Table of Contents

Evaluation in Accounts Receivable

The are many predefined evaluations in SAP.

Customer List Details

Transaction code F.20 (left-hand screenshot) you can list customers details, you can chose what information is displayed and you can also limit the customers or the company code, the report can be seen in the right-hand screenshot

Next we can look at the customers balance, this will help to find good volume customers.

Customer Balance Report

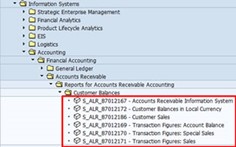

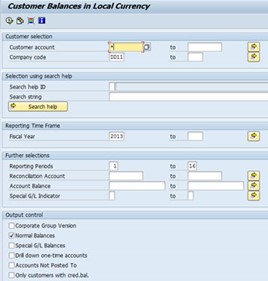

Transaction code S_ALR_87012172 or you can use the SAP easy access menu as seen below

Again we get a similar filter screen (left-hand screenshot) which can widen or narrow your search, the report is displayed in the right-hand screenshot

Next, we can see the customer payment history which is equally important as sales.

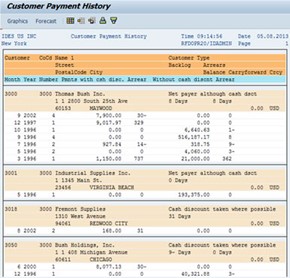

Customer Payment History

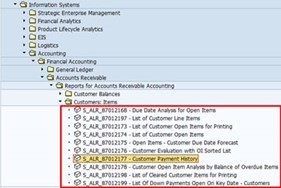

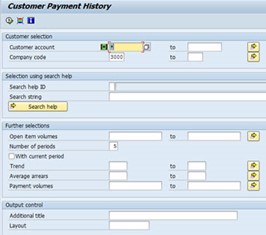

Transaction code S_ALR_87012177 or use the SAP easy access menu as seen below

Again we start with a filter screen (left-hand screenshot), the report is displayed in right-hand screenshot, this report can detail the customers who pay late regularly (see the arrear column and the ones with the minus sign)

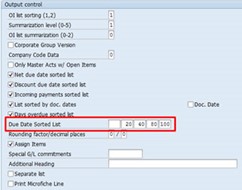

Customer Invoice Aging Report

Customer valuation with OI sort list is a good aging report (transaction code S_ALR_87012176), it details customer information, commitments, sales information, payment information, dunning information sales amounts and payment amounts, etc. You can also adjust the due date sort list into whatever days you want (see left-hand screenshot)

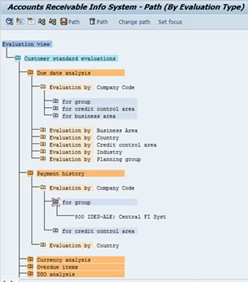

Account Receivable Info system

Transaction code : F.30

The accounts receivable info system is a kind of data cube that is filled with up-to-date information at regular intervals, you can view rotate and turn the cube to view it from different perspectives, you can use transaction code F.30, the initial screen is shown below, remember that the data of the cube is static and needs to be refreshed from time to time which I will show you how to do in a moment

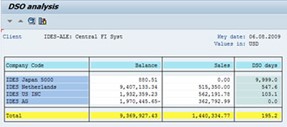

The DSO (days sales outstanding) is the period between the billing and the incoming payments, this monitors the customer payment behavior, you can breakdown into complete client (group) or individual credit control areas (see screenshot above). In the below screenshot we can see the DSO information at the client level, we are basically looking for low levels in the DSO days column, if this become to high (I have a high level here as i need to update notice the key date in the top right-hand corner) then you need to investigate why it is taking so long to get the payment, perhaps the dunning needs to be more efficient. If you double-click on any of the company codes, you will get the right-hand screenshot which breaks down into the customers.

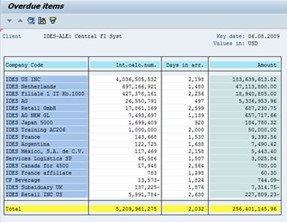

Next we can have a look at the overdue items, here I am looking at the client level which details all the company codes, again we are looking in the days in arrear column for high number of days, you can also keep drilling down by double-clicking on a company code, this will display the document numbers.

If a receivable exist in a foreign currency the gain or loss from exchange rate fluctuation is implemented at the time of the incoming payments, you can use the currency analysis of the accounts receivable info system to illustrate the effects of the current exchange rates in advance. In the screenshot below you can see that the customer Becker Berlin we can see the difference of -229.49. The currency analysis helps you keep an overview of the possible risks and the losses and gains from the exchange rate fluctuation during the periods between the billing and the incoming payment.

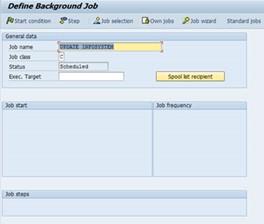

To update the info system, we will use transaction code F.29, enter a job name and then click on the step button

We enter the job details, SAP have automatically suggested a program name and a variant, select the save button

Then we select the start condition button and the below screen will be displayed, here I have selected immediate, however you could create a schedule here if you wish

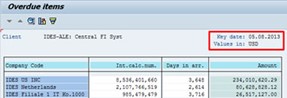

Now lets have a look at the overdue items again we can see that the key date has been updated, remember to update the data before you start analyzing

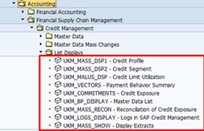

Next we can have a look at the credit management, you can use transaction UKM_MALUS_DSP or use the SAP easy access menu as per below, you will be taken to a filter screen which you can apply any filtering

The report will eventually produce a list, here we can see the exposure details of each business partner, the credit exposure, credit limits, utilization, it even has a icon to give a visual indication, anything over 100% utilization needs to be investigated

Hopefully with the above you should be able to identify any customers who are not paying and thus you could change the dunning procedures to try and get the payments in on time without upsetting the customer.

You can also have quick access to the payable reports using transaction F.99, you can even turn on the technical name of the reports.

For detailed, step-by-step instructions on SAP Finance, business process, configuration and development follow along with my video tutorial below. SAP FICO Training

Pingback: SAP Tutorials | AUMTECH Solutions-SAP Training