Accounts Receivable- Business User Guide

In contrast to general ledger accounting in which you only manage the total of receivables for the financial statement, you use accounts receivable accounting for recording all details regarding the business transactions such as invoices, credit memos and incoming payments. The interaction between the sales department and accounts receivable accounting assumes a significant role here. The sales employees are interested in sales orders and sales volume and they receive incentives in the form of bonus payments for their work. The task of accounts receivable accounting is to convert the invoice amount that was agreed on by contract with the customer into cash receipt. There is a general saying that states "sold and delivered goods remain a gift until they are paid".

The management will include rules to handle certain business cases for example how to handle insolvency of one or more customers or total loss in receivables, or if customers are paying too late or don't pay the total invoice amount, these all result in delayed or loss in the cash receipt, however the management must keep the business running. A key figure that is mentioned in business is the DSO (days sales outstanding) value, that is the period outstanding of receivables. Another addition to management is how much time and hence money is invested internally to go from sales order to cash receipt, this determined how well sales and financial account interact with each other, this calls for very clear responsibilities and goals.

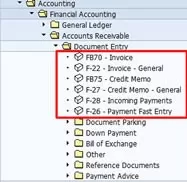

I will not be mentioning on how to enter incoming invoices in this section as they are the same as in accounts payable, the only different is the transactions codes and the easy access menu location which can be seen below, which means we can focus on the sections that are related to the account receivable.

FI-AR Component

The SAP system includes two components or subledger's to save customer data

- FI-AR (accounts receivable)

- FI-CA (contract accounting)

This dualism is due to that enterprises use different business models - business to business (B2B) and business to consumer (B2C) in practice. The B2C business model primary concerns SAP industry solutions for communication enterprises, electricity provides and the media segment. One challenge is to map millions of end customers quickly and efficiently, the data model and the existing programs for FI-AR quickly reach their (time) limits. This is where FI-CA (contract accounting) emerged, which is based on the industry solutions for mass accounting. The processes and hence the programs such as invoice posting, dunning procedures or incoming payments are developed for these industries specifically for the FI-CA subledger. FI-AR and the general ledger are connected in real time, however they are connected asynchronously that is they are connected to the background processing with a time delay.

The FI-AR component keeps and manages account-based customer data, the component is an integral part of sales and distribution controlling, it also provides effective credit management through a close integration with SD (Sales and Distribution) module and information for the optimization of the liquidity planning through a connection with the cash management and forecast.

Account analyses, alarm reports, due date lists and flexible dunning are available for the open item management, an incoming payment can be assigned to the corresponding receivables manually on the screen or by electronic means. By means of the payment program you can automate both the debit memo procedure and the payment of credit memos. To document the processes in accounts receivable accounting you can use account balances, journals, balance audit trails and numerous standard reports. For key date valuations you revaluate foreign currency items, determine customers on the credit side and scan the balances established this way for remaining terms.

SAP AR Master Data

Master data is made of three parts, the general data is maintained at the client level, this data is available for all company codes, at this level you specify the name of the subledger account in subledger accounting, the tax number and the bank details.

Next is the company code data, this includes the account number of the reconciliation account in the general ledger, the terms of payment and the settings for the dunning procedure. For integrated use with the SD module you are provided with additional fields for the customers master record, these fields contain information that is required for handling business transactions in the sales and distribution area and that is used exclusively in the SD module, the data includes terms of delivery, price list type and remarks regarding the customer, these specifications control the order processing, the shipping data and the billing information provided that these business transaction are recorded by means of a transaction to SD. I will be fully covering sales and distribution in another section.

The SAP system provides a special master record type for one-time customers, in contrast to the regular master records, this is similar to the accounts payable, the master record does not contain specific data of the business partner such as address or bank details. The information is entered for each business transaction during document entry. When posting to a one-time account the system automatically navigates to an entry screen to enter the business partners specific data.

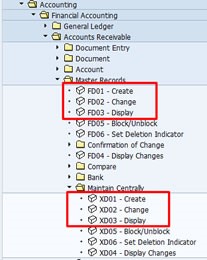

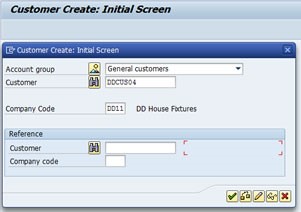

Creating a customer is very similar to creating a vendor which we performed in the accounts payable section, you can either create a customer centrally or create it centrally/company code level, the below screenshot displays both methods, we will use transaction code FD01

The initial screen requests for a account group, customer name and the company code, the account determines the account numbering or lettering and the field status parameters. here I will just enter the minimum to get started, also if you notice you can copy an existing account using the reference fields.

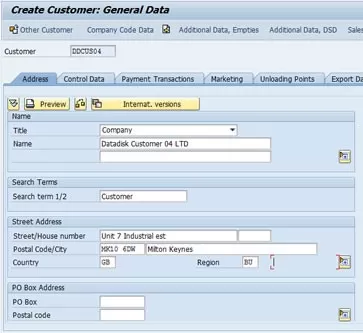

The first details we will fill in is the address tab (left-hand screenshot), this is all self-explaining, the next screen/tab is the control data (right-hand screenshot), here we can enter tax details, locations (this help in SD for delivery locations, etc.), you can also specify if the customer is also a vendor (if you do then a field called Clearing with ... in the account management tab in the company code will appear, you need to activate this field), and you can implement authorizations so that specific users can alter the customers details.

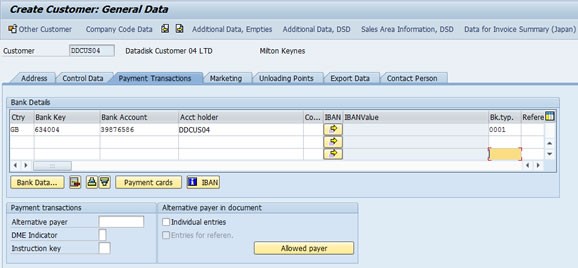

The next screen is the bank details (left-hand screenshot) again this is self-explaining, the account management screen (right-hand screenshot) details the reconciliation account (remember the customer is a subledger), sort key, cash management group, also you can setup the interest calculation parameters, below are some of the parameters for the account management screen

- reconciliation account - Each posting to an account of subledger accounting automatically creates an entry to the general ledger, this is done via the reconciliation account, the field status group in the master record of the reconciliation account specifies the screen layout for document entry. The items of the customer’s account are managed in the currency of the reconciliation account

- sort key - used to sort line items, normally line items are sorted using the assignment field in the document.

- authorization - specify who receives change or read authorization for this account

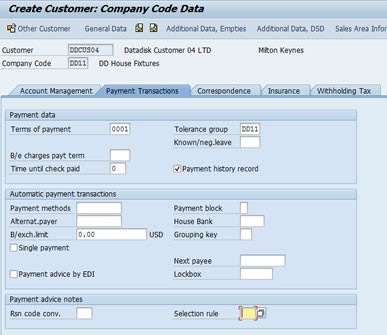

Next, we fill in the details for the payment transactions here we have the payment terms, tolerance group, automatic payment transactions

- Terms of payment - is used for orders, purchase orders and invoices and provide information about dunning and payment transactions, the value entered here is used as a default value for the document entry

- Tolerance group - you make specifications for granting of cash discounts and for handling of payment differences for each tolerance group, this entry affects dunning and entry of payment transactions. For manual closing the payment differences are accepted by the system up to the define tolerance and the items are closed

- Payment history record - the system records the customer payment history, this is important for credit management.

- Payment methods - you can define the payment methods that are allowed for the customer if the automatic payment program is used.

- Payment block - this causes a block on the account, in the automatic payment program the block is effective if it is set either in the master record or in the document, if set in the master record all open items of this customer are transferred to the exception list.

- Single payment - determines that all open items are paid or collected separately, this prevents multiple open items being cleared jointly with one payment.

- Clearing with vendor - this checkbox only appears if a value is entered in the vendor field in the control data tab, however an actual clearing within the automatic SAP procedure only takes place if this field is selected

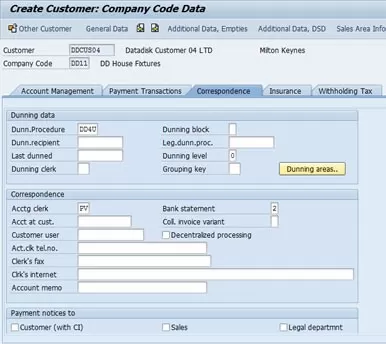

Next is the correspondence screen which involves dunning, the accounting clerk, bank statements, etc.

- Dunning procedure - the dunning procedure which is company code independent and can be used by all company codes within a client. Only the dunning notices are controlled separately for each company code. To be consider as part of the dunning process you must define a procedure here.

- Dunning Frequency/Interval - determines the minimum number of days that must elapse after a dunning run before an account can be dunned again. The date of the last dunning run is recorded in the master record, using this date and the frequency/interval the SAP can determine if it is available to be in the dunning run.

- Grace day/minimum number of days in arrears - used to determine the due date of open items and whether an account can be dunned. An item whose days in arrears are smaller or equal to the grace days must be considered as not due.

- Number of dunning levels - for each dunning level you can specify how many days in arrears a line item must be to reach the corresponding dunning level. The dunning level determines the associated dunning notice.

- Processes to be dunned - you specify whether the stand and/or special G/L transactions are dunned with a procedure, special G/L transaction include bill of exchange payment request, payment requests, down payments and down payment requests.

- Dunning block - the business partner is not included in the dunning run, you can enter a blocking key which is a descriptive text that indicates the reason for the block, blocked accounts are output in an exception list which includes the block reason.

- Dunning level - normally this is set within the dunning program, however you can set it here, the dunning level influences the next dunning run, if set to 0 the system uses the minimum number of days in arrears that are specified in the dunning procedure to calculate the necessary days in arrears for all other dunning levels the system uses grace days

- Dunning clerk - the name of the clerk whose ID is indicated in this field is printed on the dunning notices, the dunning and account clerks can be same of different

- Accounting clerk - the name of the clerk whose ID is indicated in this field appears on all correspondence documents sent to the business partner, additionally it is printed on the dunning notices, if the dunning clerk field is blank

The customer will now be available for you to post invoices, etc.

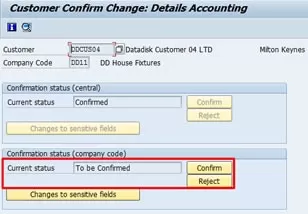

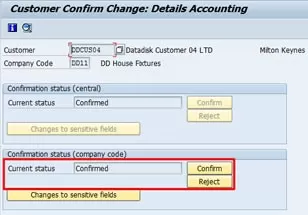

If you display the customer and you receive the below informational message (left-hand screenshot) this means you need to confirm the customer (you need to be a different user), from the display screen select extras -> confirmation of change from the menu bar and you will be taken to the customer confirm change screen (middle screenshot), if you notice in the confirmation status (company code) it needs to be confirmed, select the confirm button and the screen will be updated, you will then not see this message again.

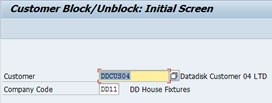

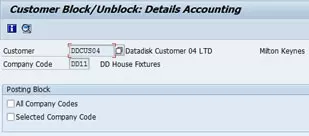

As in vendors you can block customers, using transaction code FD05 the initial screen (left-hand screenshot) requests for the customer name and company code, you can block for all company codes or just the selected company code. You can also do this centrally using transaction code XD05.

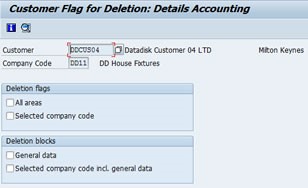

The subledger's provide you the option to set flags for the deletion of all master data or company code specific master data of certain company codes, you can use transaction code FD06

- General data - this flag prevents the deletion of general data from the master record by archiving the program

- Selected company code Inc. general data - this flag you determine the company-specific data of the master record must not be deleted, if set none of the associated general data is deleted.

Overview of the Integrated Business Transaction

Like we did in the accounts payable I am going to explain the business transactions relating to account receivable, this usually concerns the individual steps from order entry to incoming payments (order to cash), again different departments will be involved, departments of sales and distribution, accounts receivable accounting, controlling, and treasury.

During the incoming orders in the sales and distribution department two critical checks are implemented in the background

- can the goods be delivered at the requested date

- does the customer have a sufficient credit limit

Both may require interaction with the customer, a successful incoming order impacts the future cash inflow of an enterprise, with the date of required payment you are provided with a date for the planned cash receipt, this is significant for the treasury department. The controlling department can identify planned revenues for products x, y, and z, already in the forecasts by means of the incoming orders.

In real life the next steps of the process chain, the goods issue, is carried out days, weeks or even months after the incoming order, at this time the goods are removed from storage and delivered to the customer, again credit checks may be performed just before the goods are sent. The next step is the billing documents for the delivery and services provided as a receivable in the accounts receivable accounting. The customer is requested to pay within the time period that was agreed on the incoming orders, at the same time this information is forwarded onto the controlling and treasury departments. The billing status is much more meaningful that the incoming order status for a profitability analysis of products x, y and z for a liquidity planning. At this point the order is processed, the goods are delivered and the billing brings in the cash receipt closer.

There is a saying as in accounts payable that "delivered goods remain a gift until they are paid", a customer will receive written dunning notices in multiple dunning levels after the date of required payment has been reached. In practice you use three or four dunning levels with dunning intervals of 7 to 14 days, however customers (not all customers) normally delay payment until they receive the third or last dunning notice. Dunning can be performed by email and by telephone where you would call the customer to remind them at the payment is due, plus this adds the bonus that you can ask them if they are satisfied with anything or if you can help them with more services, almost trying to obtain additional sales without being too demanding but using the justification of the dunning notice for the call.

The final step of the process chain takes place when the customer pays, the payment is credited to the enterprise account, and the information is available via an electronic bank statement. Payment notes indicate which bills are supposed to be paid with the cash receipt, these notes are used for an automatic clearing of the original bill, however there may be times which manual intervention is required to match the payment with the order.

Monitoring Credit Limits

It is important to monitor the credit lines of customers, credit checks are performed and goods/services are not performed or sent until clarification has been obtained with the customer for the credit limit breaches, it maybe that credit limits can be increased or that they customer will pay over the phone to reduce the amount of credit they have. Over time credit limits will match what the customer needs and hopefully there will not be too many issues, as the last thing that you want to do is make the customer go else where for the goods or services but at the same time you need to make sure that orders are being paid on a reasonable timescale.

The SAP credit management system allows you to keep the history on each customer in one place, this includes payment history, dunning levels and order volumes and external information regarding credit ratings.

When you enter a order (transaction code VA01) or invoice (transaction code FB70) the system will check and alert if any credit limit (right-hand screenshot) is breached or if a clerk does not have the limits to input the invoice (left-hand screenshot), you can see how to create credit limit areas in the FI setup and configuration section.

Dispute Management

I will cover the dispute management lightly here until I get more experience with it, all businesses have to deal with disputes with customers and vendors, and they can be divided into three categories

- The customer informs the enterprise proactively - the complaints department, the account manager and accounting must all be able to initiate a dispute case

- The customer claims payment deductions - the SAP system unsuccessfully tries to settle a number of invoices by means of a electronic bank statement. The dispute management can automatically generate a dispute case with the associated items, indicate difference and forward it to the clerk defined in the customer master record.

- The customer hold backs the payment - the open items become over due after the terms of payment have expired, a dispute case can be created automatically before the dunning notice.

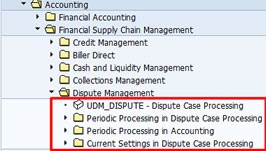

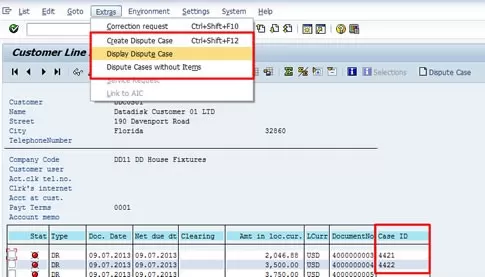

The dispute case created remains connected to the open items or the business transaction, you can open the dispute case processing from the SAP menu as seen below

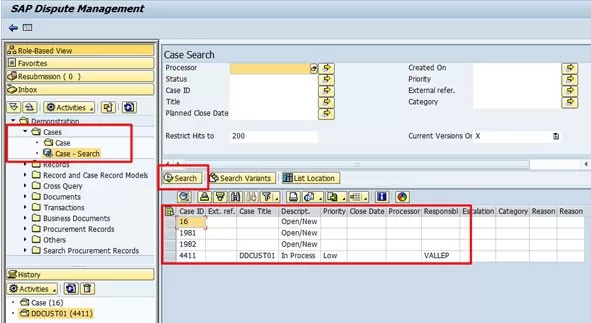

When you open the dispute management you are taken to the initial screen as per the below screenshot (left-hand screenshot), I have highlighted in red boxes some simple search options that you can use to find open cases, also you have different RMS (Record Management Systems) which are used for the logical separation of different business areas (right-hand screenshot), which are physically used in the same client of an installation. By dividing the records of a company into discreet units means that it is possible to provide particular groups of users access to particular records.

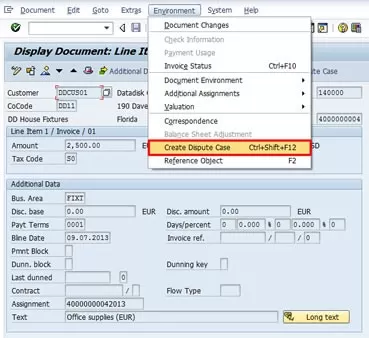

So lets create a dispute case with a existing transaction, for this example I will use customer DDCUS01 and select a open transaction, you can then select environment -> create dispute case

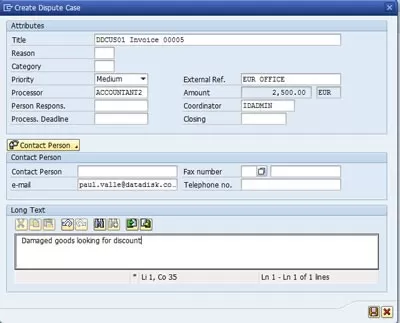

The dispute case initial screen looks like below, fill in as much as you can and then select the save icon

The SAP system then displays a confirmation message that a dispute has been opened for this document.

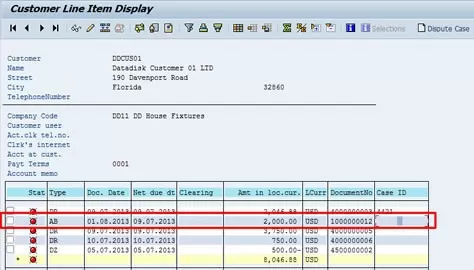

You can add an additional column called case ID in the customer line item display screen, which displays the dispute case id for all the documents, you can either double-click the case ID or select extras -> display dispute case to see the dispute case

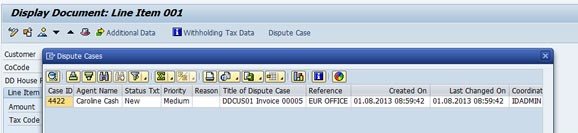

The system then displays a list of the dispute cases, again you can double-click on the dispute case to see the header information

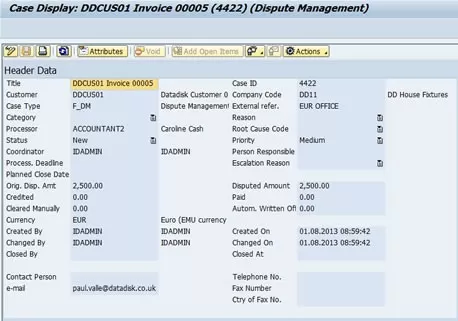

The dispute case header information has lots of details which includes who opened the case, the amounts involved, contact details, reasons for dispute case, etc. Notice the amount as we will be creating a credit memo later and linking to this dispute case

We can then use the dispute case manager to also view dispute cases as we saw earlier, here you can see the two cases that I have open (including the one we created earlier)

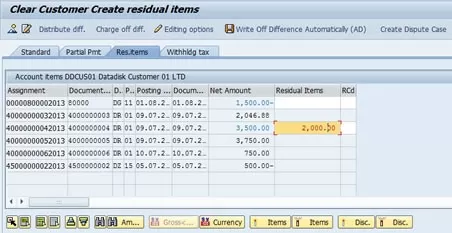

Let’s say that we have agreed to create a credit memo for 1500.00 for the damaged goods (something is better than nothing), once the credit memo has been created we use clearing to make a residual payment against the original invoice

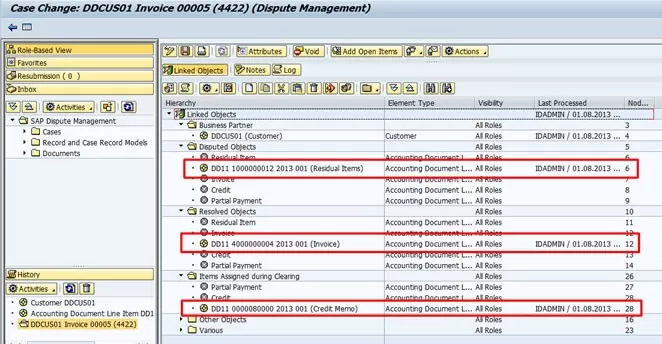

Now lets see what has happened in the dispute manager, here we can see three entries, the original invoice, the credit memo and the residual item, so the dispute manager knows what has happened, the original invoice has now been resolved but because we still have the dispute case open it has attached to the residual item. You can double-click any of the below line items to obtain more details.

If we look at the header, we can see that the amounts have been adjusted because a credit memo has been applied

Finally, you can close the dispute case by either paying the invoice and clearing the open item or by using the dispute header and selecting the void button, you can then see the closed by completed (left-hand screenshot), also if you look at the open item the case ID has been removed (right-hand screenshot)

Comments are closed.