Table of Contents

SAP Cost Center Allocation

There are three methods to do allocation in SAP.

- Periodic Reposting

- Distribution

- Assessment

Cost Center Manual Reposting

This is used to move actual amount and quantity from one cost center to another cost center. It is used to correct, incorrect actual postings made to cost centers

Controlling Business Transaction for Manual reposting is RKU1. Add to number range group in transaction code KANK.

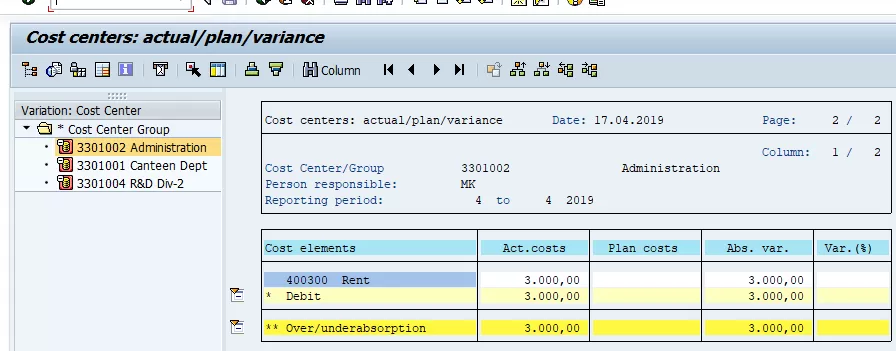

Cost Center Report# S_ALR_87013611

Run for Cost Center#3301002

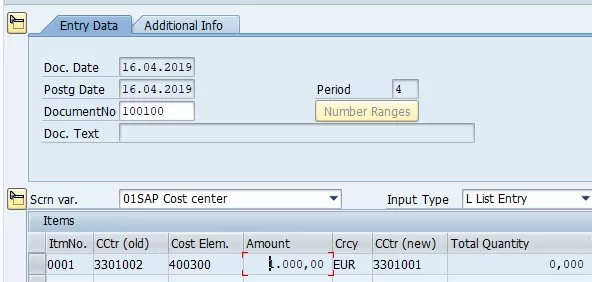

Repost the Rent amount from Cost Center3301002 to Cost Center#3301001

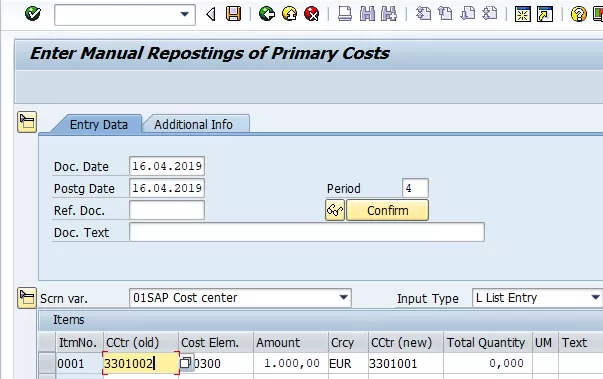

Transaction code: KB11N

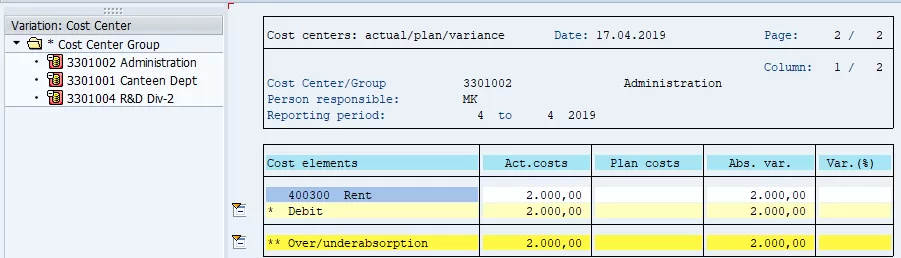

Run the cost center report again# S_ALR_87013611

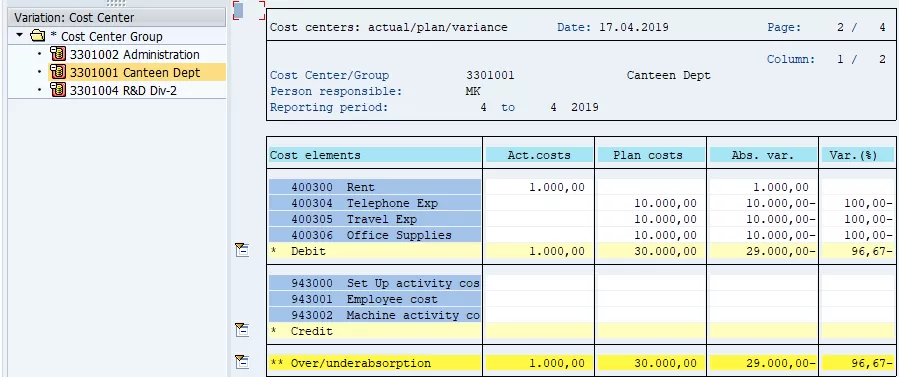

Now Cost center Rent cost is 2000 and USD 1000 transferred to cost center 3301001.

Display Manual Reposting: KB13N

Cost Center Accounting Distribution

Allocation is done using Primary Cost Element

- Source Cost Element is credited in Sender cost center

- Source Cost Element is debited in Receiver Cost Center

- Distribution cycle can have one or more Segments

- Assign business transaction #RKIV (Actual OH distribution) to Group primary posting in transaction code #KANK

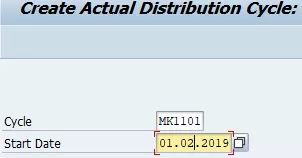

Define Actual Distribution Cycle

Transaction Code KSV1

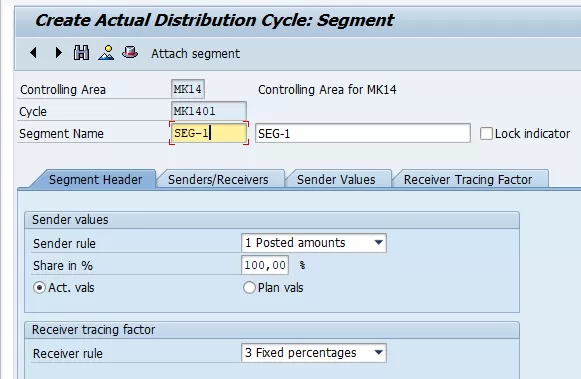

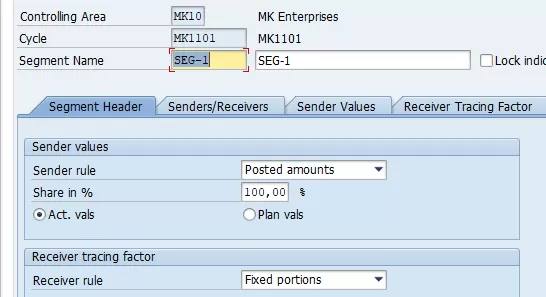

- Segment Header

- Posted Amount: Full amount of Sender Cost Center

- Fixed Amount: Fixed amount of sender Cost Center

- Share in %: 100% of posted amount. Can be less also

- Select Actual values

- Receiver Tracing Factor

- Receiver Rule: Fixed %. Give % share of receiving cost center in Receiving Tracing Factor tab

- Fixed Portion: Receiving tracing factor is ratio instead of %

- Fixed Amount: Enter fixed amount in Receiving Tracing factor

- Receiver rule is Variable: Plan SKF is the receiving Tracing factor

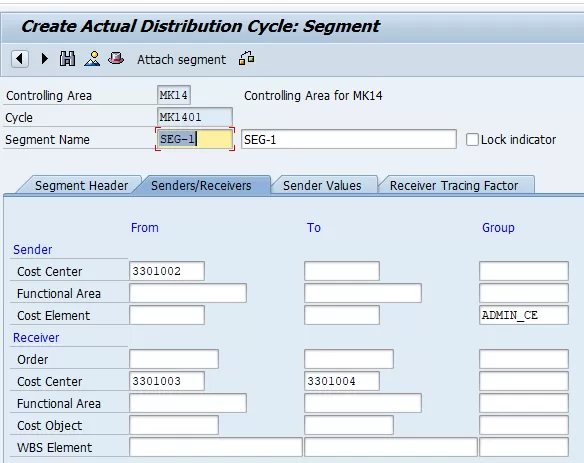

Sender / Receiver Tab

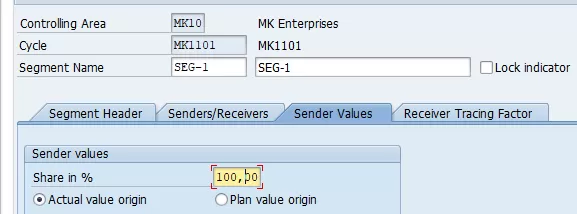

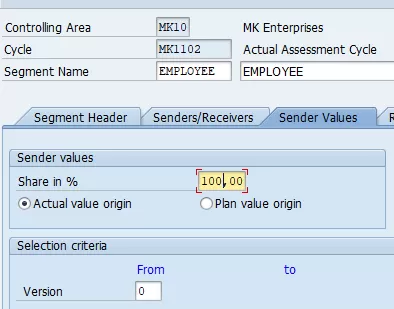

Sender Value Tab

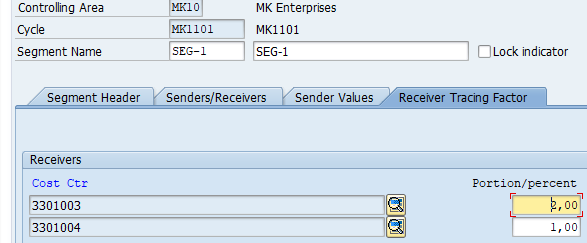

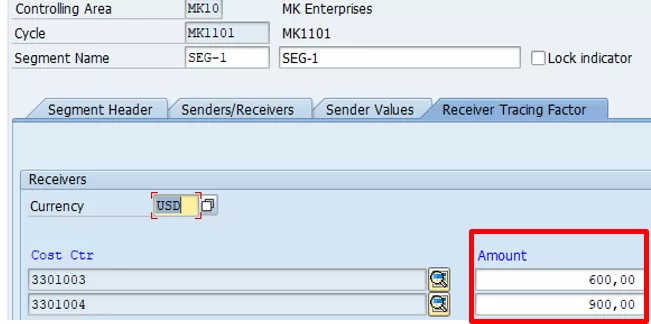

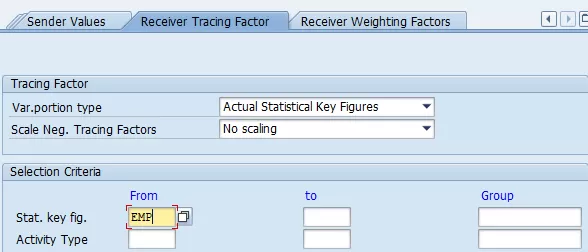

Receiving Tracing Factor

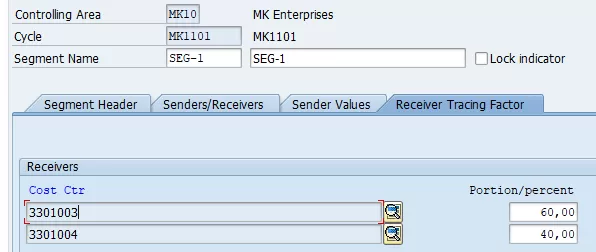

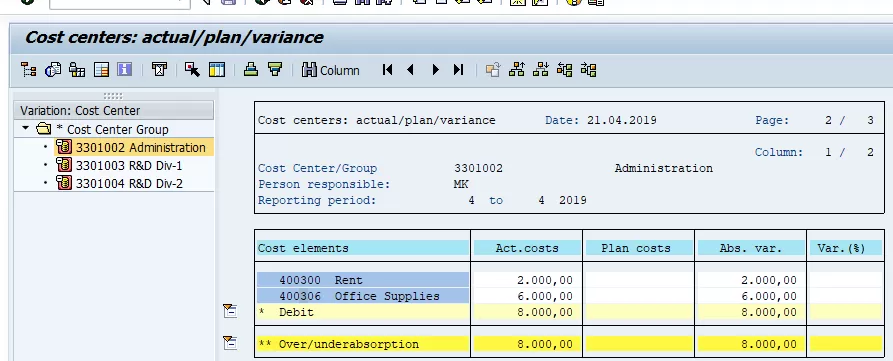

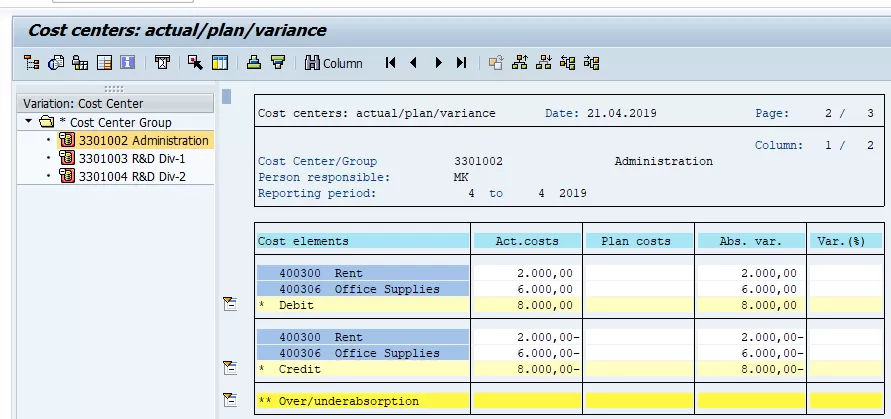

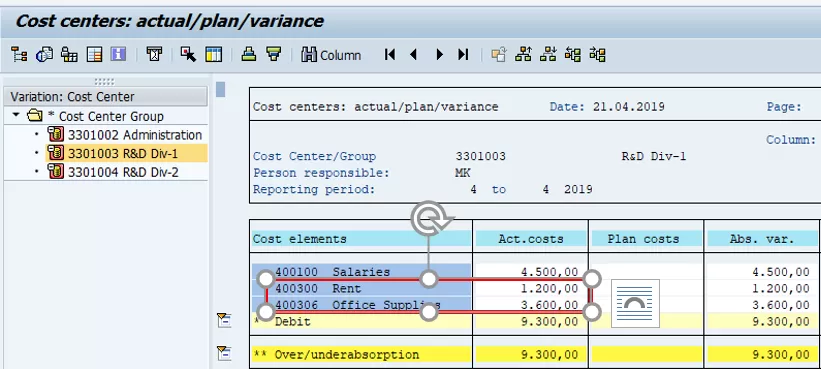

Check Cost Center Report

Tcode: S_ALR_87013611

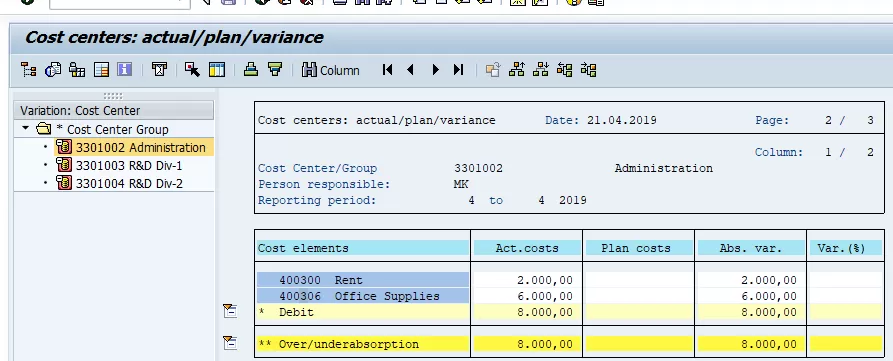

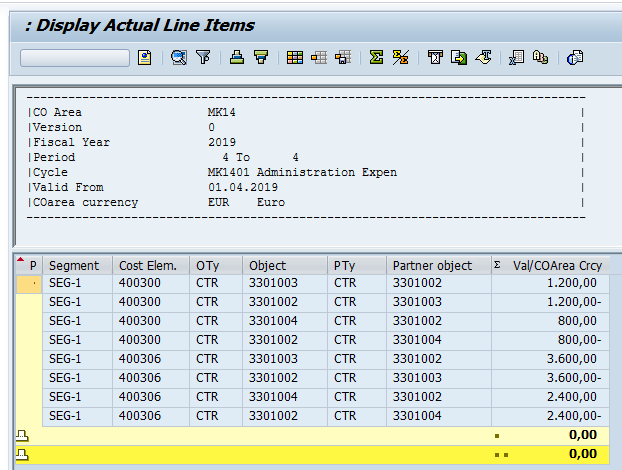

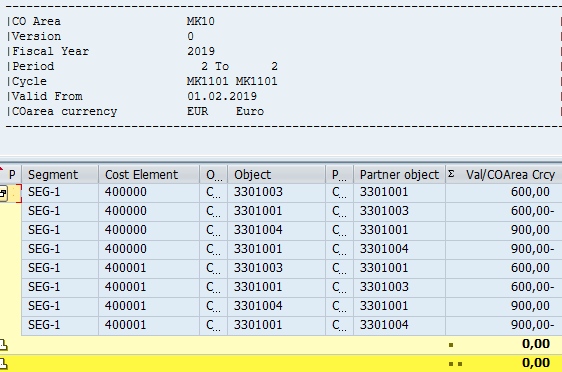

Execute Actual Distribution Cycle

Transaction Code: KSV5

Cost Center Report before execution: S_ALR_87013611

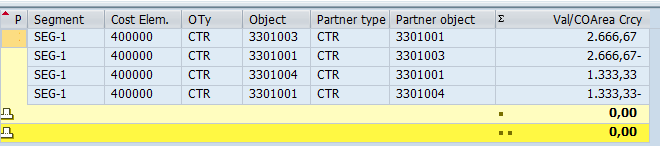

Report after execution of distribution

When Segment Header Receiver Rule is Fixed Portions

Receiving Tracing Factor will be ratio, instead of %

Execute Actual Distribution Cycle

Transaction: KSV5

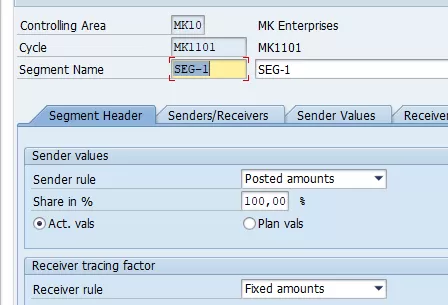

When Segment Header Receiver rule has fixed amount. Enter fixed amount in the receiving tracing factor tab

Execute Actual Distribution Cycle

Transaction: KSV5

Cost Center Accounting Assessment

Assessment is created to transfer primary and secondary costs from a sender cost center to receiving cost objects. An assessment receiver can be a cost center, WBS element, internal order or a cost object. You can only repost primary costs.

During assessment, the original cost elements are summarized into assessment cost elements (secondary cost element category = 42). The system does not display the original cost elements on the receivers. Therefore, assessment is useful if the cost drilldown for the receiver is not important

Assessment Cost Element, category is 42. Assessment is done using Secondary Cost Element

Create Assessment Cost Element: KA06

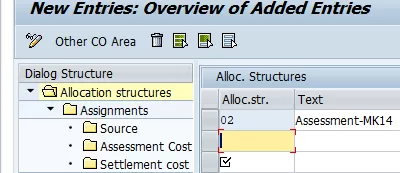

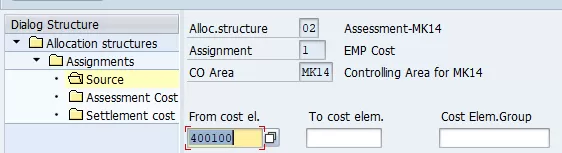

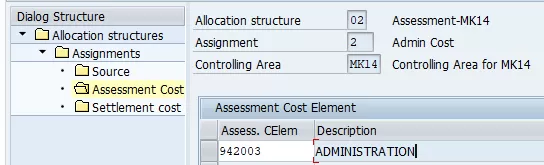

Define Allocation Structure

Transaction Code : KSES

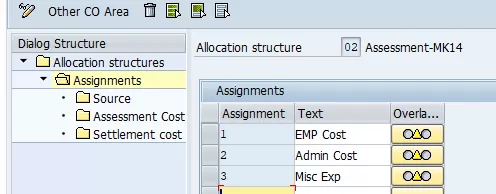

Select allocation structure 01 and click Assignments

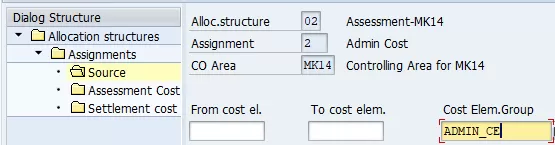

Select Assignment -1 and click source. Here assign the Primary Cost Element from which cost will flow out

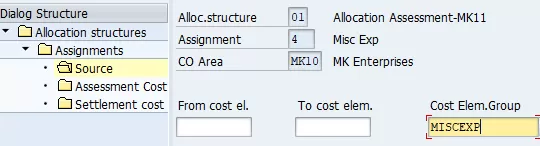

Repeat for Admin Cost, Misc. Expenses

Misc. Expenses

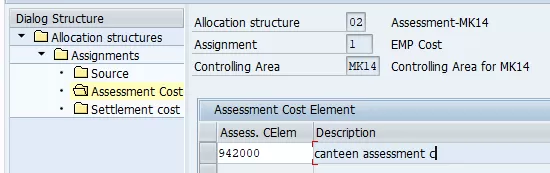

Go to folder Assignment, select assignment-1 (EMP Cost). Click Assessment Cost Element

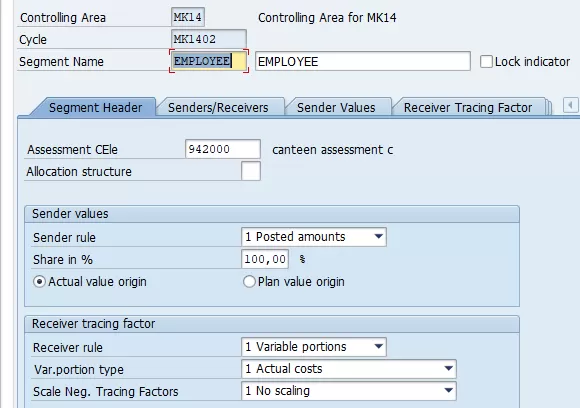

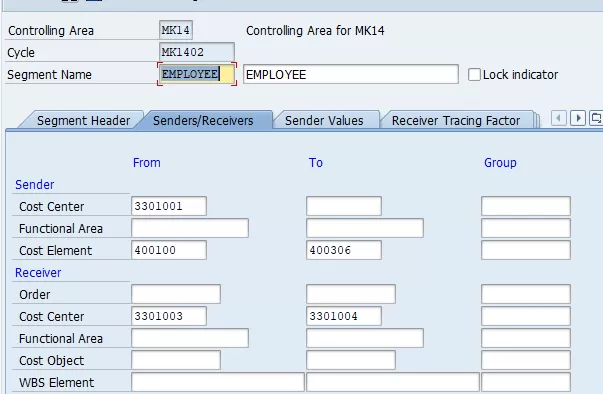

Create Assessment Cycle

We will use secondary Cost Element (Employee) to send cost from Canteen department to RD-1 and R&D-2 departments. This cost will be divided between these two departments based on actual SKF. Actual SKF will be actual number of employees in the R&D departments

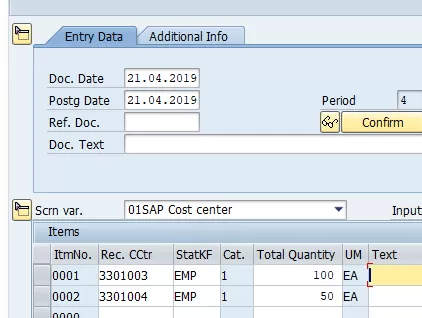

Create actual SKF

KB31N

Create Actual Assessment Cycle

Transaction Code : KSU1 / KSU2

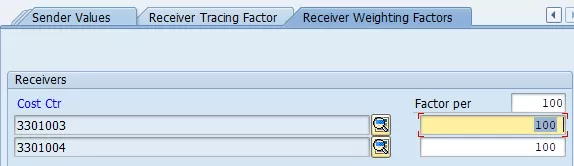

Receiving weight factor, both cost centers should be 100 each

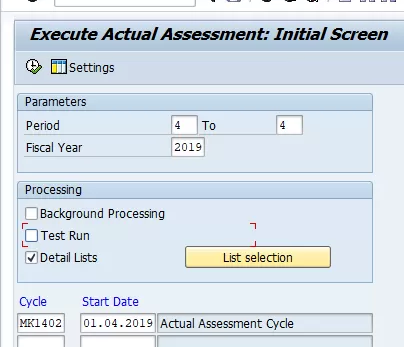

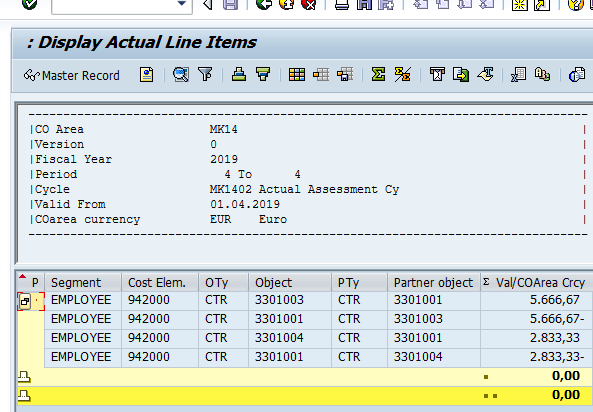

Execute Actual Assessment Cycle

Transaction Code: KSU5

Maintain number range for business transaction RKIU in transaction code# KANK

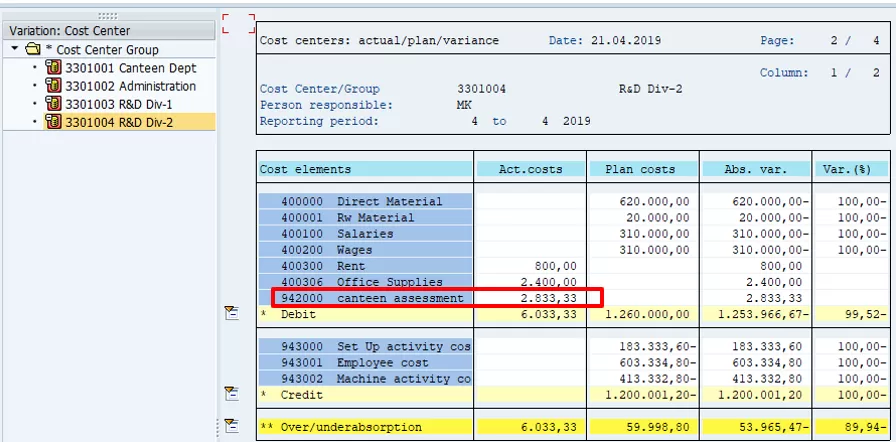

Display Cost Center Report

S_ALR_87013611

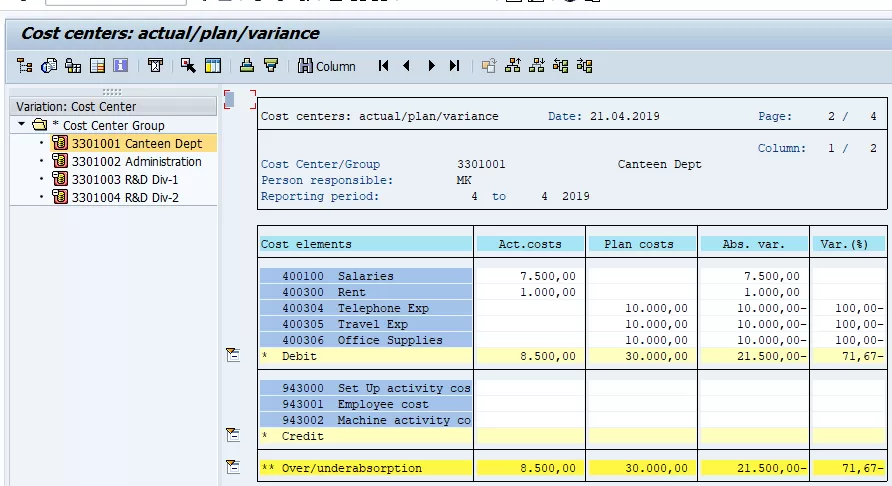

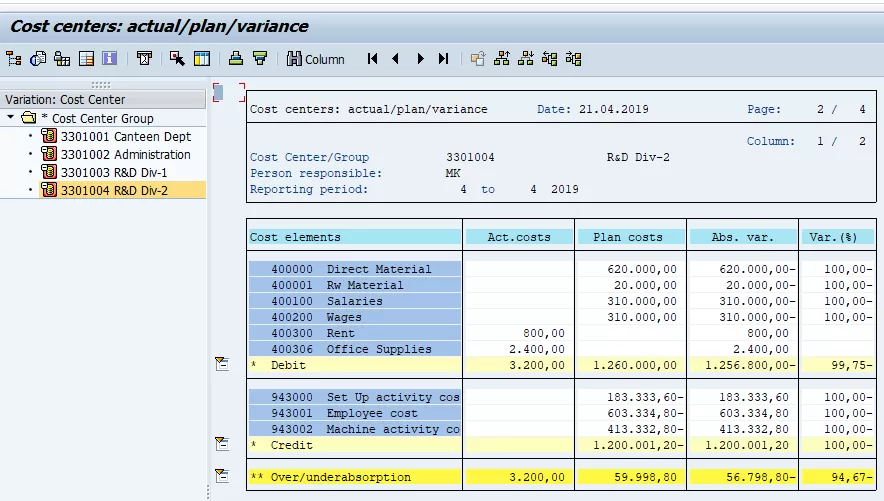

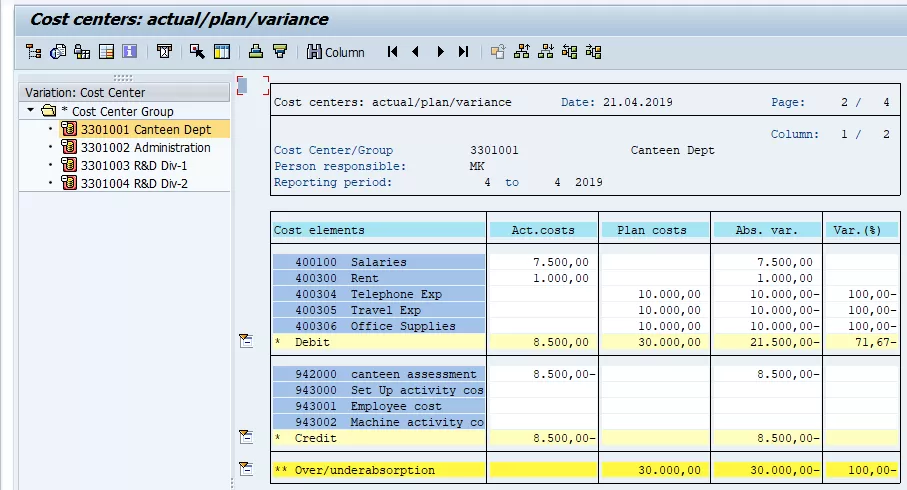

Before Assessment Cycle

After Assessment Cycle

Summary

| Period End Activities | Transactions |

| Create Plan Assessment Cycle | KSU7 |

| Execute Plan Assessment Cycle | KSUB |

| Create Plan Distribution Cycle | KSV7 |

| Execute Plan Distribution Cycle | KSVB |

| Cost Center Report | S_ALR_87013611 |

For detailed, step-by-step instructions on SAP Cost Center Allocation (Reposting, Distribution & Assessment) follow along with my video tutorial below

For detailed, step-by-step instructions on SAP Cost Center Accounting, Product Costing, Profit Center Accounting, Internal Orders, FI-MM Integration follow along with my video tutorial below : SAP Controlling Tutorial

Pingback: SAP Tutorials | AUMTECH Solutions-SAP Training

Pingback: SAP Controlling Questions & Answers | AUMTECH Solutions-SAP Training