Table of Contents

SAP Accounts Payable

SAP AP is a submodule of SAP FI and is used to manage and record Accounting data for all the vendors. It handles vendor invoices, vendor payments and related activities. SAP Accounts Payable will be covered in four post as below

- SAP Accounts Payable Master Data

- SAP Accounts Payable End users transactions

- SAP Accounts Payable Global settings for manual and automatic vendor Payments

- SAP Accounts Payable Configuration of Vendor Automatic Payment Program for ACH, Wire and Check payment

- Creation of Vendor electronic payment file using DMEE

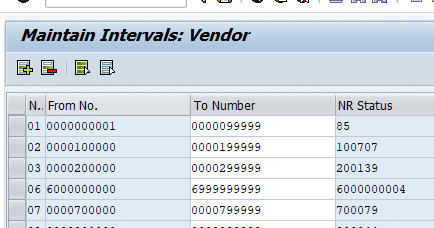

Create Number ranges for Vendor Accounts

- Number range can be internal / external

- Number range decide vendor master number at the time of creation. If external number range, you have to provide vendor number at the time of vendor creation. If internal number range, system generate the vendor number at the time of vendor creation

- Number range are assigned to Vendor Account Group

Transaction code : XKN1

IMG Path : SPRO – Financial Accounting – Accounts Receivable and Accounts Payable – Vendor Accounts – Master Data – Preparation for creating vendor master data – Create number ranges for vendor accounts

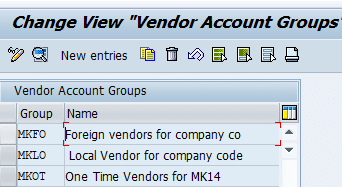

Define Vendor Account Groups in SAP

Vendors are classified into various account groups. The account group determines the following:

- Number range interval of the vendor

- Mandatory and Optional fields during vendor master creation in transactions code XK01

- Whether a vendor is one time vendor

Transaction code: OBD3

IMG Path : SPRO – Financial Accounting – Accounts Receivable and Accounts Payable – Vendor Accounts – Master Data – Preparation for creating vendor master data – Define Account groups

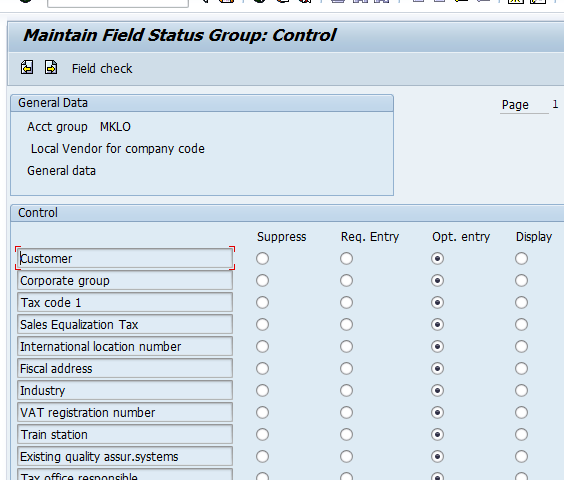

Select account group MKLO and double click. This will show the fields which can be made mandatory or optional in vendor master maintenance ( Transaction code XK02)

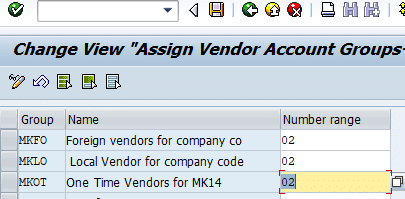

Assign Number Range to Vendor Account Groups

Transaction Code: OBAS

IMG Path : SPRO – Financial Accounting – Accounts Receivable and Accounts Payable – Vendor Accounts – Master Data – Preparation for creating vendor master data- Assign number range to Vendor account groups

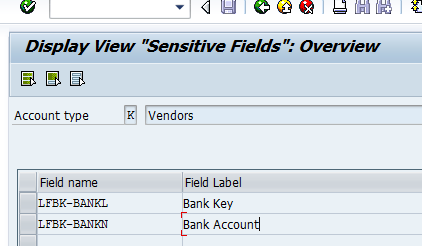

Define Sensitive Fields for Dual Control in SAP

Transaction Code: S_ALR_87003179

IMG Path : SPRO – Financial Accounting – Accounts Receivable and Accounts Payable – Vendor Accounts – Master Data – Preparation for creating vendor master data-Define Sensitive field for Dual Control (Vendors)

We can define certain fields in vendor master as sensitive fields. Any changes to these have to be confirmed by two users for the change to be effective. Further once a sensitive field is changed, vendor is blocked for payment. This block is removed when the change to sensitive field is confirmed by second user in transaction code FK08. If the change is rejected by second user in transaction code FK08, vendor remains blocked for payment till the time sensitive field is confirmed /rejected by the second user. Generally fields like Vendor Bank account number, routing number are defined as sensitive fields

Transaction code to confirm the sensitive field changes : FK08 or FK09.

Create Vendor master in SAP

Transaction codes

Centrally: XK01

Only for Accounting Area: FK01

Purchase Organization area alone: MK01 / MK02 /MK03

Alternatively use SAP menu path as below

SAP Menu – Accounting – Financial Accounting – Accounts Payable – Master Records – Create

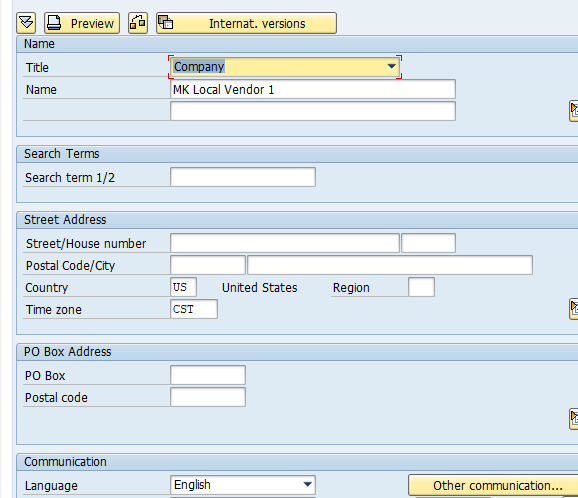

Vendor Master fields under General View

Data under general view is applicable to every company code and purchasing organization in your company, it includes the vendor’s name, address, language, and telephone

number

- Vendor Name Field: Field Name 1 is Legal Name, Filed Name 2 is Spill Over Name, Field Name 3 is Commercial Name and Field Name 4 is Spill Over Name

- Tax Information:

- Tax Number 1 is Social Security Number,

- Tax Number 2 is Tax ID,

- Tax Number 3 is Canadian VAT Tax,

- Tax Number 4 is VAT European Union

- Bank Details :

- Vendor bank fields are generally identified as sensitive so changes here have to be confirmed by another user in FK08 / FK09

- Bank details are entered for ACH and Wire Transfer Payments

- CTRY : Country

- Bank Key : Routing Number

- Bank Account : Account Number

- Acct Holder : Vendor Name

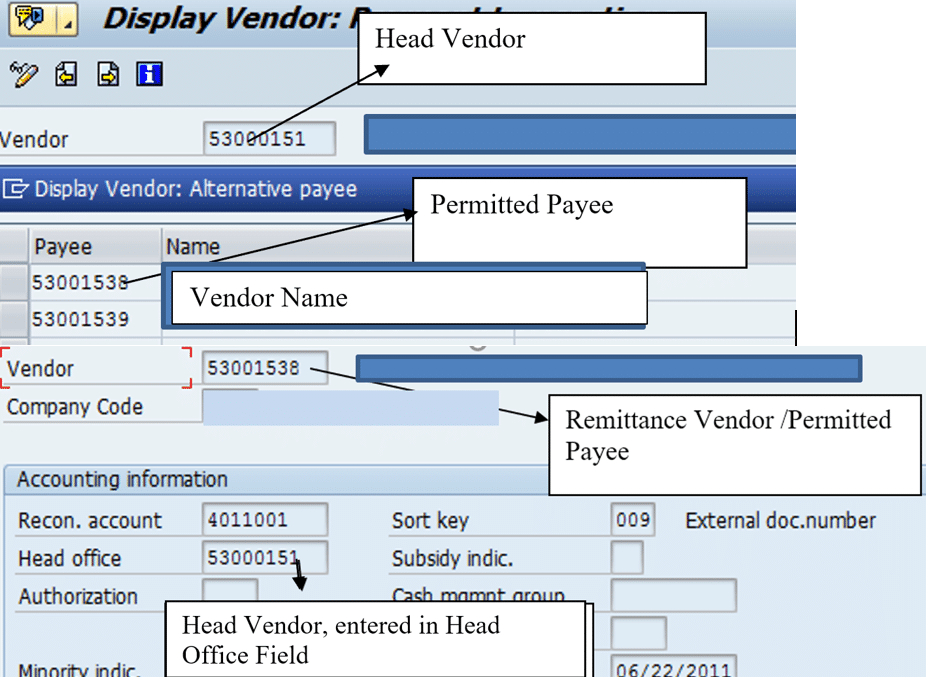

- Permitted Payee: Permitted payee option enable linking multiple remittance vendors address to the Head vendor. These remittance vendors can then be selected during invoice entry. This allows control to issue payments to multiple remittance addresses. All Remit Vendor numbers are listed in the “Permitted Payee” section of the Head Vendor (general data). Head vendor is linked to Permitted payee by entering it in Head office field in Permitted payee vendor master data

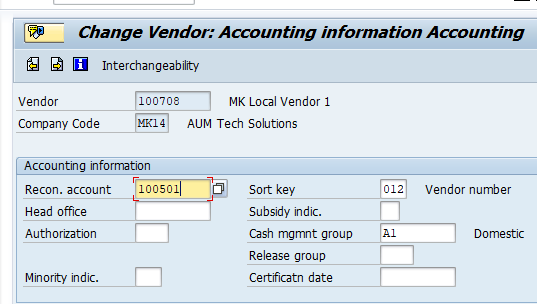

Vendor Master Fields under Company Code View

Specific to an individual company code, the company code data includes information

like the reconciliation account number, payment terms

- Minority Indicator: Used for representing the size of the vendor’s business and for other reasons (example – small business or a minority group or a female leading a corporate). This is only used for USA.

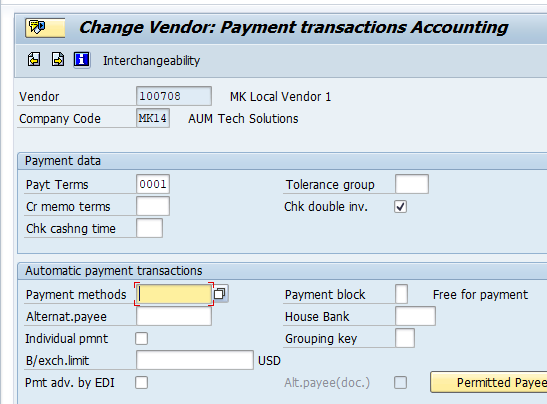

- Payment Method:

- A ACH Payment

- C Check USA

- W Wire Transfer

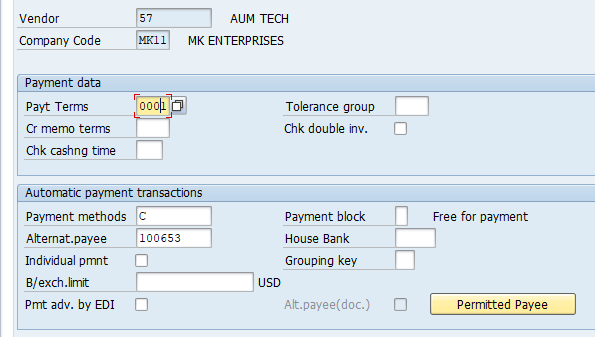

- Alternate Payee: The payment program can make payment to a vendor other than the one to which the invoice was posted. Payment is made to an alternative payee, which is specified in the master record. In the below case all open invoices for vendor#57 will be paid to vendor#100653 by payment program (Transaction code#F110)

Vendor Master Fields under Purchase Organization View

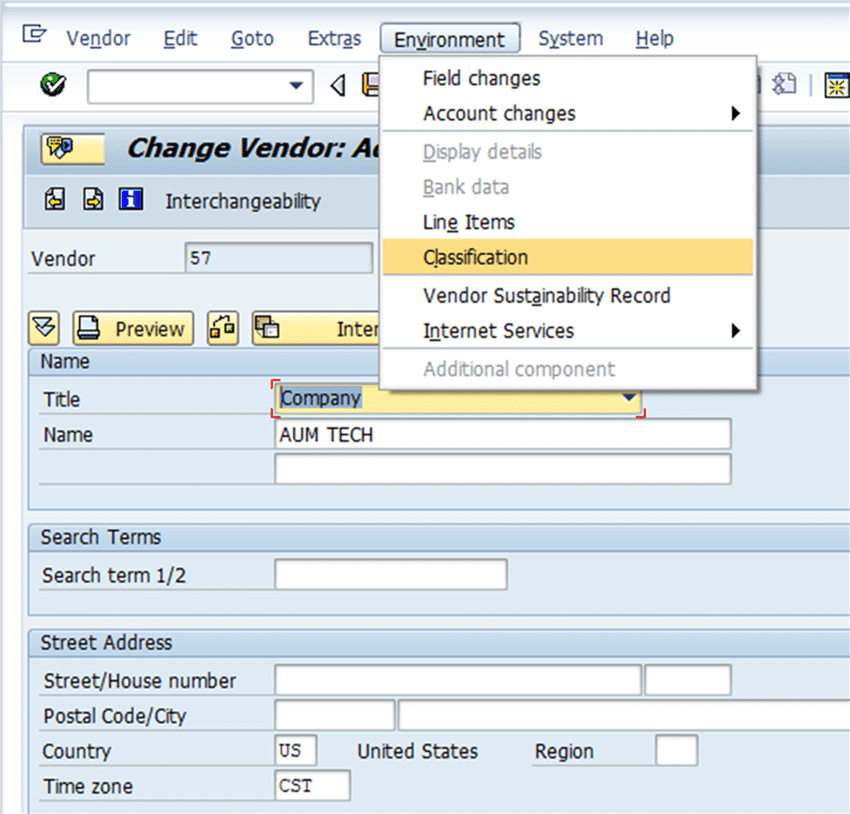

Classification

There is often a Business need to classify the vendors for reporting & audit purposes. SAP provides standard Functionality in Vendor master to classify the Vendors according to Business needs.

Maintain Classifications

We can utilize SAP Class & Method Functions to configure Vendor Master Classification.

For example the vendor master needs to be classified as “Type of Vendor” the same can be achieved in following three steps

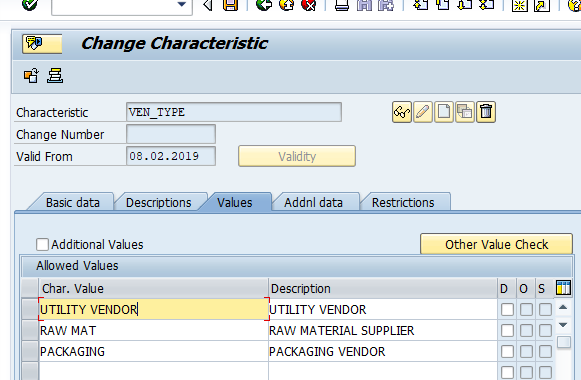

1) Creation of Characteristics

Execute the Transaction CT04 & create characteristics as follows

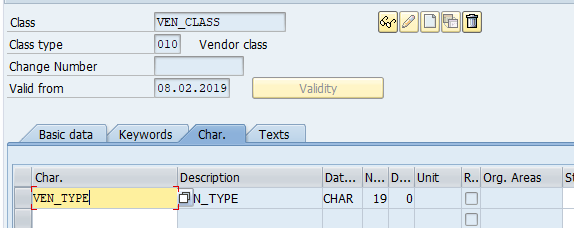

2) Creation of Class

Execute Transaction CL02

Create class Ven_Class and assign vendor characteristic Ven_Type to Ven_Class

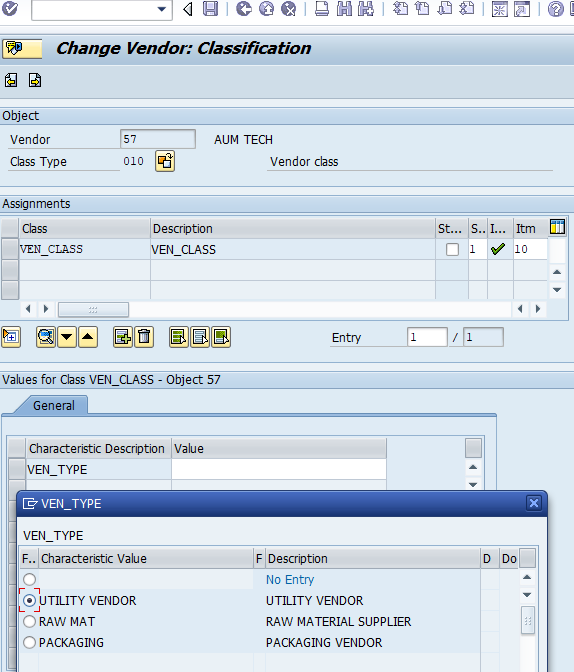

3) Assign the Characteristics in Vendor Master

This way characteristics can be defined and assigned to vendors

Transaction Code: OBR2

You cannot delete Vendor Master Record if transactions have been posted

Thus it is recommended to delete the records in Test environment during implementation

In case Vendor master is linked to another master record which could be a customer. First delete the referenced records. You can find referenced master records by running program SAPF047

For detailed, step-by-step instructions on SAP Finance, business process, configuration and development follow along with my video tutorial below. This course covers topics like Enterprise structure, General Ledger, Accounts Payable, Accounts Receivable, Bank Accounting, Electronic Bank statements, Dunning, New General Ledger etc.

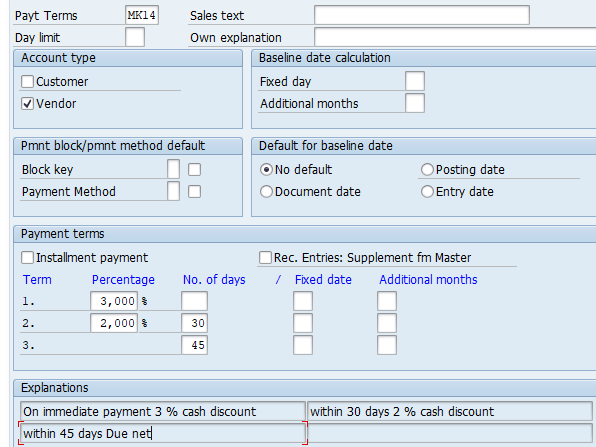

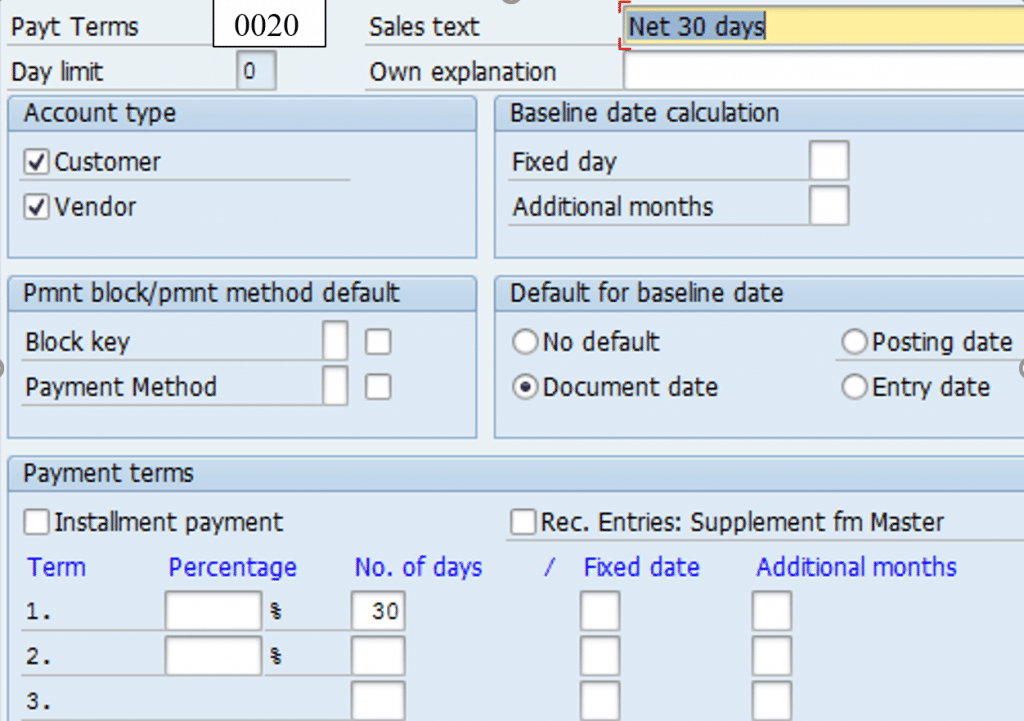

Maintain Terms of Payments

Tcode : OBB8

IMG Path : SPRO – Financial Accounting – Accounts Receivable and Accounts Payable – Business Transactions – Incoming Invoices – Maintain Terms of Payments

Transaction Code: OBB8

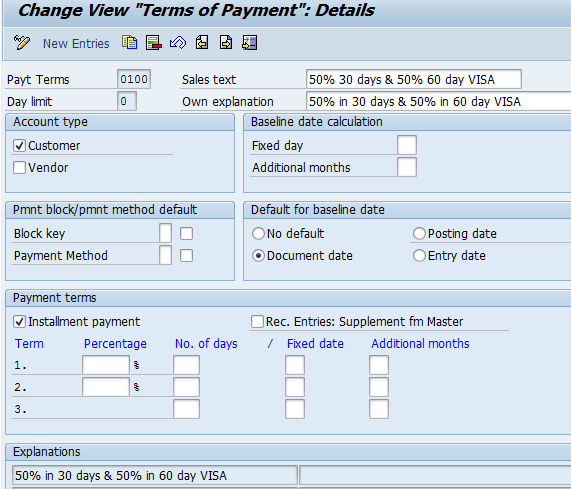

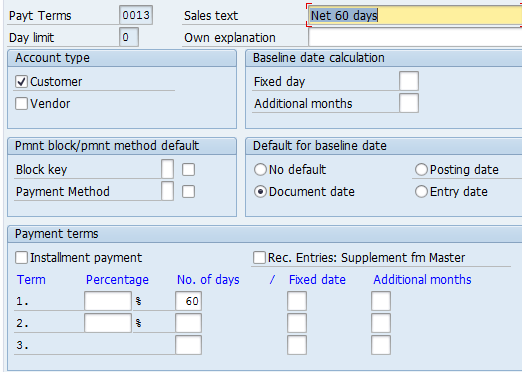

Payment terms: 0100

Select check box installment payment

Create Payment Terms 0020, due in 30 days. Do not select check box installment payment

Payment Terms 0013, due 60 days. Do not select check box installment payments

Assign Payment terms 0020 and 0030 to Payment term 0010 in transaction code OBB9 to create installment payment terms 0010

Transaction Code: OBB9

IMG Path : SPRO – Financial Accounting – Accounts Receivable and Accounts Payable – Business Transactions – Incoming Invoices – Define Terms of Payment for Installment Payments

Document Types used in Accounts Payable

Transaction code : OBA7

| Doc Type | Description | No. Range |

| KR | Vendor Invoice | 01 |

| KZ | Vendor Payment | 04 |

| KA | Vendor Document | 17 |

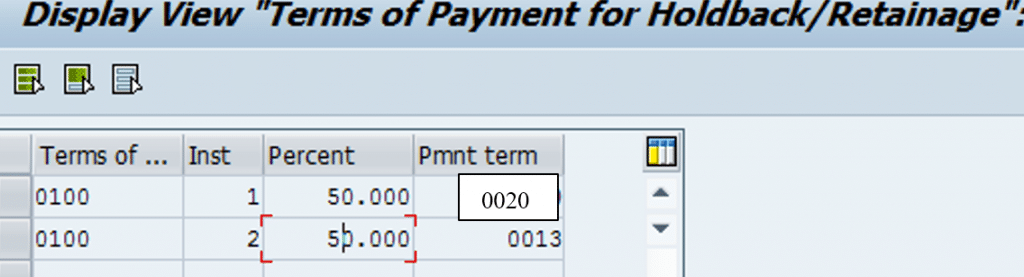

Vendor Automatic Payment Program

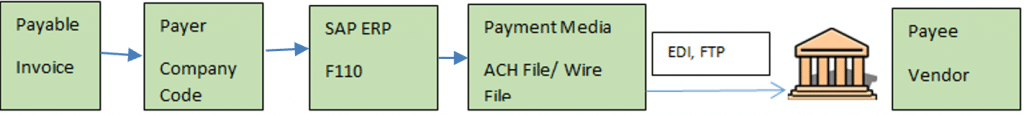

Below is an overview SAP Payment Process when Payment made to vendors through Check

- Invoice : Accounts Payable department receives vendor invoice. This is entered in SAP system (Transaction : FB60 / MIRO). Invoices becomes due for Payment on their due date. Invoices due date is calculated based on terms of payments in the invoice. If terms of payments is 15 days from Document date, than invoice becomes due for payment 15 days after it’s document date

- Payment Method : Payment method in this case is Check

- Positive Pay File : Positive pay file is a list of check numbers generated by SAP payment program. An electronic file is generated of these check numbers and sent to bank. This can be done through manual upload on bank website or through FTP, EDI or any other method.

SAP Payment Process – ACH/Wire

- Payment Method : Payment method in this case is ACH or Wire

- ACH : Stands for Automated Clearing House. It is form of Electronic payment in USA

- Wire Transfer : It is a form of Electronic payment. Wire transfer results in fund transfer on the same day, whereas ACH may take 2-3 days for fund transfer. Wire transfer is more expensive than ACH.

- Payment Process: Accounts department runs the payment program generally on fixed days (Every Tuesday / Thursday). Payment program picks the vendor open invoices which are due for payment on the payment run date. It than creates a Payment advice which can be sent electronically (Email) or through mail to the vendor. It also creates an ACH payment media file. File can be manually uploaded on bank website or electronically sent to the Bank (EDI, FTP…). Based on data in the file bank makes payment to the Vendors. Banks also sends and electronic confirmation (email) of the payment file receipt.

SAP Automatic Payment Program can handle both outgoing and incoming payments. It can make payments to vendors in a number of payment methods like check, ACH, Wire transfer etc. It can make both domestic and foreign payments. Payments can be made in company code currency or foreign currency. It makes payment for Vendor open Invoices based on their due dates. Below are the configuration steps involved in SAP automatic Payment program.

Topics discussed

|

Vendor Payments ACH/Wire/ Check-Part 1 |

Configuration Steps |

|

SAP Payment Process – ACH/Wire/Check |

ACH/Wire/Check Payment Process business overview |

|

Automatic Payment program configuration |

Define Bank Key – FI01 |

|

Define the House Bank – FI12 |

|

|

Set up All company code –FBZP |

|

|

Set Up Paying Company code –FBZP |

|

|

Set Up Payment Method per Country FBZP |

|

|

Set up payment Method per company code –FBZP |

|

|

Set up Bank Determination –FBZP |

|

|

Define Value Date rules – FBZP |

|

|

Update new Payment Method in Vendor Master – XK02 |

|

|

Post Vendor Invoice in transaction code: FB60 |

|

|

Verify Amount due to Vendor in vendor line item report: FBL1N |

|

|

Run Automatic Payment Program: F110 |

SAP Payment Process – Configuration transaction codes

- Define Bank Key – FI01

- Define the House Bank – FI12

- Set up All company code –FBZP

- Set Up Paying Company code –FBZP

- Set Up Payment Method per Country –FBZP

- Set up payment Method per company code –FBZP

- Set up Bank Determination –FBZP

- Define Value Date rules – FBZP

- Update new Payment Method in Vendor Master – XK02

For detailed, step-by-step instructions on SAP ACH, Wire, business process, configuration and development follow along with my video tutorial below.

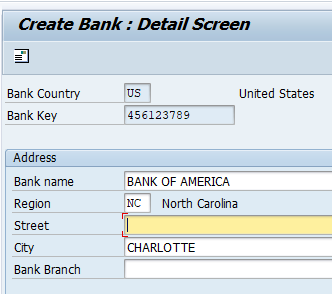

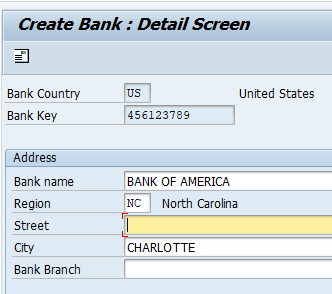

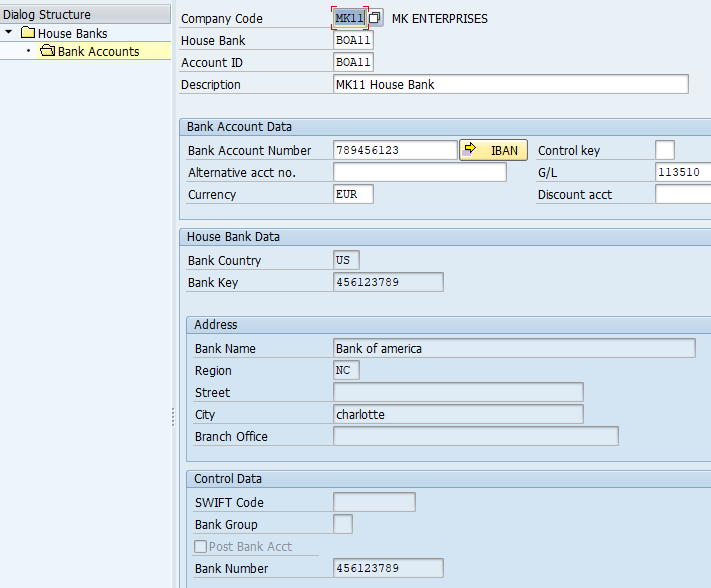

Define Bank Key

Transaction Code : FI01

Bank Country : US

Bank Key : 456123789

Bank Name : Bank of America

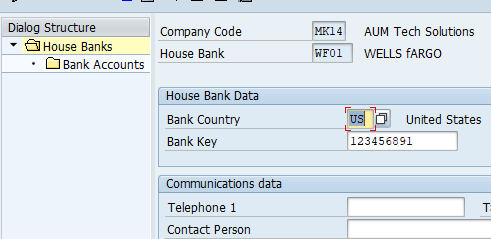

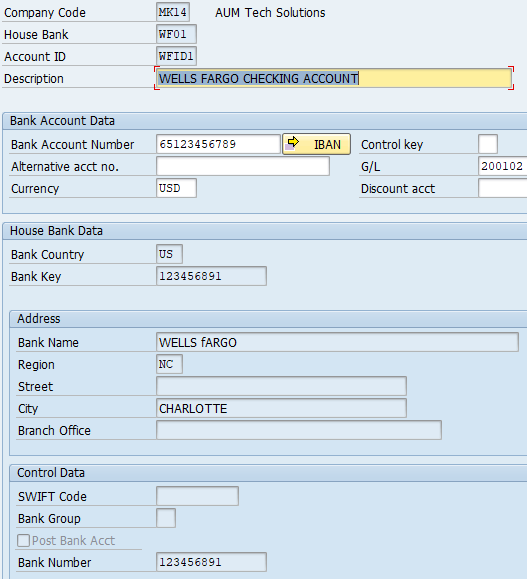

Define House Bank

Transaction code : FI12

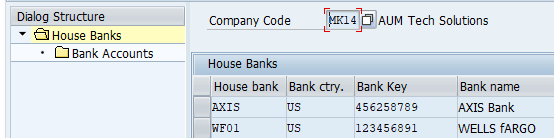

Select House bank WF01 and double click Bank account to create account ID as shown below

House Bank : These are banks through which payments are made in payment program.

Similarly we create AXIS House bank

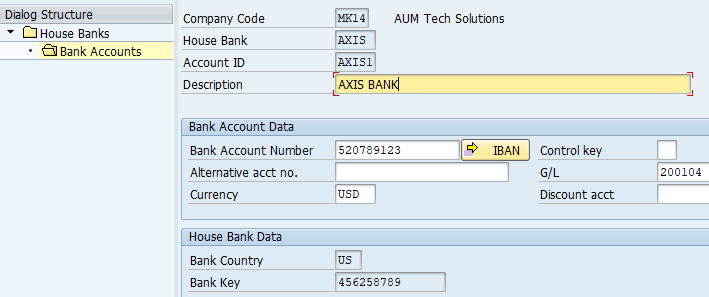

Details of AXIS1 Account ID

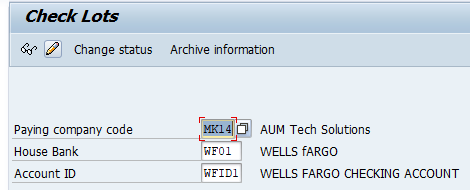

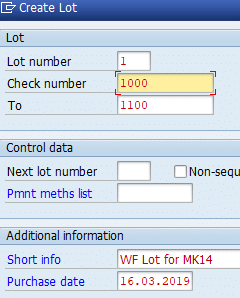

Creation of Cheque Lot

Transaction code : FCHI

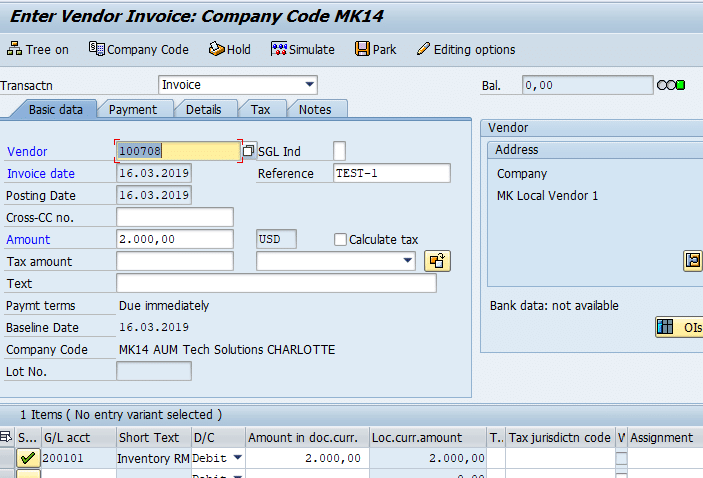

Purchase Invoice Posting

Transaction Code : FB60

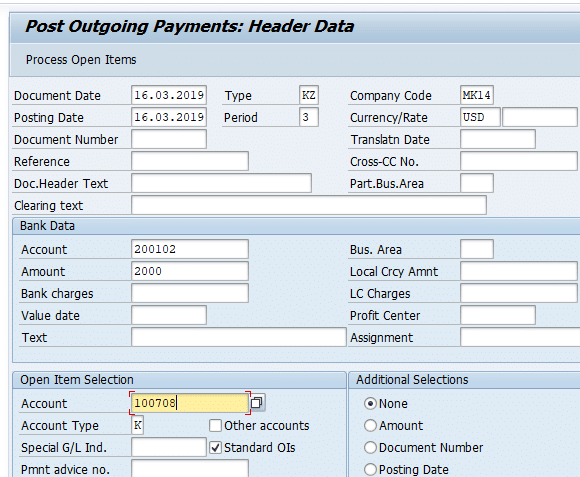

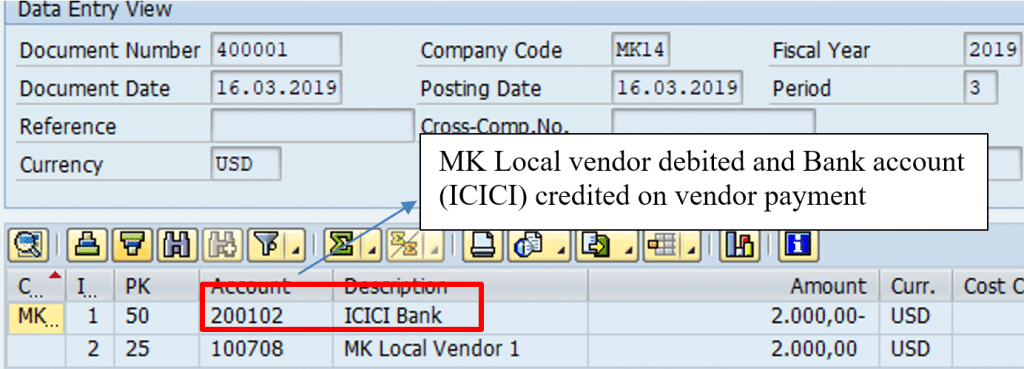

Manual Payment Of Vendor Invoice using bank Account

Transaction code : F-53

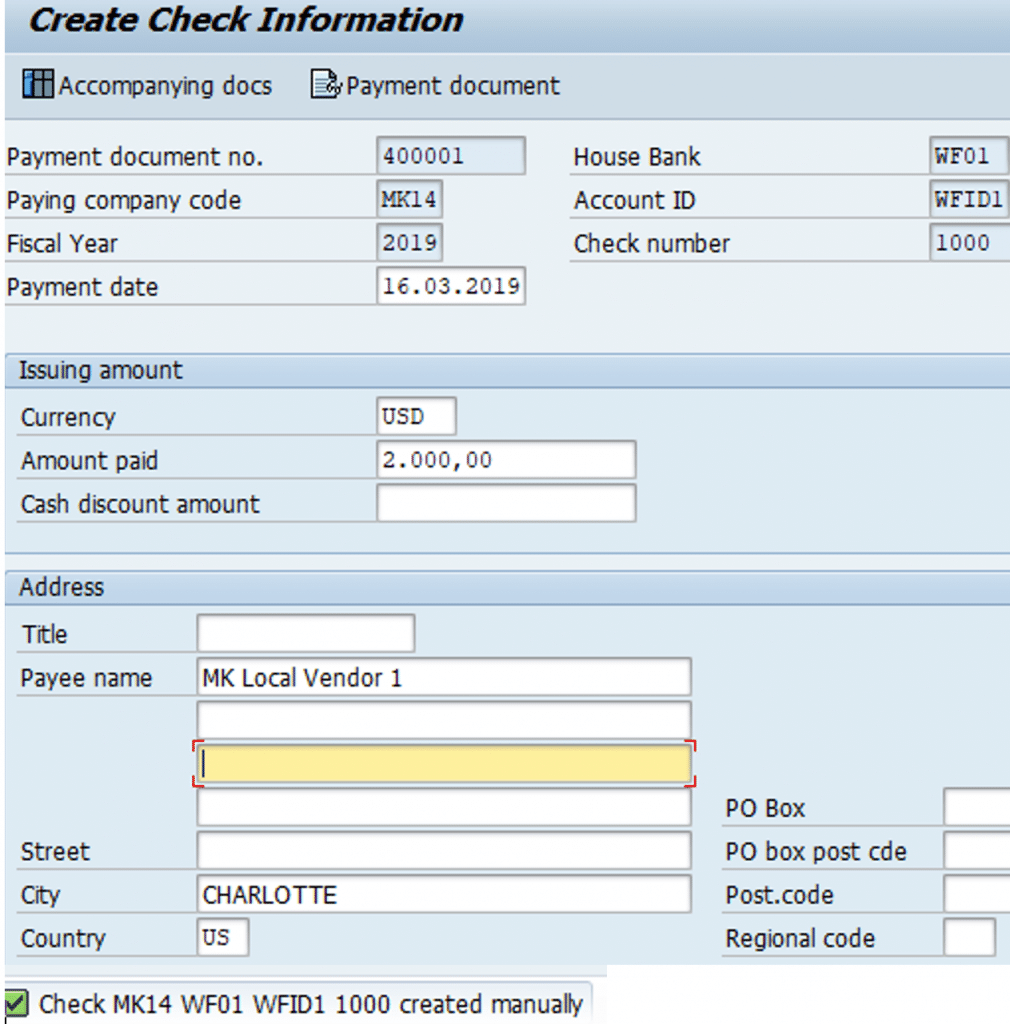

Manually create check for payment document posted in previous step

Transaction : FCH5

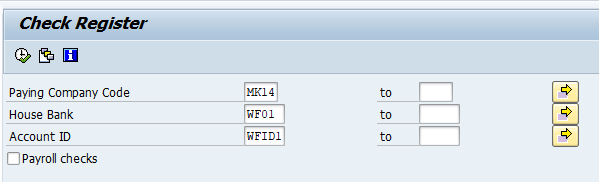

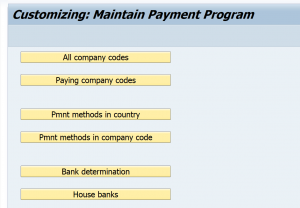

Display Check Register

Transaction code : FCHN

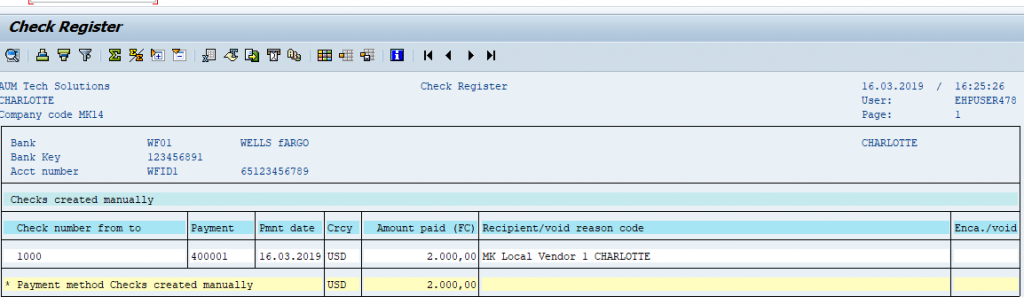

Encashment Date : This is the date on which the check was cashed at the bank by the payee.

Transaction Code: FCH6

Transaction code relevant to Manual Check processing

| Description | Transaction code |

| Cancel Unused Checks | FCH3 |

| Creation of Void Reasons | FCHV |

| Issued check cancellation | FCH8 |

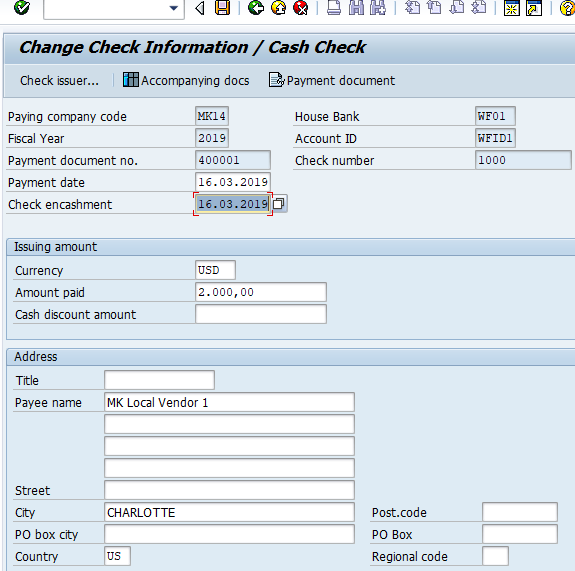

Automatic Payment Program Configuration– Payment Method Check

Transaction Code : FBZP

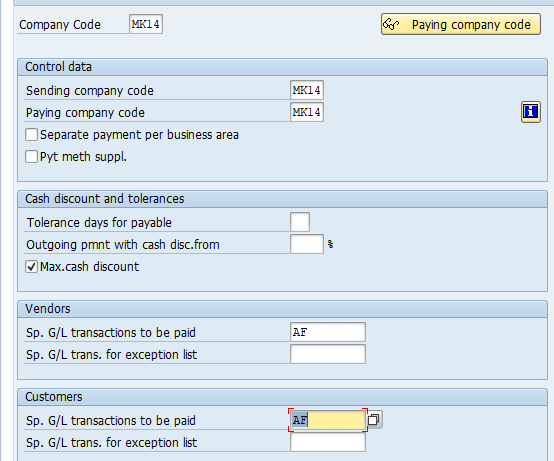

Click tab All Company codes tab and enter below details

- Company code MK14 : Company code for which Payment program configuration settings are made

- Sending Company Code MK14 : Company code sending the payment to the vendor. Can be same or different from paying company code

- Paying Company Code MK14 : Company code which makes payment to vendor. This is generally same as sending company code. In case of centralized payments there can be one company code making payments for various other company codes.

- Outgoing payment with cash discount from 1% : Only items that have a cash discount percentage rate greater than or equal to the one specified here are paid with the cash discount deducted. If the percentage rate is less than the one specified here, payment is made at the due date

- Max. Cash Discount : Means that the maximum cash discount is always to be deducted when automatically paying vendor invoices.

- Vendors: Sp. G/L transactions to be paid : F Down Payment Request, A Down Payment on current assets

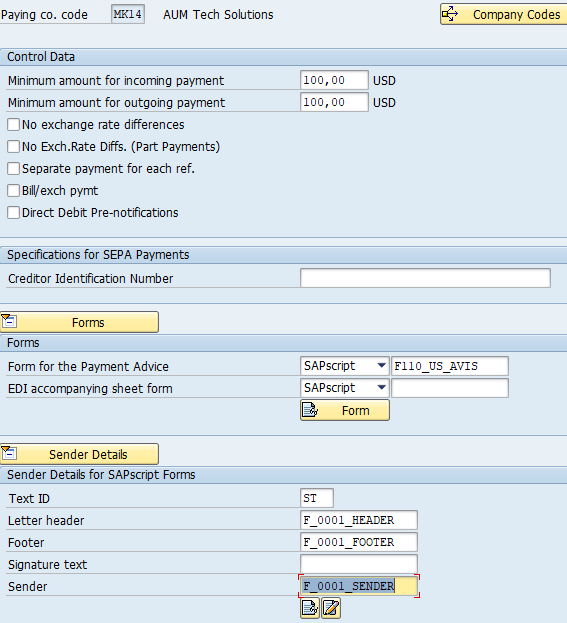

Step 2 : Click tab Paying Company Codes and below details

- Paying Company Code MK14 : Can click on right to see the listing of all company codes for which it will act as paying company code

- Min amount incoming Payment 100 : If amount less than specified here, it is listed in the exception list.

- Minimum amount outgoing payment 100: If a payment amount does not equal or exceed the amount specified in this field, the line items that make up this amount are printed in an exception list.

- No exchange rate differences : Select. If the indicator is not selected, the difference between the exchange rate at the time of posting and the exchange rate at the time of payment is determined for items which are posted in foreign currency. The exchange rate differences which have been determined are automatically posted for each payment.

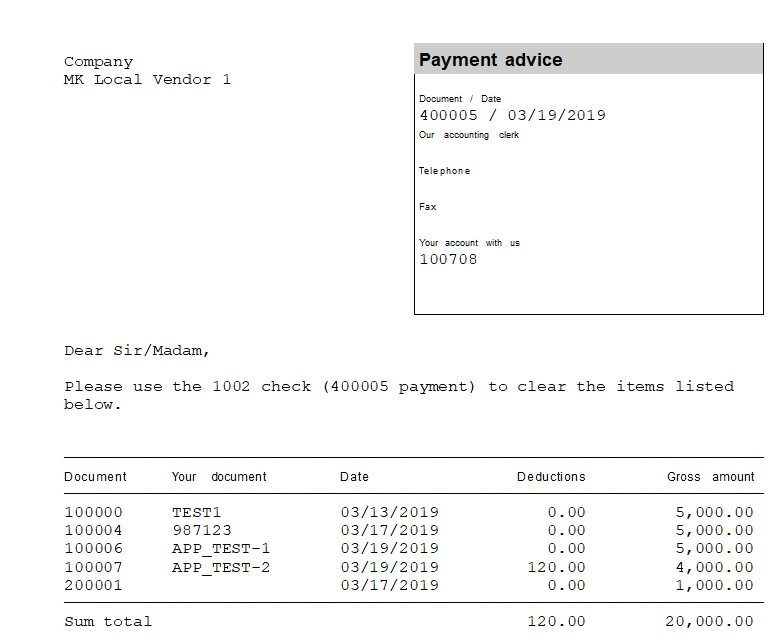

- Form for the Payment Advice F110_US_AVIS : Name of the SAP script used to create a payment advice note in this company code.

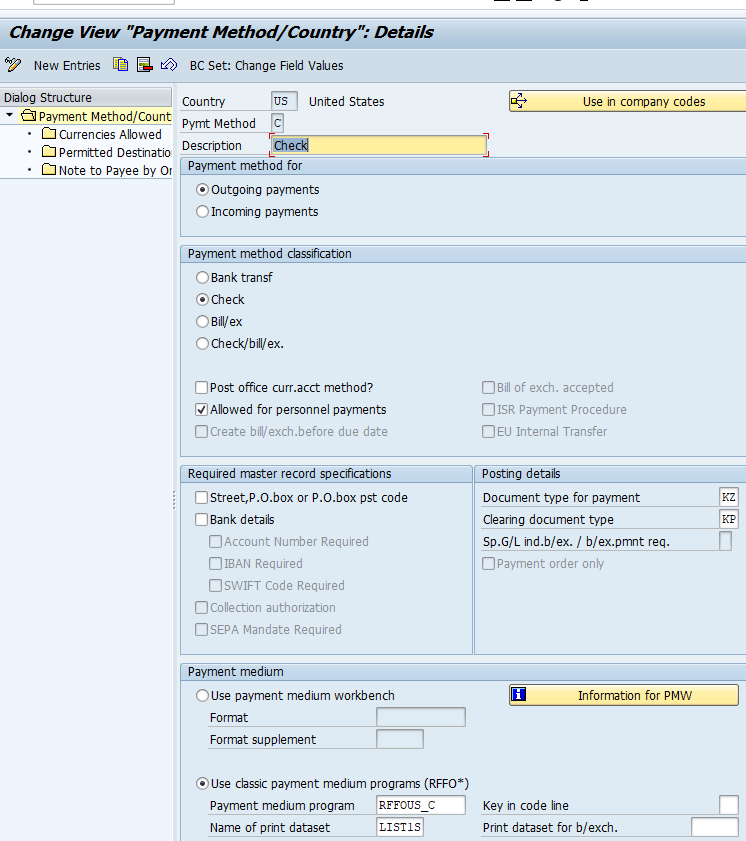

Step 3 : Click Tab Payment Method per Country and enter below details

A payment method specifies how payment is to be made. Popular payment

methods include Check, ACH, Wire Transfer

- A Payment Method define how a payment will be made to the vendor. Standard payment methods are Check, ACH, Wire Transfer

- Payment Method : H (ACH)

- Payment method for : Outgoing Payments

- Document Type for Payment : ZP

- Clearing Document Type : ZV

- Currencies Allowed : If no currency is specified here all currencies are allowed for making payment. To restrict currencies used for payment, specify them in currencies allowed tab.

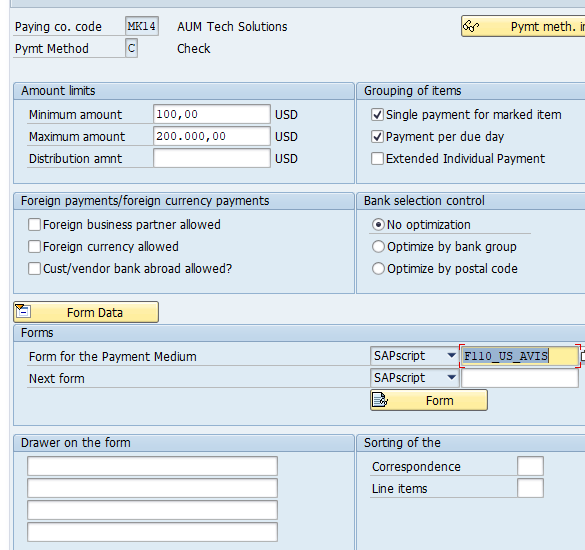

Step 4 : Click tab Payment Method per Co. Code and enter below details

Transaction Code : FBZP

- Min. Amount : Minimum amount required to use this Payment method

- Maximum Amount : Maximum amount that can be paid using the method

- Single payment for marked item: All line items for which the Payment method is entered explicitly during document entry get paid separately

- Foreign Business Partner allowed : When selected payment can be made to vendors outside company code home country. In this case vendors outside USA

- Foreign currency allowed: When selected payment program can make payments in currency other than company code local currency.

- Cust/ Vend Bank aboard: Used for international wire transfer payments. Select where the vendor bank to which payment has to be made is outside company code country ( USA).

- Payment Transfer Medium : F110_US_AVIS

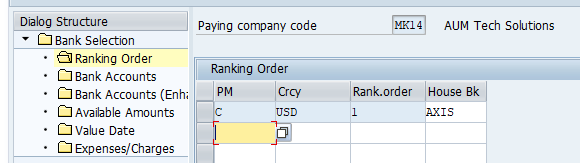

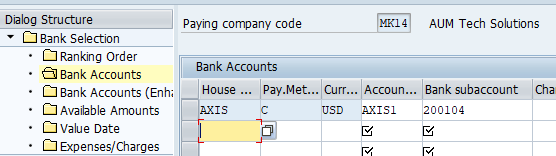

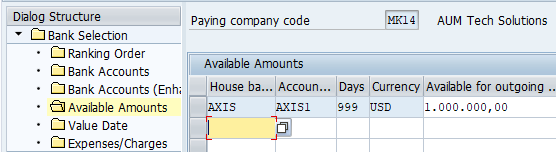

Step 5 : Bank Determination

Transaction Code : FBZP

Ranking Order: Here maintain the house bank from which payment will be made to vendor. You can specify many banks and give ranking order in which they have to be considered for payment by SAP payment program. Also where a payment method is not specified for a house bank, it is considered for payment by all the payment methods.

Bank Accounts: specify the Bank clearing account to which payments will be posted for combination of House bank, Payment method and Bank Account

Available Amount: Maintain the maximum amount available for payment from a house bank

Value Date : Enter days in the value date field. These are added to the Payment document posting date to arrive at the date on which debit/ credit memo is expected in the Bank account. Useful in case of check payments, where checks are presented to bank after 3-4 days of issue to the vendor. It provides date for cash management / forecast

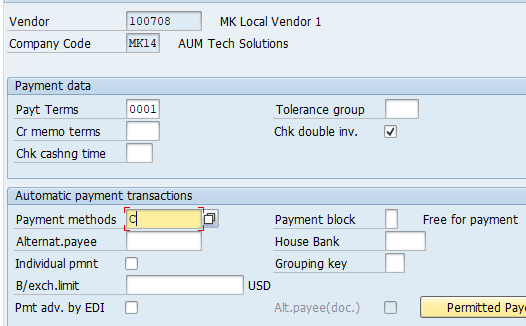

Step 6 : Update Vendor Master with Payment Method

Transaction code : XK02

Add Payment Method C to Vendor master field Payment methods

Testing Vendor Payment Configuration

- Post Vendor Invoice in transaction code : FB60

- Verify Amount due to Vendor in vendor line item report: FBL1N

- Run Automatic Payment Program : F110

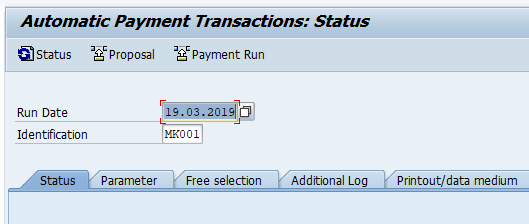

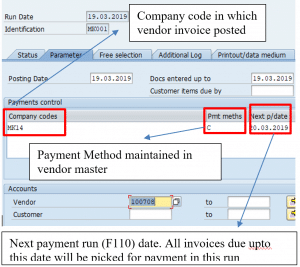

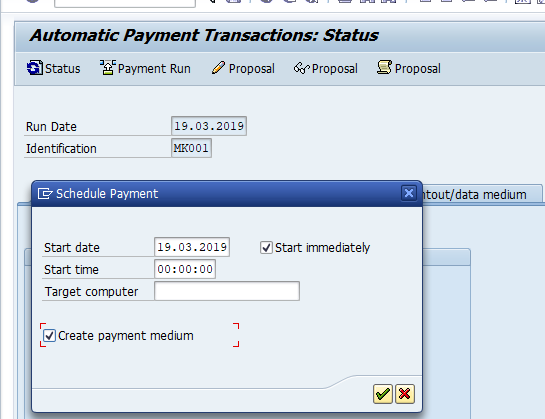

Transaction code : F110

Enter run date and RUN ID ( Can be any alphanumeric number) in below screen

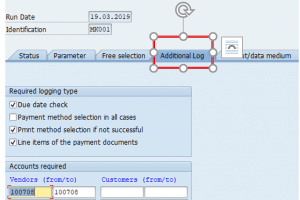

Click Tab Parameters.

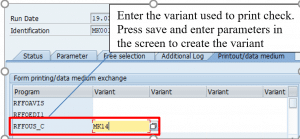

Once you press the save button. Below POP up screen will appear. Select both check box

Create Payment Medium check box : This will create a spool of cheques to be printed. Spool can be displayed in transaction code SP01 and printed through connected printer

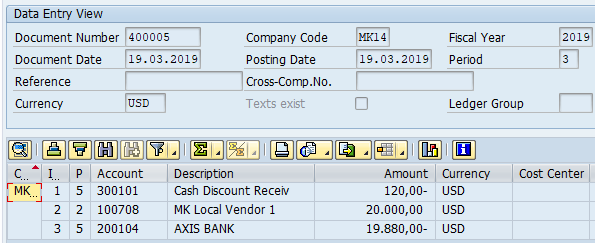

Payment Document posted with Max Cash discount received

Click own spool request or use transaction code SP01 to display image of check that can be printed

SAP Vendor Payment Configuration (FBZP Configuration in SAP)

- Define Bank Key – FI01

- Define the House Bank – FI12

- Set up All company code –FBZP

- Set Up Paying Company code –FBZP

- Set Up Payment Method per Country –FBZP

- Set up payment Method per company code –FBZP

- Set up Bank Determination –FBZP

- Define Value Date rules – FBZP

- Update new Payment Method in Vendor Master – XK02

Define Bank Key

Transaction Code : FI01

Bank Country : US

Bank Key : 456123789

Bank Name : Bank of America

Define House Bank

Transaction code : FI12

House Bank : These are banks through which payments are made in payment program. House Bank is associated with country US through Bank key 456123789

Automatic Payment Program Configuration in SAP

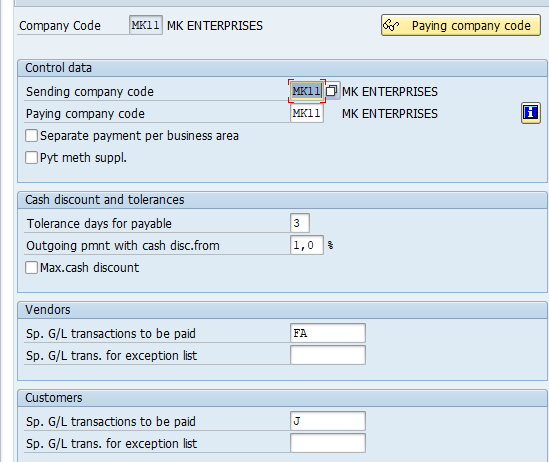

All Company Codes

Transaction Code : FBZP

- Company code MK11 : Company code for which Payment program configuration settings are made

- Sending Company Code MK11 : Company code sending the payment to the vendor. Can be same or different from paying company code

- Paying Company Code MK11 : Company code which makes payment to vendor. This is generally same as sending company code. In case of centralized payments there can be one company code making payments for various other company codes.

- Outgoing payment with cash discount from 1% : Only items that have a cash discount percentage rate greater than or equal to the one specified here are paid with the cash discount deducted. If the percentage rate is less than the one specified here, payment is made at the due date

- Vendors: Sp. G/L transactions to be paid : F Down Payment Request, A Down Payment on current assets

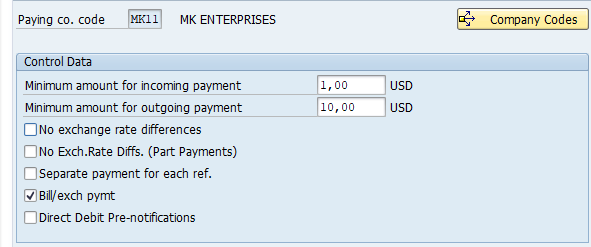

Paying Company Codes

Transaction Code : FBZP

- Paying Company Code MK11 : Can click on right to see the listing of all company codes for which it will act as paying company code

- Min amount incoming Payment 1 : If amount less than specified here, it is listed in the exception list.

- Minimum amount outgoing payment 10: If a payment amount does not equal or exceed the amount specified in this field, the line items that make up this amount are printed in an exception list.

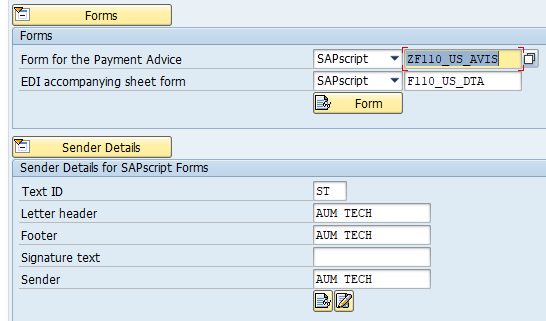

- No exchange rate differences : Select. If the indicator is not selected, the difference between the exchange rate at the time of posting and the exchange rate at the time of payment is determined for items which are posted in foreign currency. The exchange rate differences which have been determined are automatically posted for each payment.

- Form for the Payment Advice F110_US_AVIS : Name of the SAP script used to create a payment advice note in this company code.

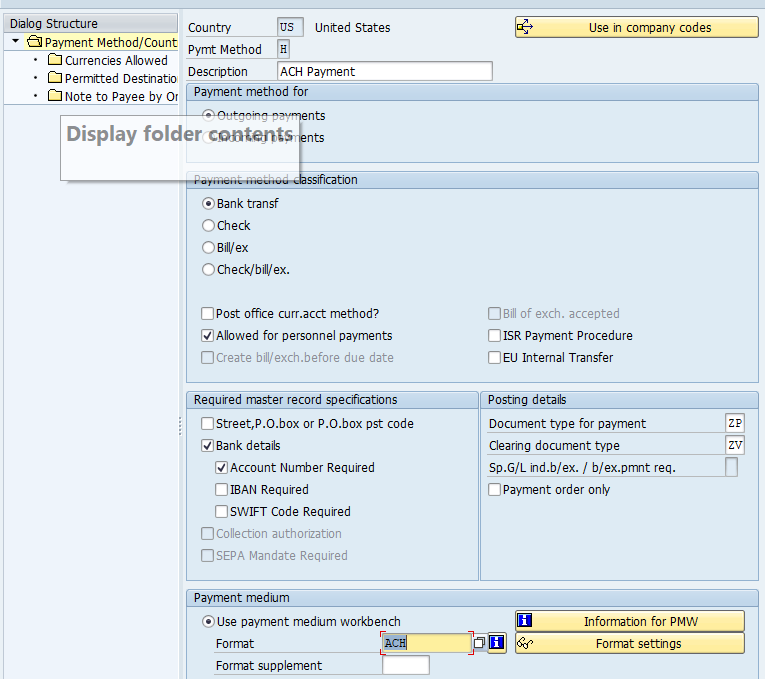

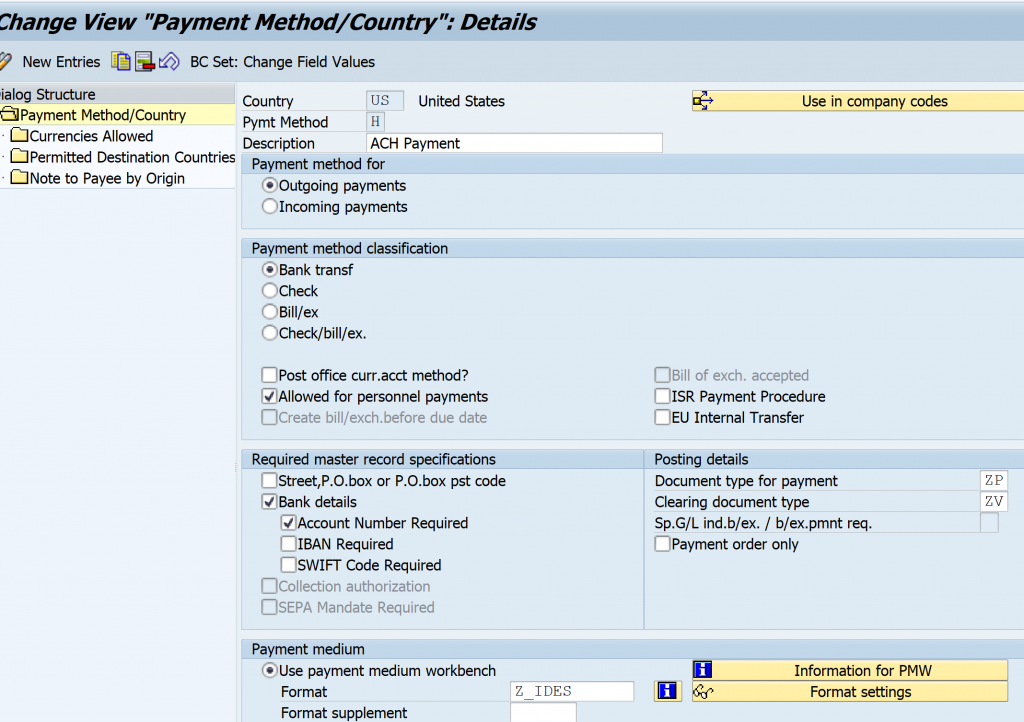

Payment Method per Country in SAP

A payment method specifies how payment is to be made. Popular payment

methods include check, ACH, Wire Transfer

Transaction Code : FBZP

- A PM define how a payment will be made to the vendor. Standard payment methods are Check, ACH, Wire Transfer

- Payment Method : H (ACH)

- Payment method for : Outgoing Payments

- PM Classification : Bank transfer

- Required master data : Select Bank details as vendor Bank account number and routing number are required in the payment file online transfer of funds by Bank

- Payment Medium : Leave blank. Select Payment Medium workbench. Format of file (Z_MK11) will be created using DMEE tool later in the course.

- Document Type for Payment : ZP

- Clearing Document Type : ZV

- Currencies Allowed : If no currency is specified here all currencies are allowed for making payment. To restrict currencies used for payment, specify them in currencies allowed tab.

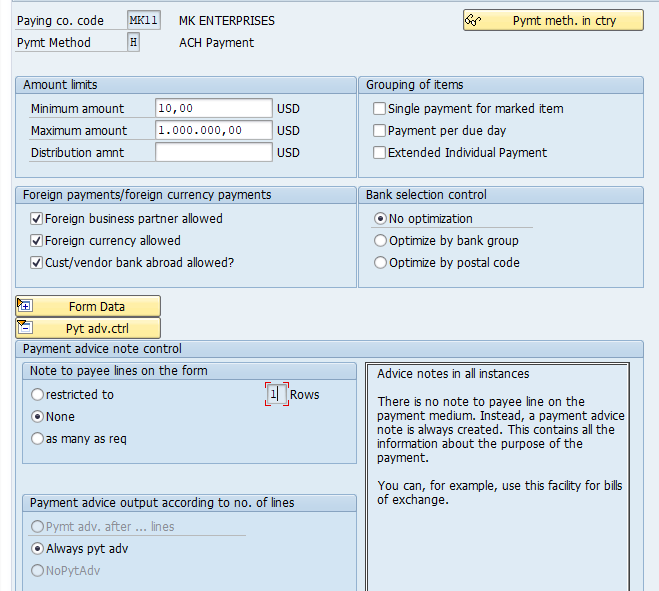

Payment Method per Co. Code

Transaction Code : FBZP

- Min. Amount : Minimum amount required to use this Payment method

- Maximum Amount : Maximum amount that can be paid using the method

- Single payment for marked item: All line items for which the Payment method is entered explicitly during document entry get paid separately

- Foreign Business Partner allowed : When selected payment can be made to vendors outside company code home country. In this case vendors outside USA

- Foreign currency allowed: When selected payment program can make payments in currency other than company code local currency.

- Cust/ Vend Bank aboard: Used for international wire transfer payments. Select where the vendor bank to which payment has to be made is outside company code country ( USA).

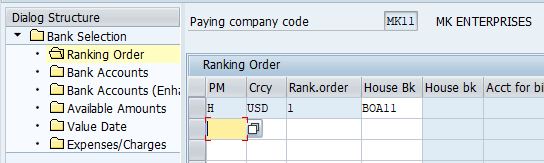

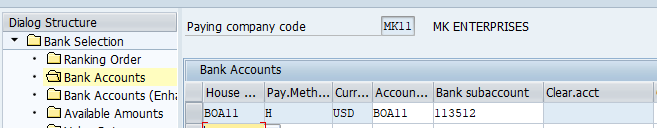

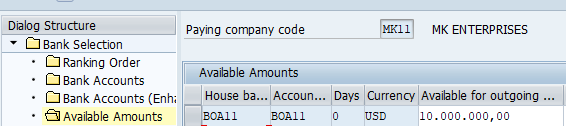

Bank Determination in SAP

Transaction Code : FBZP

Ranking Order in automatic payment program: Here maintain the house bank from which payment will be made to vendor. You can specify many banks and give ranking order in which they have to be considered for payment by SAP payment program. Also where a payment method is not specified for a house bank, it is considered for payment by all the payment methods.

Bank Accounts: specify the Bank clearing account to which payments will be posted for combination of House bank, Payment method and Bank Account

Available Amount: Maintain the maximum amount available for payment from a house bank

Value Date : Enter days in the value date field. These are added to the Payment document posting date to arrive at the date on which debit/ credit memo is expected in the Bank account. Useful in case of check payments, where checks are presented to bank after 3-4 days of issue to the vendor. It provides date for cash management / forecast

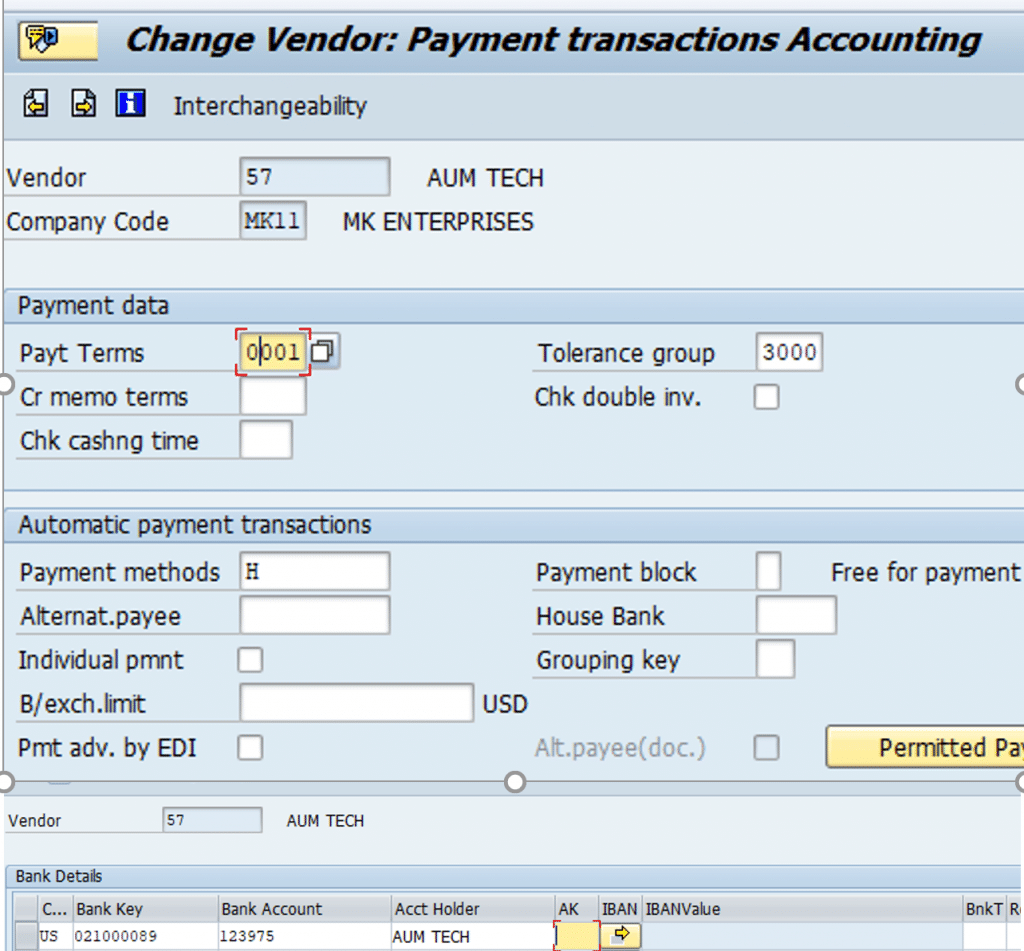

Update Vendor Master with Payment Method

Transaction code : XK02

Add Payment Method H to Vendor master field Payment methods

Add Vendor Bank Account Number, Routing number in the Vendor master

DMEE Configuration in SAP

Create Payment Medium file for Vendor Payments using SAP DMEE. Steps Involved in creating an electronic vendor payment file are as below:

- Step 1 : Create Payment Medium Format -OBPM1

- Step 2 : Create Payment Media File Layout –DMEE. This is covered in next post FI_AP_DMEE

- Step 3 : Create Payment file Variant – SE38-SAPFPAYM

- Step 4 : Assign Variant to the Payment File – OBPM4

- Step 5 : Assign File format to Payment Method – FBZP

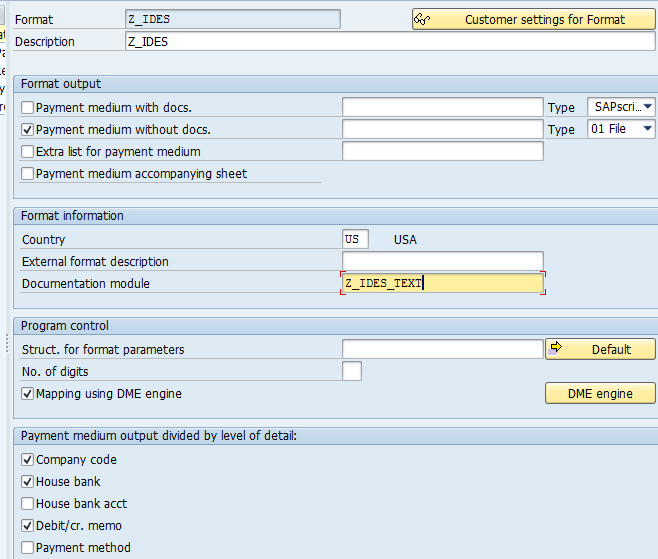

SAP Create Payment Medium Format using DMEE

Transaction code : OBPM1

- Select Payment medium without docs. Payment medium with docs is selected in case of checks

- Mapping using DMEE : Select as we will use DMEE tool to create the file layout

- Select Company Code, House Bank: This instruct program to create a payment file for combination of company code and House Bank

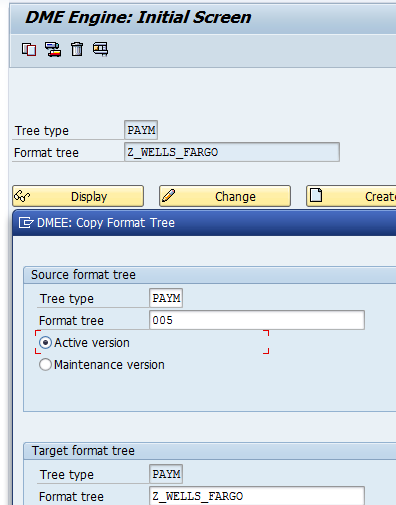

SAP Create Payment Media File Layout using DMEE

Transaction Code : DMEE

- Tree Type : PAYM

- Format Tree : Z_JPMC – Select Flat File

- Click Create

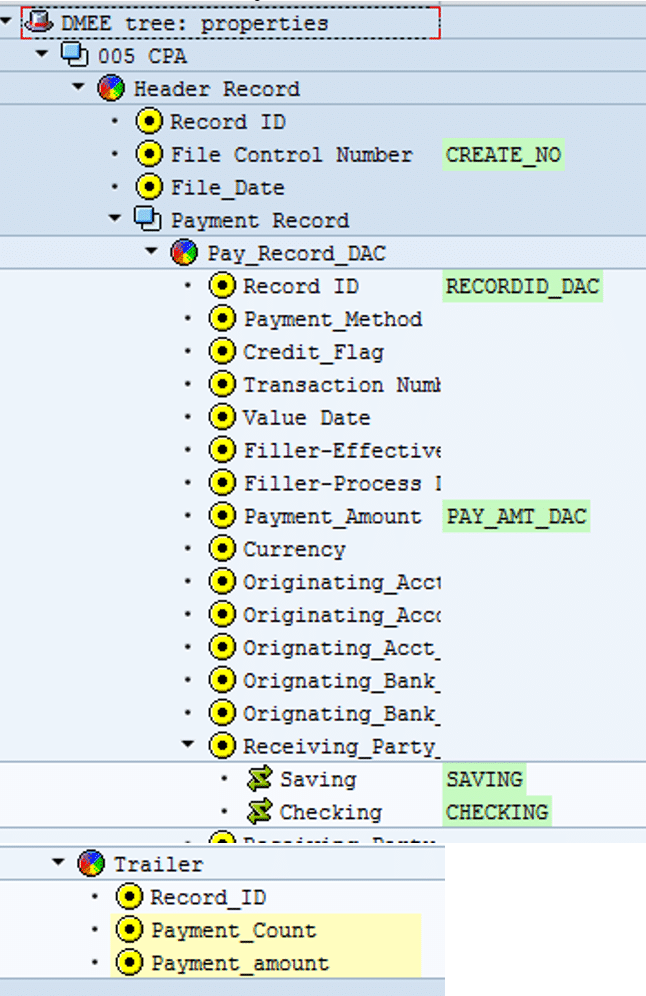

SAP DMEE Tree Properties

- Format Attributes – Field Type : Flat file can be fixed space file or delimiter file. We will select delimiter file format. Here fields / value in file are separated by a delimiter. Delimiter could be a pipe | , comma, semicolon

- Levels: The level of a node describes the position of the node in the file hierarchy. Levels must be assigned to all nodes that represent the hierarchy structure, for example segments and segment groups in flat files. Level 1 represents the top hierarchy level. It is assigned to a segment representing the header and Trailer record of a file. Header record has multiple segment/ segment groups assigned to it. These segment groups have vendor payment details. We will assign level 2 to the Segment with Payment details

- Repetition limit for a level in format tree : Specify the maximum number up to which a segment can be repeated in the flat file. For Header we give 1, Payment details level 2 we give 9999

- File data : Select Carriage return and Line feed. Carriage Return is used for creating new line in a flat file or PDF format and Line Feed is used for creating new line in XML format at the end of a Segment. A segment is a line in the txt file. When carriage return and line feed is selected, each segment start from the beginning in a new line

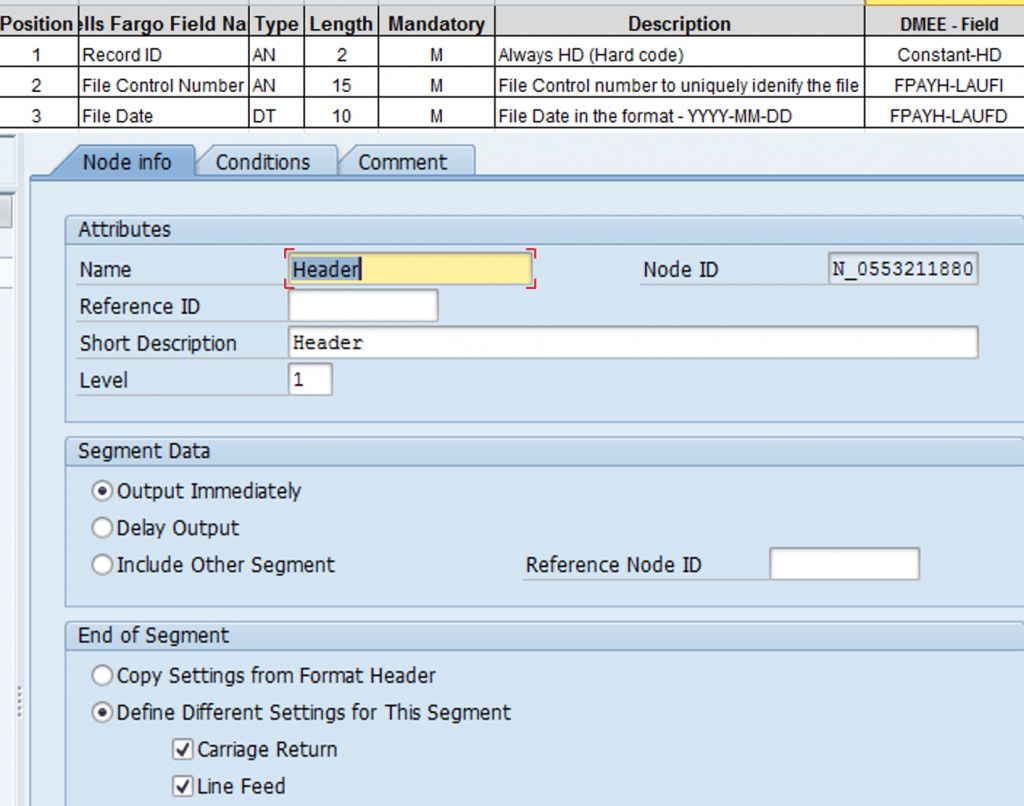

SAP Create Payment Media File using DMEE – Header

SAP Create Payment Media File – File Structure

- File Structure: EFT file has mainly 3 components. Header, Payment records and Trailer. Segment Group : It is a group of segments and used for arranging segments

- Segment : A segment represents a record in the target file. Each segment must have at least one element as a sub node.

- Element : An element represents a field in the target file. For each element, you specify with which value or from which source field this file field is to be filled

- Atom : Sub nodes of Elements. Used where multiple conditions are used to populate field values in an Element

SAP Create Payment Media File – Payment Records

- We create a Segment as sub node of Header. This will be level 2. Thus as per DMEE properties we can add 9999 payment record for one Header record

- To this we will add elements. Each of these elements is a Field / Appear as a value in the Payment File

- Open the JPMC Functional Spec and start creating elements

- Element Fields Description:

- Name : Name of the Element node

- Ref ID : uniquely identify the node in DMEE tree, if reference is to be made to this node from another node

- Length : Maxi number of characters in the field

- Character : Whether Character/ numeric / currency value in the field

- Status : here we can specify whether the values in the field are mandatory or optional

- Mapping Procedure:

- Constant : Any value entered here is like hard coded. It appears in the payment file. Generally constant like segment identifier are entered here

- Structure Field : Select this and than go to source tab. In the source tab specify the structure table and the field from which values will be populated in this field

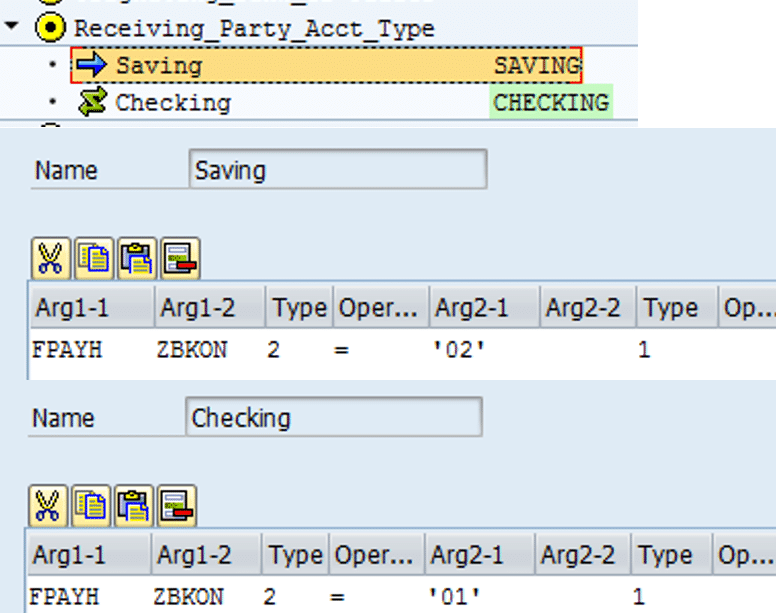

SAP DMEE Conditions

Conditions :This function enables you to define conditions that control whether a certain format tree node is processed during file generation or conversion.

- Arg1-1 : Here you specify field 1 of the first part of the condition argument

- Arg1-2: Here you specify field 2 of the first part of the condition argument. If, in Arg1-1, you entered a: Constant, then leave this field blank. Structure field, then enter the field name (which you can take from the source field inventory).

- Type : Enter the type of argument for the first part of the condition argument: 1 = constant, 2 = field in source, structure, 3 = reference ID

- Operator: Enter the operator to be used for the comparison, such as equal to (=) or less than (<).

- Arg2-1 : Here you specify field 1 of the second part of the condition argument

- Arg2-2: Here you specify field 2 of the second part of the condition argument.

- Type: Enter the type of argument for the second part of the condition argument

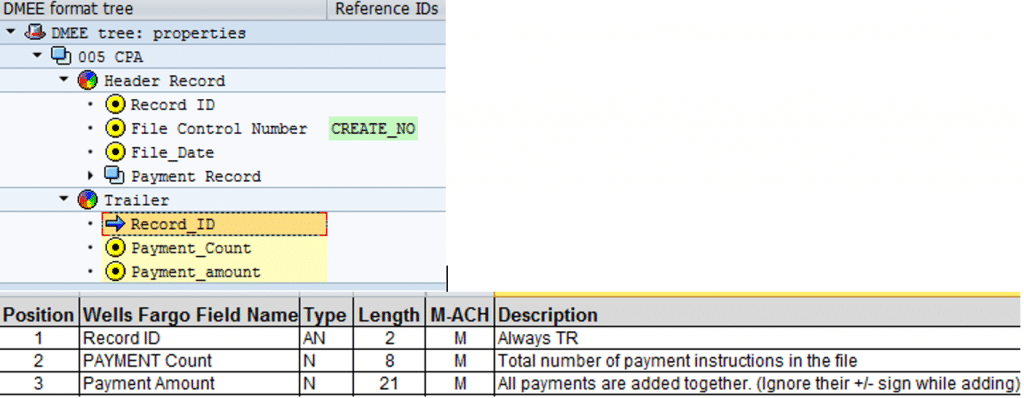

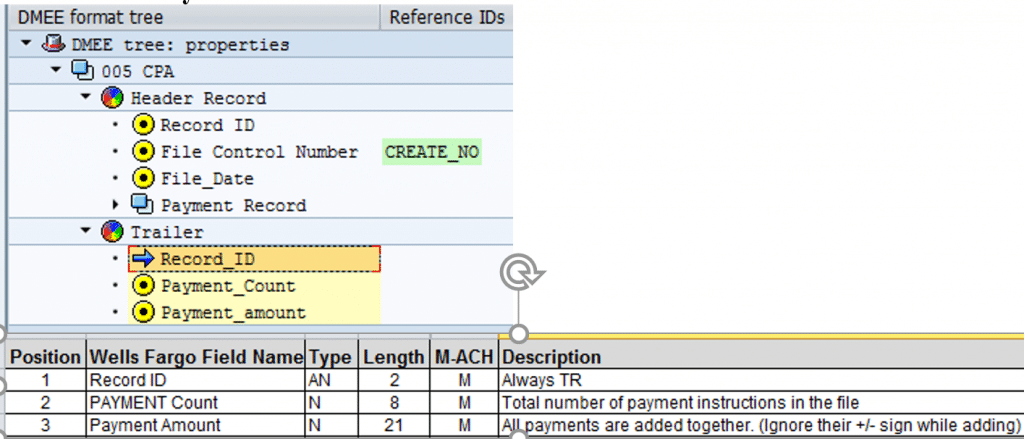

SAP Create Payment Media File –Trailer Records

- Case Study AUM Corporation

- File Layout JPMC ACH Payment – Payment Records

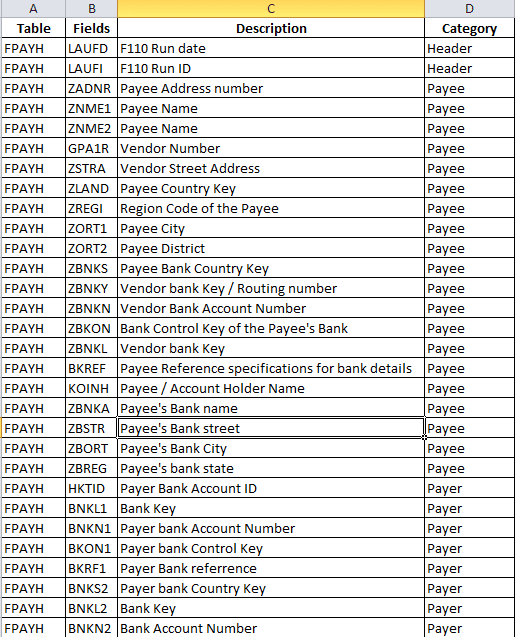

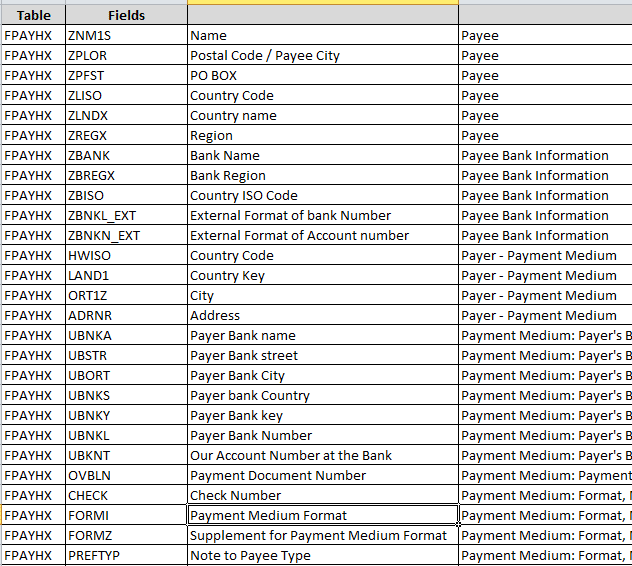

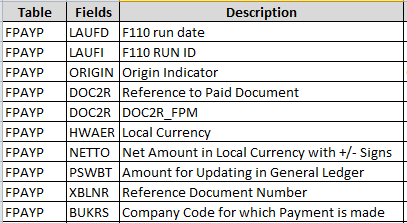

Field Mapping for Table FPAYH, FPAYHX, FPAYP

SAP Create Payment Media File –Trailer Records

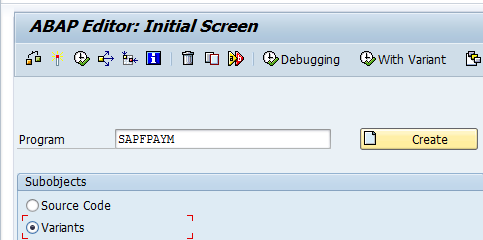

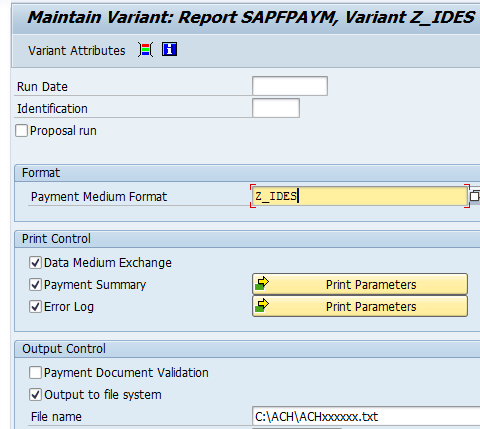

Create Variant for Payment Medium File

Transaction code : SE38-SAPFPAYM

- Variant has to be created in program SAPFPAYM for payment file created using PMWB. This variant is assigned to the file layout in transaction OBPM4. Payment program uses this variant to create the file during payment program run (F110)

- Specify the location where file can be downloaded. Alternatively create a directory where file can be transferred. AL11

- Assign the format to the payment method in Country : FBZP

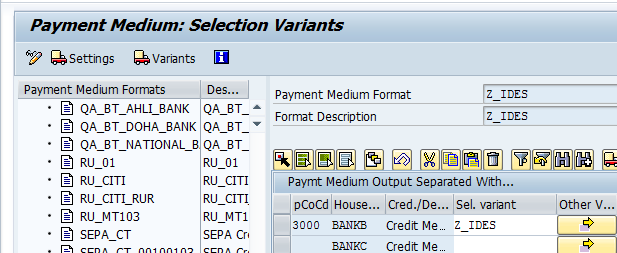

Step 4 : Assign Variant to the Payment File

Transaction Code : OBPM4

Step 5 Assign File format to Payment Method

Transaction Code : FBZP – Payment methods in Country

Testing Vendor Payment Configuration in SAP

Summary of Transactions codes used in Vendor payment testing

- Post Vendor Invoice : FB60

- Verify Amount due to Vendor : FBL1N

- Run Automatic Payment Program : F110

- Generate Wire Transfer File : FBPM

Automating Payment Run (F110) through Batch Job

Steps involved in setting up F110 batch job

- Create F110S Variant : SE38 – RFF110S

- Set Up Batch Job for program RFF110S : SM36

- Create variant for downloading ACH/ Wire Transfer file : SE38 – SAPFPAYM

- Set up batch job for downloading ACH/ Wire Transfer file : SM36

For detailed, step-by-step instructions on SAP ACH, Wire, business process, configuration and development follow along with my video tutorial below.

Please refer following post for SAP Withholding Taxes configuration & End user transactions

Pingback: SAP Finance Enterprise Structure | SAP FINANCE and Treasury

Pingback: Vendor Payments-ACH/Wire, DMEE-Part 2 | SAP FINANCE and Treasury

Pingback: SAP Finance Substitutions

Pingback: SAP Finance Tutorials | AUMTECH Solutions-SAP Training

Pingback: SAP DMEE Demystified | AUMTECH Solutions-SAP Training

Pingback: SAP FICO Interview Questions & Answers | AUMTECH Solutions-SAP Training

Pingback: SAP S4/HANA Finance Accounts Payable | AUMTECH Solutions-SAP Training