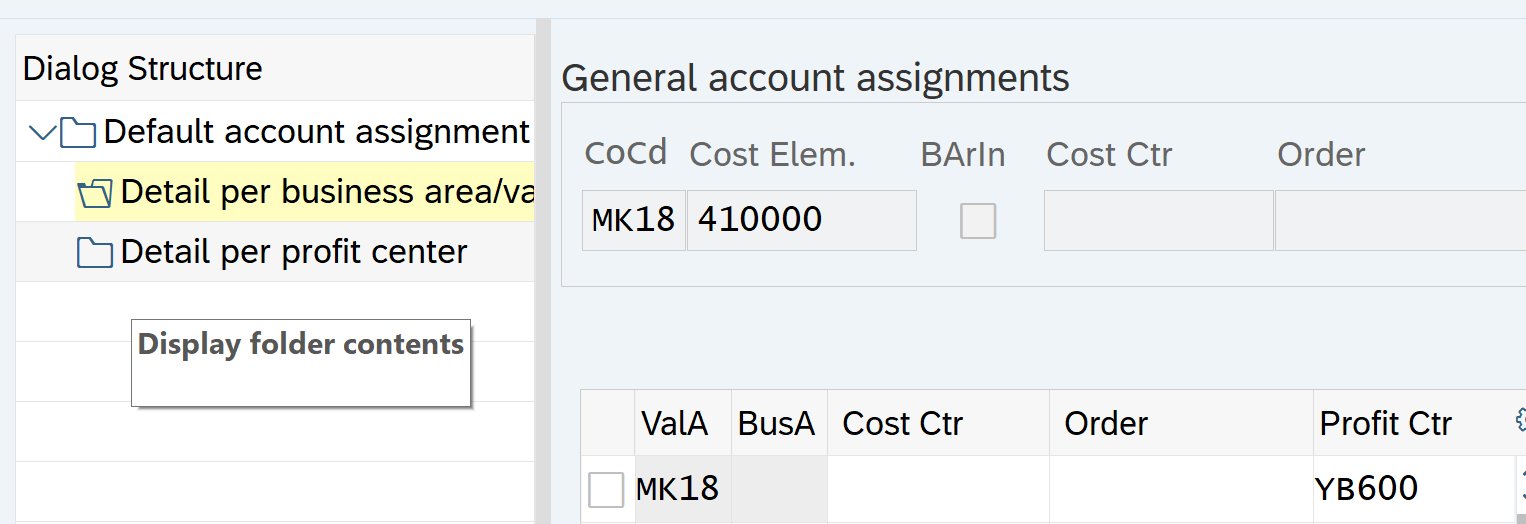

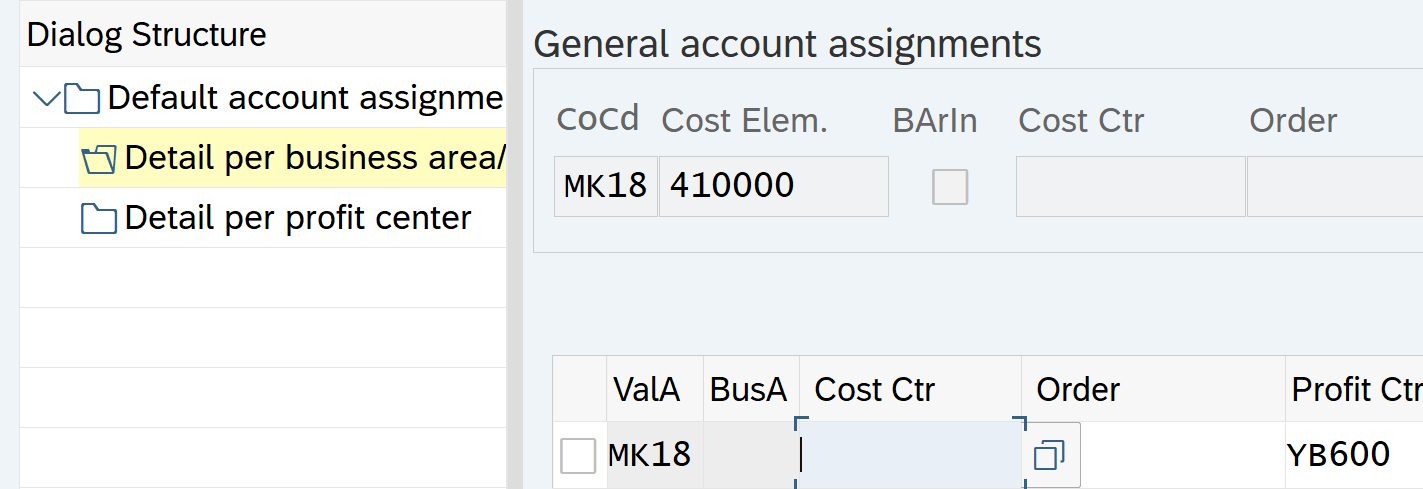

Assign Default Profit center

Transaction code : OKB9

Cost in Profit center accounting comes from cost centers or other real cost object. Profit center default assignment can be made only for revenue cost elements

Default account assignment is specific to Plant/ Valuation area

Click new entries and enter Company code, Cost element and Account assignment.

Now select the row and click detail per valuation area (valuation area is the plant)

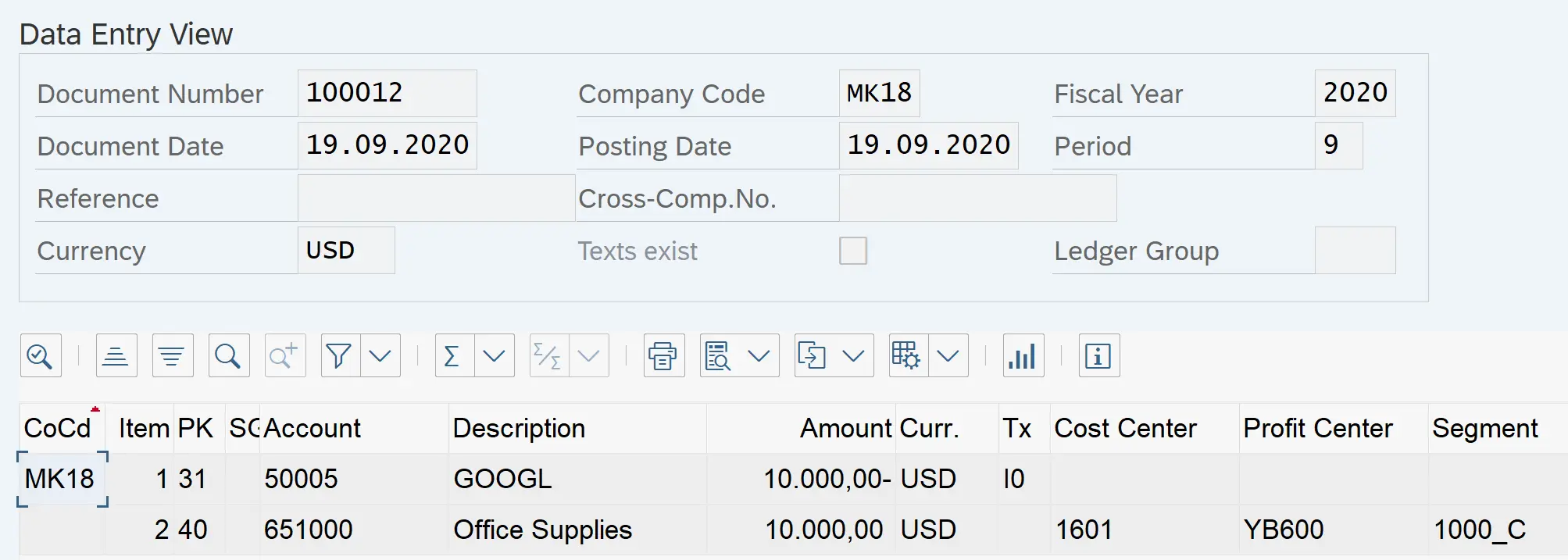

Actual Postings:

Post Vendor Invoice

Transaction code: FB60

Cost Center Master Data: KS02

Profit Center Master Data : KE52

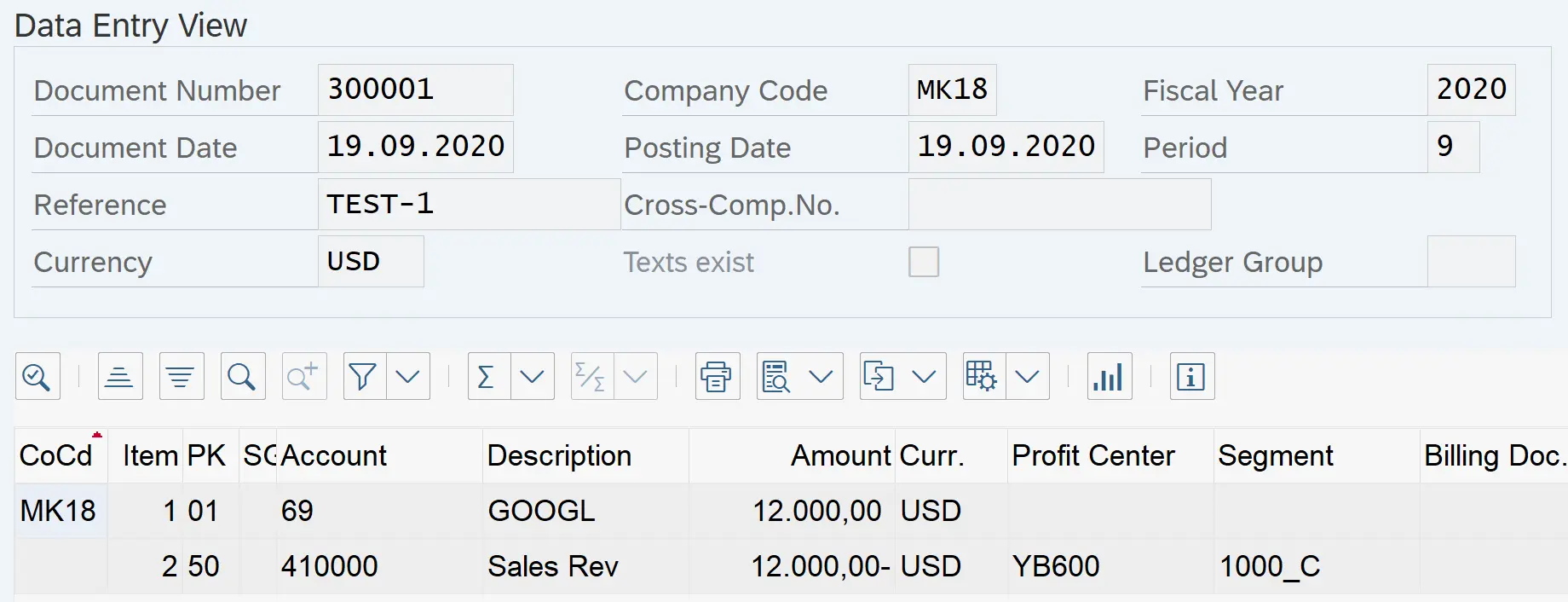

Post a Sales Invoice

Transaction code: FB70

Default Profit Center for Revenue Account is coming from OKB9 (Automatic Account assignment)

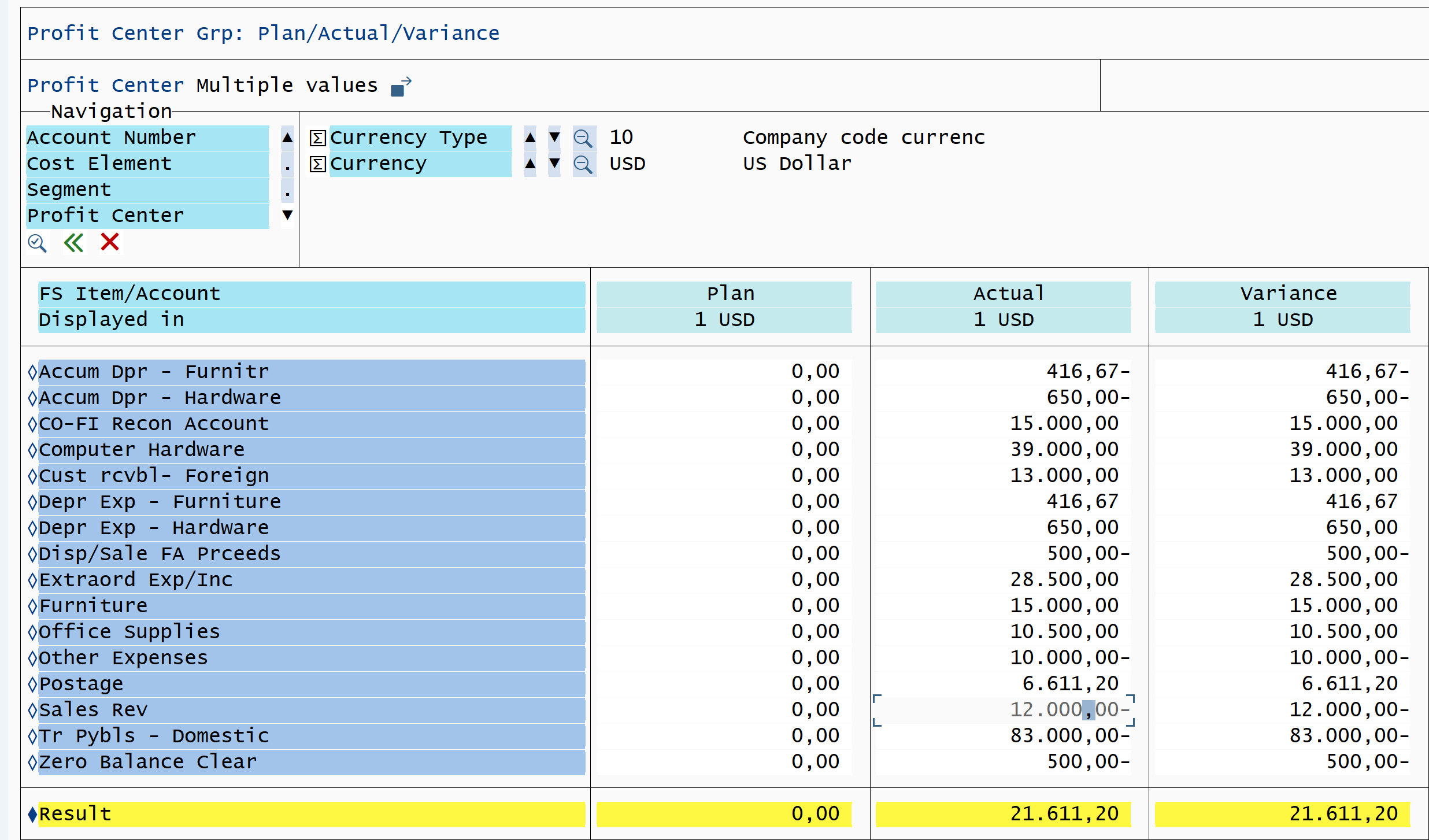

Profit Center Reporting in New GL

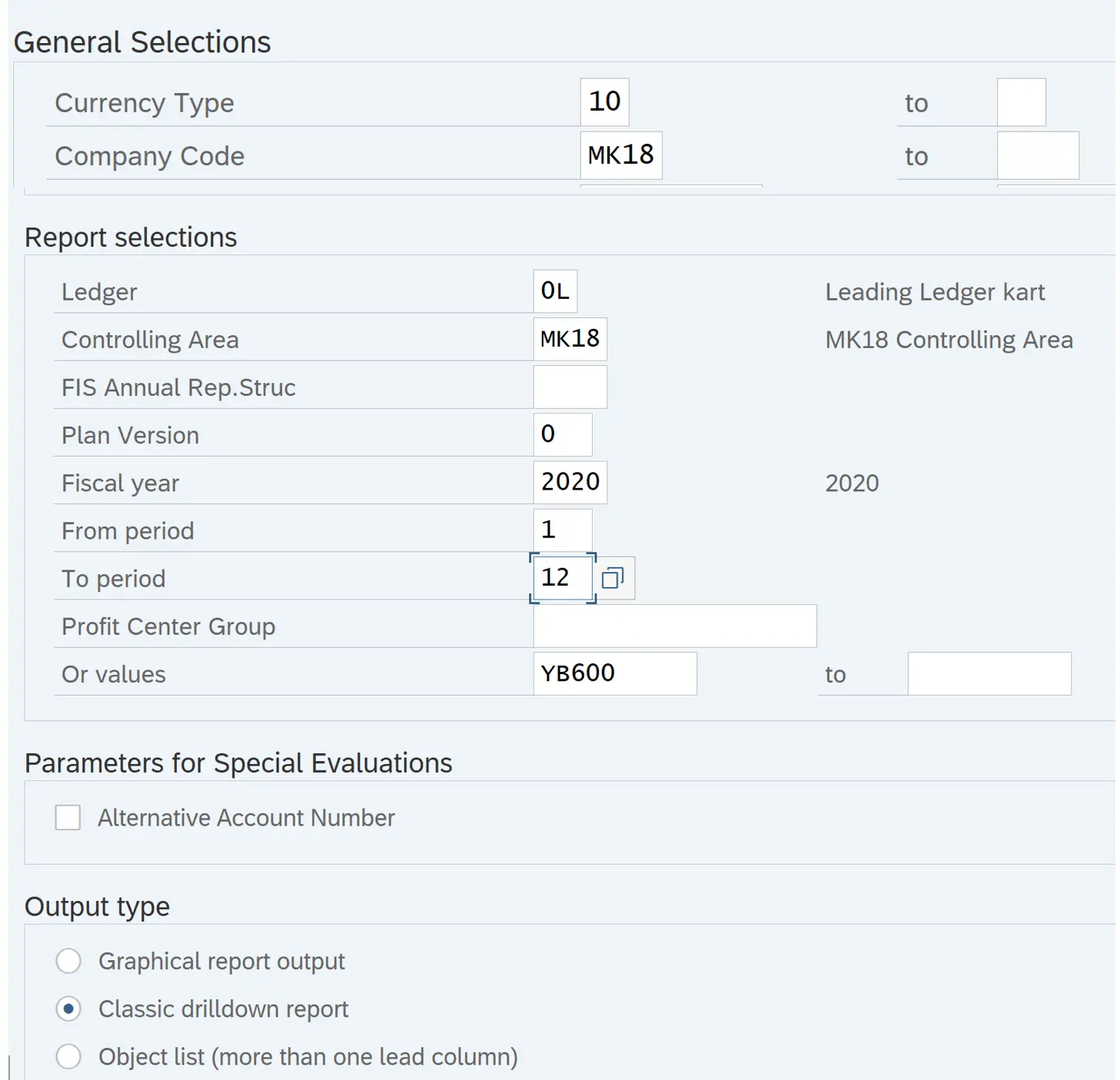

Profit Center Plan and Actual Line Item Report

Transaction Code: S_E38_98000088

Selection Screen:

For detailed, step-by-step instructions on SAP Profit Center Accounting, follow along with my video tutorial below

Pingback: SAP Cost Center Accounting-3 (Report Painter) | SAP FINANCE and Treasury

Pingback: SAP Internal Order | SAP FINANCE and Treasury

Pingback: sap controlling overview

Pingback: SAP Controlling Tutorials | AUMTECH Solutions-SAP Training

Pingback: SAP Tutorials | AUMTECH Solutions-SAP Training

Pingback: SAP S4/HANA Finance Part-1 | AUMTECH Solutions-SAP Training